Global Tissue Engineered Skin Substitutes Market

Global Tissue Engineered Skin Substitutes Market Size, Share, and COVID-19 Impact Analysis, By Product (Synthetic and Biosynthetic), By Application (Acute Wounds and Chronic Wounds), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

Global Tissue Engineered Skin Substitutes Market Insights Forecasts to 2035

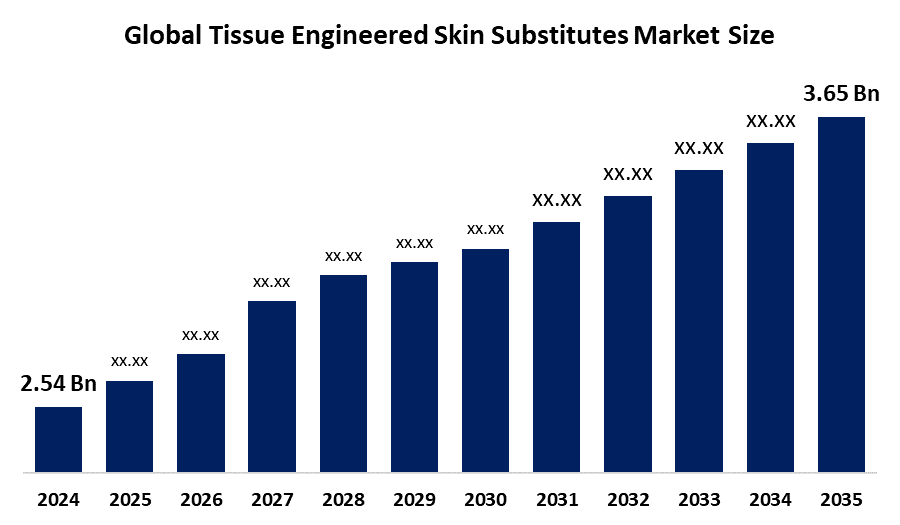

- The Global Tissue Engineered Skin Substitutes Market Size Was Estimated at USD 2.54 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.35% from 2025 to 2035

- The Worldwide Tissue Engineered Skin Substitutes Market Size is Expected to Reach USD 3.65 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

According to a research report published by Decisions Advisors and Consulting, The Global Tissue-Engineered Skin Substitutes Market Size was Worth Around USD 2.54 Billion in 2024 and is Predicted to Grow to Around USD 3.65 Billion by 2035 with a Compound Annual Growth Rate (CAGR) of 3.35% from 2025 to 2035. The growing prevalence of acute and chronic wounds, the high need for skin grafts, the growing awareness of different treatment alternatives, and technical improvements in healthcare are all contributing factors to the growing demand for tissue-engineered skin substitutes.

Market Overview

Tissue engineering is essentially a method of keeping, enhancing, and repairing tissues and organs that have been damaged. The basis of tissue engineering is the use of a combination of living biological molecules, cells, and scaffolds to grow different types of functional tissues. These tissue engineering skin substitutes offer a new approach to traditional methods of tissue extraction and wound healing. The significant increase in the need for skin grafts is also acting as a catalyst for the growth of the market worldwide. Skin graft is mostly used as part of the treatment for acute wounds. Different forms of tissue-engineered skin substitutes, synthetic and biosynthetic, are used in the treatment of severe to moderate burns. Besides that, the increasing demand for breast reconstruction is expected to provide a significant boost to the market growth worldwide. Furthermore, the rising number of investments for developing dermo, epidermal and complex skin substitutes is likewise accelerating the growth of the market globally during the forecast period. The market is expanding due to the increasing use of tissue-engineered products in clinical settings. Significant developments in biomaterials, cell-based technologies, and 3D bioprinting techniques that improve product functionality and integration with native tissues characterise the current situation. Market growth is being bolstered by favourable regulatory frameworks and healthcare investments in wound care.

Report Coverage

This research report categorises the tissue engineered skin substitutes market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the tissue engineered skin substitutes market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the tissue engineered skin substitutes market.

Driving Factors

The market for tissue-engineered skin substitutes experienced a steady increase in demand alongside several factors, such as the rise of chronic wounds, burns, and trauma cases, advancements in regenerative medicine, and an increase in the ageing population. Major changes in tissue engineering, biomaterials science, and regenerative medicine resulted in the production of more advanced tissue-engineered skin substitutes with improved healing qualities and biocompatibility. The uptake of tissue-engineered skin substitutes for applications other than wound healing is expected, such as in cosmetic surgery, dermatology, and reconstructive surgery, thereby increasing the market potential. The personalisation of medicine and tailored treatment approaches are poised to become the main reasons for the purchase of the customised tissue-engineered skin substitutes that will be able to satisfy the needs and preferences of individual patients. Development in drug delivery systems, nanotechnology, and biomaterials science will most probably improve the delivery efficiency and therapeutic efficacy of tissue-engineered skin substitutes, which will further drive the market growth.

Restraining Factors

The tissue-engineered skin substitutes can be costly; patients and healthcare facilities with limited funds may not be able to use them. Cost limitations are expected to impede market penetration and adoption rates, especially in developing nations and impoverished communities. Manufacturers may find it difficult to enter the market due to strict regulations and protracted approval procedures for tissue-engineered products. Complying with intricate regulatory frameworks can impede innovation and delay market growth.

Market Segmentation

The tissue engineered skin substitutes market share is classified into product, and application.

- The biosynthetic segment accounted for the largest market share in 2024 and is projected to grow at a substantial CAGR over the forecast period.

Based on the product, the tissue engineered skin substitutes market is segmented into synthetic, and biosynthetic. Among these, the biosynthetic segment accounted for the largest market share in 2024 and is projected to grow at a substantial CAGR over the forecast period. The segment of biological tissue engineered skin substitutes accounted for the largest market share due to the increasing incidence of acute wounds worldwide. A significant benefit of biological tissue engineered skin substitutes is that skin can be conveniently sourced from the patient. Compared to other types, biological tissue engineered skin substitutes contain more extracellular matrix, which greatly promotes re-epithelialization and accelerates the wound healing process.

- The acute wounds segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the tissue engineered skin substitutes market is classified into acute wounds, and chronic wounds. Among these, the acute wounds segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This is due to the growing number of surgeries and the rising incidence of burn injuries. Moreover, burn injuries are one of the leading causes of unintentional injury and death in the segment, which has been further divided into burn injuries, trauma, and surgery.

Regional Segment Analysis of the Tissue Engineered Skin Substitutes Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the tissue engineered skin substitutes market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the tissue engineered skin substitutes market over the predicted timeframe. The existence of developing nations like China, India, and Japan is expected to accelerate the region's market expansion. Additionally, the region's growing need for tissue-engineered skin substitutes can be linked to the fast-expanding medical tourism sector in these nations. In India, individuals and healthcare professionals are becoming more knowledgeable about cutting-edge medical procedures and technologies. Tissue-engineered skin substitutes are becoming more and more popular as patients look for efficient wound care options to enhance their quality of life and healing results. Traumatic injuries from traffic accidents, industrial catastrophes, and natural calamities are common in India.

North America is expected to grow at a rapid CAGR in the tissue engineered skin substitutes market during the forecast period. This is due to the growing incidence of burn injuries, the development of technology in the healthcare industry, and the existence of important players in the area. The market in North America is expected to be driven by rising sports injuries, traffic accidents, and the presence of numerous major competitors in the area. The region's market is also anticipated to be driven by the availability of qualified professionals and advancements in healthcare infrastructure. With large investments in biotechnology, regenerative medicine, and tissue engineering, the US is a centre for medical research and innovation. The market is expanding as a result of ongoing developments in biomaterials science and technology, which help create more sophisticated and efficient tissue-engineered skin substitutes.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the tissue engineered skin substitutes market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Amarantus BioScience Holdings

- BSN medical

- Integra LifeSciences Corporation

- KCI Licensing, Inc.

- Kerecis

- LifeNet Health

- Medline Industries Inc

- Medtronic

- MiMedx

- Mölnlycke Health Care AB

- Organogenesis, Inc.

- Regenicin

- Smith and Nephew

- Tissue Regenix

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2025, McMaster University announced a simple tool for tissue engineering techniques. It describes a novel method that accelerates wound healing using accessible, low-cost approaches. This innovation could influence both clinical adoption and market growth by lowering barriers to advanced skin substitute technologies.

- In May 2025, the University of South Australia (UniSA) declared a new generation of skin substitutes for Tissue Engineered Skin Substitute. It highlights advanced biomaterial innovations designed to improve healing outcomes for severe burn patients.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the tissue engineered skin substitutes market based on the below-mentioned segments:

Global Tissue Engineered Skin Substitutes Market, By Product

- Synthetic

- Biosynthetic

Global Tissue Engineered Skin Substitutes Market, By Application

- Acute Wounds

- Chronic Wounds

Global Tissue Engineered Skin Substitutes Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

- What is the current market size and projected growth?

The market was valued at USD 2.54 billion in 2024 and is expected to reach USD 3.65 billion by 2035, growing at a CAGR of 3.35% from 2025 to 2035.

- What are the main product types?

The market segments into synthetic and biosynthetic skin substitutes, with biosynthetic holding the largest share in 2024 due to better biocompatibility and wound healing promotion.

- What applications drive the market?

Acute wounds (like burns, trauma, and surgery) generated the highest revenue in 2024, outpacing chronic wounds, fueled by rising injury rates.

- Which region leads the market?

Asia-Pacific holds the largest share, driven by medical tourism, rising awareness in countries like India, China, and Japan, plus high trauma incidence.

- What factors are boosting market growth?

Key drivers include increasing chronic wounds, burns, ageing populations, regenerative medicine advances, and demand for skin grafts in reconstruction.

- What challenges limit adoption?

High costs restrict access in developing regions, while strict regulations and long approval processes slow innovation and market entry.

- Who are the major companies?

Key players include Integra LifeSciences, Organogenesis, Smith & Nephew, Medtronic, MiMedx, and others like Kerecis and Mölnlycke Health Care.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 220 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |