Global Transcatheter Embolization and Occlusion Devices Market

Global Transcatheter Embolization and Occlusion Devices Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Embolization Coils, Embolization Particles/Microspheres, Liquid Embolic Agents and More), By Application (Peripheral Vascular Disease, Oncology and More) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

Global Transcatheter Embolization and Occlusion Devices Market Size Insights Forecasts to 2035

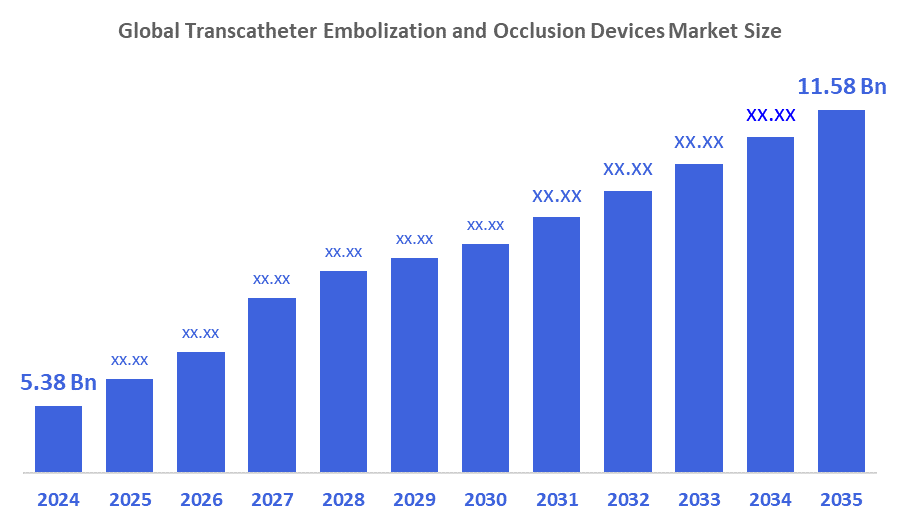

- The Global Transcatheter Embolization and Occlusion Devices Market Size Was valued at USD 5.38 Billion in 2024

- The Global Transcatheter Embolization and Occlusion Devices Market Size is Expected to Grow at a CAGR of around 7.22% from 2025 to 2035

- The Worldwide Transcatheter Embolization and Occlusion Devices Market Size is Expected to Reach USD 11.58 Billion by 2035

- Asia-Pacific is expected to grow the fastest during the forecast period.

According to a research report published by Decisions Advisors and Consulting, The Global Transcatheter Embolization And Occlusion Devices Market Size Was Worth Around USD 5.38 Billion In 2024 And Is Predicted To Grow To Around USD 11.58 Billion By 2035 With A Compound Annual Growth Rate (CAGR) Of 7.22% From 2025 To 2035. Future opportunities include technological innovation and the expansion of minimally invasive procedures and the increasing prevalence of oncology and vascular diseases and the development of healthcare infrastructure in emerging markets and the rising investment in research and development for advanced embolic materials and delivery systems.

Market Overview

The Global Transcatheter Embolization And Occlusion Devices Market Size refers to the worldwide industry that develops minimally invasive devices which doctors use to create intentional blood vessel blockages for treating medical conditions that include tumors and aneurysms and excessive bleeding. Additionally, the market is experiencing significant growth because ongoing technological developments in embolic agents and device delivery systems continue to create new business opportunities. The development of new embolic coils and particles and liquid embolics delivers better clinical results through their enhanced accuracy and compatibility with biological systems and specialized drug delivery methods. The design of smaller flexible catheters together with guidewires enables medical professionals to access difficult-to-reach blood vessels and their associated complex vascular systems. Furthermore, The US Food and Drug Administration (FDA) maintained its approval process for new medical devices during this period which led to Contego Medical receiving Premarket Approval (PMA) for its Neuroguard IEP System that combines an embolic filter with other functions in October 2024.

Report Coverage

This research report categorizes the transcatheter embolization and occlusion devices market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the transcatheter embolization and occlusion devices market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the transcatheter embolization and occlusion devices market.

Driving Factors

The transcatheter embolization and occlusion devices market experiences its most significant impact through rising healthcare expenditures which different regions now spend. The healthcare industry sees an increase in advanced medical technologies because governments and private organizations increase their funding for healthcare services. Emerging markets demonstrate this trend because they currently experience rapid growth in their healthcare infrastructure investments. The reports show that healthcare expenditures will increase by 5 percent each year which will enable medical facilities to adopt new embolization technology. Healthcare organizations show a higher tendency to finance transcatheter solutions which medical professionals require to treat difficult health issues. The market will expand because of this funding increase which will also improve treatment results for patients.

Restraining Factors

The market expansion will face obstacles because of six key factors which include expensive devices and difficulties with reimbursement and challenges during procedures and shortages of qualified professionals and strict regulatory standards and delayed technology adoption in developing areas.

Market Segmentation

The transcatheter embolization and occlusion devices market share is classified into product type and application.

- The embolization coils segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the product type, the transcatheter embolization and occlusion devices market is divided into embolization coils, embolization particles/microspheres, liquid embolic agents and more. Among these, the embolization coils segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Embolization coils achieve dominance because they provide better placement accuracy and their occlusion performance remains consistent while they maintain a high standard of clinical safety. Physicians choose these devices as their primary treatment method for aneurysms and hemorrhages and vascular malformations. The sustained demand for the treatment exists because of the increasing use of minimally invasive procedures and the growing number of chronic illnesses and the ongoing development of new medical devices which have created a dominant market position that will continue to experience rapid growth in the future.

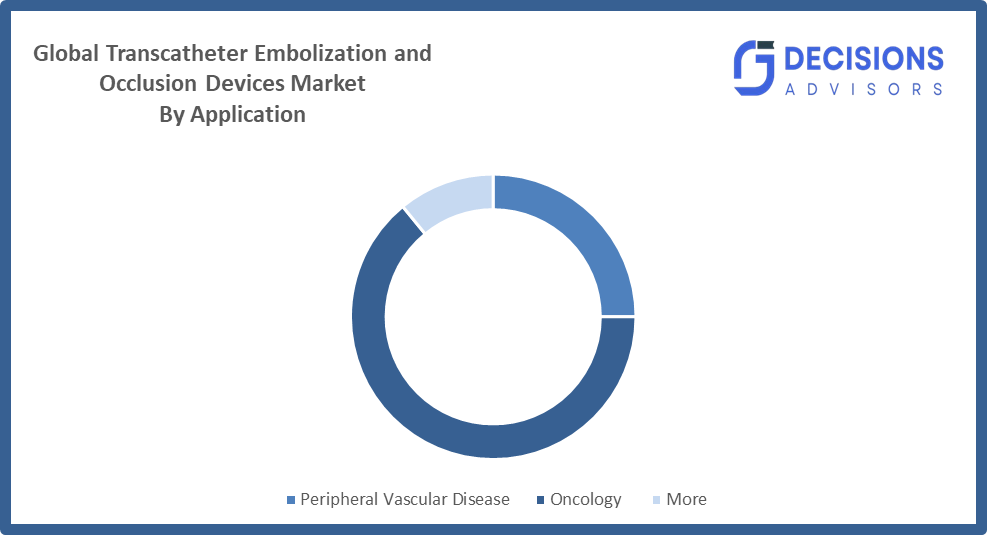

- The oncology segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the transcatheter embolization and occlusion devices market is divided into peripheral vascular disease, oncology and more. Among these, the oncology segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This growth occurs because doctors need better treatment methods for cancer which has become more common especially in patients with liver and lung and kidney tumors. Transcatheter embolization and occlusion techniques are gaining traction in oncology because they enable doctors to deliver embolic agents directly to tumors which results in complete blood supply interruption and tumor growth prevention.

Regional Segment Analysis of the Transcatheter Embolization and Occlusion Devices Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the transcatheter embolization and occlusion devices market over the predicted timeframe.

North America is anticipated to hold the largest share of the transcatheter embolization and occlusion devices market over the predicted timeframe. The healthcare system maintains advanced reimbursement methods together with extensive interventional radiology systems and quick approval procedures that follow FDA special controls regulations for neurovascular devices. The complete corporate dedication to expanding peripheral vascular operations receives confirmation from Stryker's acquisition of Inari Medical, which cost the company USD 4.9 billion. The medical studies currently underway together with the Vanguard research on Pipeline Vantage demonstrate technology effectiveness while helping doctors maintain their trust in the system.

Asia-Pacific is expected to grow at a rapid CAGR in the transcatheter embolization and occlusion devices market during the forecast period. The healthcare infrastructure development which receives extensive investment activities together with the growing middle class population base who can now access advanced medical facilities which creates a specialized healthcare system. The market operations in Japan and China face disruption because of the high number of liver cancer cases which establish tumor embolization as the main treatment method. Hospital modernization projects through government funding together with interventional cardiology and radiology training programs for local doctors create the main factors that drive business growth. The region experiences a major trend where affordable locally produced medical devices enter the market to compete against high-priced Western products which leads to increased medical procedure activities in second and third-tier urban areas. The rapid urban development together with changing lifestyles in India and Southeast Asia has resulted in higher rates of cardiovascular and peripheral arterial diseases which has created a large unserved patient population for occlusion technology products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the transcatheter embolization and occlusion devices market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Boston Scientific Corporation

- Terumo Corporation

- Medtronic

- DePuy Synthes (Johnson & Johnson)

- Stryker

- Cordis

- Abbott

- Pfizer Inc.

- Sirtex SIR-Spheres Pty Ltd.

- Nordion (Canada) Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the transcatheter embolization and occlusion devices market based on the below-mentioned segments:

Global Transcatheter Embolization and Occlusion Devices Market, By Product Type

- Embolization Coils

- Embolization Particles/Microspheres

- Liquid Embolic Agents

- More

Global Transcatheter Embolization and Occlusion Devices Market, By Application

- Peripheral Vascular Disease

- Oncology

- More

Global Transcatheter Embolization and Occlusion Devices Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

- What is the CAGR of the transcatheter embolization and occlusion devices market over the forecast period?

A: The global transcatheter embolization and occlusion devices market is projected to expand at a CAGR of 7.22% during the forecast period.

- What is the market size of the transcatheter embolization and occlusion devices market?

A: The global transcatheter embolization and occlusion devices market size is estimated to grow from USD 5.38 billion in 2024 to USD 11.58 billion by 2035, at a CAGR of 7.22% during the forecast period 2025-2035.

- Which region holds the largest share of the transcatheter embolization and occlusion devices market?

A: North America is anticipated to hold the largest share of the transcatheter embolization and occlusion devices market over the predicted timeframe.

- Who are the top 10 companies operating in the global transcatheter embolization and occlusion devices market?

A: Boston Scientific Corporation, Terumo Corporation, Medtronic, DePuy Synthes (Johnson & Johnson), Stryker, Cordis, Abbott, Pfizer Inc., Sirtex SIR-Spheres Pty Ltd., Nordion (Canada) Inc., and Others.

- What are the market trends in the transcatheter embolization and occlusion devices market?

A: The transcatheter embolization and occlusion devices market shows major market trends because hospitals need these devices to treat patients with chronic diseases and because the medical field currently experiences a surge in minimally invasive procedures and oncology treatments and because companies continue to introduce new technologies and customers worldwide increase their product usage.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 250 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Feb 2026 |

| Access | Download from this page |