Global Tissue Sealants and Adhesives Market

Global Tissue Sealants and Adhesives Market Size, Share, and COVID-19 Impact Analysis, By Product (Natural or Biological and Synthetic & Semi-Synthetic), By Application (General Surgery, Orthopedic Surgery, Gynecology Surgery, Cardiovascular Surgery, Cosmetic Surgery, Neurosurgery, and Other Applications), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 -2035

Report Overview

Table of Contents

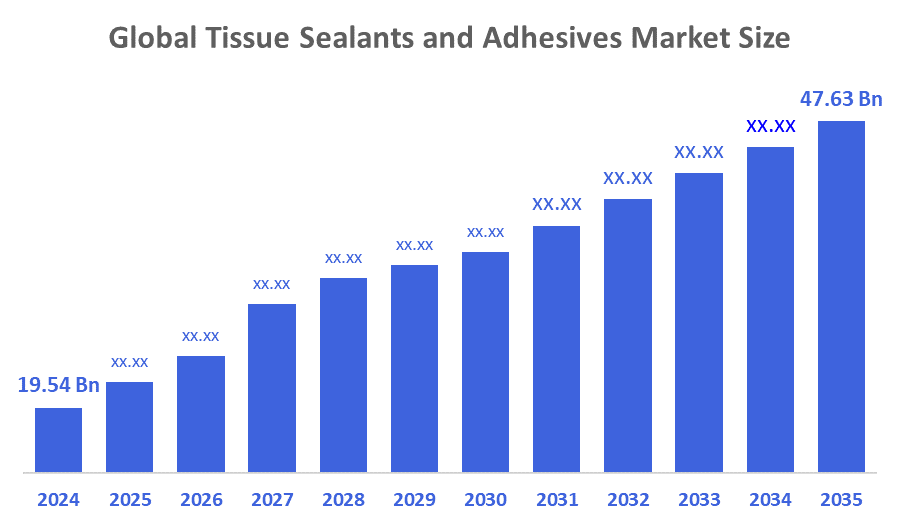

Global Tissue Sealants and Adhesives Market Size Insights Forecasts to 2035

- The Global Tissue Sealants and Adhesives Market Size Was Estimated at USD 19.54 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.44 % from 2025 to 2035

- The Worldwide Tissue Sealants and Adhesives Market Size is Expected to Reach USD 47.63 Billion by 2035

- Europe is expected to grow the fastest during the forecast period.

According to a research report published by Decisions Advisors and Consulting, The Global Tissue Sealants And Adhesives Market Size Was Worth Around USD 19.54 Billion In 2024 And Is Predicted To Grow To Around USD 47.63 Billion By 2035 With A Compound Annual Growth Rate (CAGR) Of 8.44 % From 2025 To 2035. The market expansion is increasing due to key businesses developing innovative tissue glue and bio-adhesive sealants to appeal to a wide range of customers, including young and elderly patients, as well as children. Moreover, tissue sealants are used to shield delicate, sensitive skin from harm and to stop the spread of infections and cross-contamination. Large corporations are making significant investments in R&D in order to launch breakthrough products; all of these elements are probably going to create a lot of chances for the growth of the worldwide tissue sealants and tissue adhesive market.

Market Overview

The global tissue sealants and adhesives market refers to the segment of medical devices and surgical supplies that provide alternatives to traditional sutures and staples by bonding tissues, controlling bleeding, and promoting healing during surgical procedures. Tissue adhesives support tissue repair and inhibit the occurrence of infection at the site of injury. Tissue adhesives will improve the quality of tissue repair by accelerating the formation of new tissue. Tissue adhesives are gaining popularity among individuals with chronic illnesses, such as diabetes, that result in the development of long-lasting wounds, thereby driving the growth of the market. The predominant application for tissue adhesives today is based on the basis of cellulosic (plant-based) adhesives. Tissue adhesive is currently the preferred choice for surgical closure during cardiovascular surgery. Innovations in the design of delivery devices that facilitate the application of tissue adhesives may provide untapped growth opportunities. Tissue adhesives can be utilised for other types of cosmetic and aesthetic surgeries. Tissue adhesives provide superior benefits for tissues that have been treated using tissue adhesives to provide a wound closure and stop bleeding with little to no scarring or negative impact on appearance for both surgeons and patients. Tissue adhesives also create better adhesion for reconstructive surgical procedures, allowing for greater precision and control.

Sealonix's capital infusion, which invested $20 million through its Series A funding round, is directed specifically. In addition, their focus is on the production/development of hemostatic sealants for O&P operations (orthopaedic and abdominopelvic), thus establishing themselves in a sector dedicated to the development of products intended to control blood loss, provide tissue adhesion and assist with the closure of wounds.

Report Coverage

This research report categorises the tissue sealants and adhesives market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the tissue sealants and adhesives market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the tissue sealants and adhesives market.

Driving Factors

Tissue sealants and tissue adhesives are being developed in conjunction with the increasing number of surgical procedures being performed, along with the growing preference for more minimally invasive surgical techniques, as well as the increasing demand for effective closure solutions after surgery, which result in a reduced healing period and fewer complications after surgical procedures. Continuous improvements in biomaterial technologies have allowed for the creation of improved synthetic and biologic sealant materials, with greater tensile strength, flexibility and compatibility with the body, which has led to an increased usage of these products by clinicians. Also, due to the rise in the number of trauma patients, along with an increase in chronic wounds and age-related illnesses, as well as an increase in the number of patients in the older population, there is an increase in the demand for these products. With the ever-increasing number of developed countries offering reimbursement incentives for the use of tissue sealant products and increasing numbers of medical professionals aware of the benefits that using tissue sealant materials over traditional suture materials provide for patients, the tissue sealant and tissue adhesive market continues to grow.

Terumo introduced AQUABRID, a fully synthetic surgical sealant, into the EMEA market, designed specifically for aortic surgical procedures where bleeding control is critical. Already used in Japan under the name HYDROFIT®. AQUABRID® is optimised for wet conditions and provides strong, elastic sealing within 3–5 minutes.

Restraining Factors

Although there are many opportunities for growth in the market, there also exist numerous obstacles due to competition from traditional techniques such as staples or stitches. These traditional methods continue to be used frequently because of the low cost, longevity and ease of use for both practitioners and clients. Moreover, the result of the high initial price associated with the use of a tissue adhesive and also the logistical issues around refrigerating products, which are relatively slow to enter the market compared to the other types of products currently available.

Market Segmentation

The tissue sealants and adhesives market share is classified into product, and application.

- The natural or biological segment accounted for the largest market share in 2024 and is projected to grow at a notable CAGR over the forecast period.

Based on the product, the tissue sealants and adhesives market is segmented into natural or biological and synthetic & semi-synthetic. Among these, the natural or biological segment accounted for the largest market share in 2024 and is projected to grow at a notable CAGR over the forecast period. For instance, Collagen is an incredible natural resource because it is identical to the human body's own natural healing process, meaning there are no adverse effects associated with using collagen. Therefore, there are no concerns about an immune reaction to a wound or surgical site when utilising collagen compared to the synthetic glue; a synthetic glue could create problems with immune response and infections.

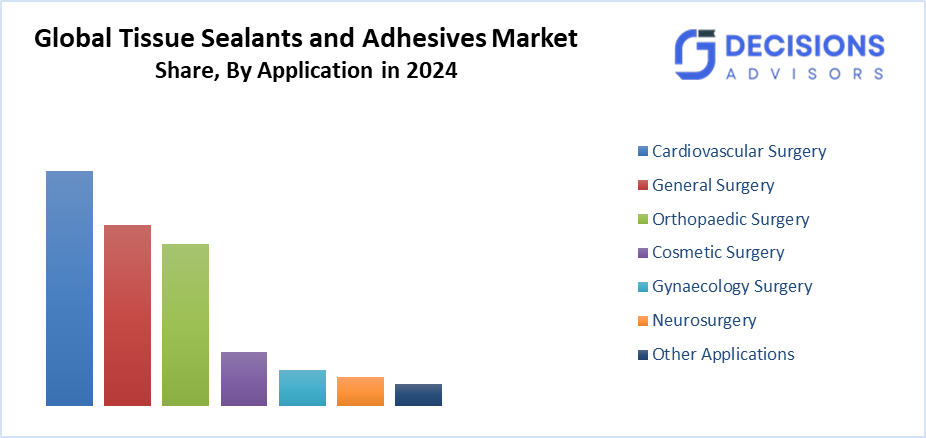

- The cardiovascular surgery segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the tissue sealants and adhesives market is differentiated into general surgery, orthopaedic surgery, gynaecology surgery, cardiovascular surgery, cosmetic surgery, neurosurgery, and other applications. Among these, the cardiovascular surgery segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Advanced sealants are important because of the increased complexity and risk associated with cardiovascular procedures. These sealants improve patient outcomes by allowing tissues to heal at a faster rate, thus reducing potential complications from bleeding and other procedures. This is because these tissue sealants offer quicker and more effective closure methods than traditional suturing techniques, which helps reduce the duration of the operation.

Regional Segment Analysis of the Tissue Sealants and Adhesives Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the tissue sealants and adhesives market over the predicted timeframe.

North America is anticipated to hold the largest share of the tissue sealants and adhesives market over the predicted timeframe. This is due to numerous world-renowned healthcare companies located in the United States, which is one of the primary sources of growth of tissue sealants at an advanced level around the globe. There continues to be room for ongoing research and development in this area, resulting in innovative products with improved biocompatibility and increased adhesion strength. The United States also has an extensive healthcare infrastructure, and it currently spends more money on healthcare than any other nation in the world. Health care policies have provided an excellent environment for advanced medical technologies to flourish in the USA. Furthermore, the rising incidence of chronic diseases and age-related health issues among Americans has created a growing demand for tissue adhesives. The FDA has formed partnerships with various industry stakeholders to support the development of new products, as well as to confirm their safety and effectiveness.

Europe is expected to grow at a rapid CAGR in the tissue sealants and adhesives market during the forecast period. Some key factors that drive growth within European markets include population ageing. For instance, according to Eurostat, Germany has one of the oldest populations within Europe, with a significant percentage of its population falling within the age group of 65 years or older. As the population ages, it will experience many chronic diseases related to the state's population ageing process, such as degenerative diseases, such as heart disease, arthritis, and degenerative diseases that require surgical treatment. With this increased prevalence of chronic diseases, the need for improved surgical techniques and less invasive methods to perform surgeries is at an all-time high, resulting in increased demand for tissue adhesives and tissue sealants. The German Government has supported the German manufacturing industry as they work to produce high-quality products by maintaining strict quality standards. Thus, the German manufacturing sector continues to innovate and develop high-quality, reliable surgical adhesives and tissue sealants to serve the domestic and international markets.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the tissue sealants and adhesives market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Baxter International Inc.

- C.R Bard

- Chemence Medical, Inc.

- Cohera Medical, Inc.

- Exapharma

- Integra LifeSciences

- Johnson & Johnson

- Luna Innovations Incorporated

- Smith & Nephew

- Tissuemed Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the tissue sealants and adhesives market based on the below-mentioned segments:

Global Tissue Sealants and Adhesives Market, By Product

- Natural or Biological

- Synthetic & Semi-Synthetic

Global Tissue Sealants and Adhesives Market, By Application

- General Surgery

- Orthopedic Surgery

- Gynaecology Surgery

- Cardiovascular Surgery

- Cosmetic Surgery

- Neurosurgery

- Other Applications

Global Tissue Sealants and Adhesives Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

1. What is the current size and projected growth of the global tissue sealants and adhesives market?

The market was valued at USD 19.54 billion in 2024 and is expected to reach USD 47.63 billion by 2035, growing at a CAGR of 8.44% from 2025 to 2035.

2. What are the main product segments in the tissue sealants and adhesives market?

The market segments into Natural or Biological (the largest share in 2024, projected for a notable CAGR) and Synthetic & Semi-Synthetic products.

3. Which application holds the highest market revenue, and why?

Cardiovascular surgery accounted for the highest revenue in 2024 and is anticipated to grow at a significant CAGR, due to the need for advanced sealants in complex procedures that reduce bleeding and speed healing.

4. Which region dominates the market, and which is expected to grow fastest?

North America holds the largest share, driven by advanced healthcare infrastructure and R&D in the US. Europe is expected to grow at the fastest CAGR, fueled by ageing populations and demand for minimally invasive techniques.

5. What are the primary driving factors for market growth?

Key drivers include rising surgical procedures, preference for minimally invasive techniques, advancements in biomaterials, increasing trauma/chronic wounds, ageing populations, and reimbursement incentives in developed countries.

6. What challenges or restraining factors affect the market?

Competition from low-cost traditional sutures/staples, high initial costs of adhesives, and storage requirements (e.g., refrigeration) limit adoption.

7. Who are some key players in the global tissue sealants and adhesives market?

Major companies include Baxter International Inc., Johnson & Johnson, Smith & Nephew, Integra LifeSciences, C.R. Bard, Chemence Medical, Inc., and others like Cohera Medical and Tissuemed Ltd.

8. What recent developments highlight market innovation?

Terumo launched AQUABRID, a synthetic sealant for aortic procedures in EMEA (also HYDROFIT in Japan). Sealonix raised $20 million in Series A for hemostatic sealants in orthopaedic and abdominopelvic surgeries.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 230 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |