Global Tungsten Market

Global Tungsten Market Size, Share, and COVID-19 Impact Analysis, By Form (Powder, Mill Products, Tungsten Carbide Components, Others), By End Use (Aerospace & Defense, Construction, Automotive, Mining & Energy, Electronics & Robots, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Tungsten Market Summary

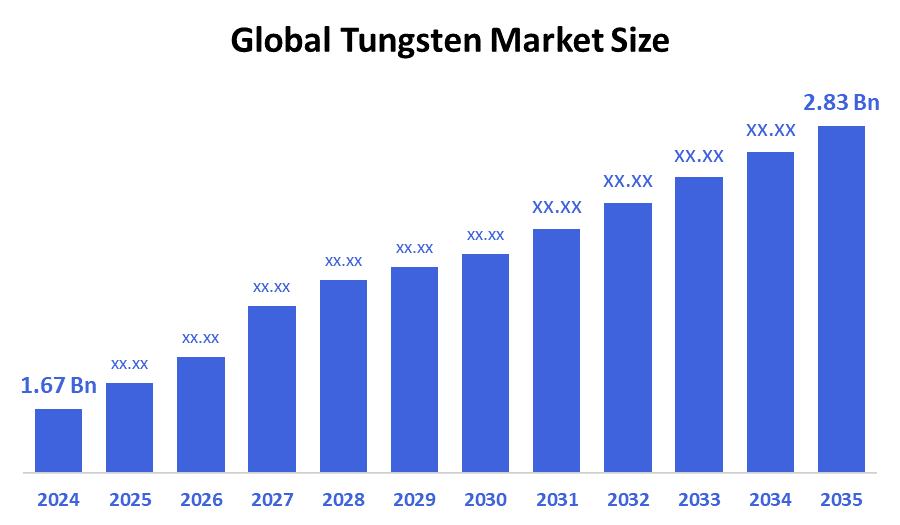

The Global Tungsten Market Size Was Estimated at USD 1.67 Billion in 2024 and is Projected to Reach USD 2.83 Billion by 2035, Growing at a CAGR of 4.91% from 2025 to 2035. A number of significant factors are driving the tungsten market's expansion, such as rising demand from different end-use sectors, advances in technology, and an increased emphasis on recycling and the circular economy.

Key Regional and Segment-Wise Insights

- Asia Pacific held the largest revenue share of 54.1% and dominated the market globally.

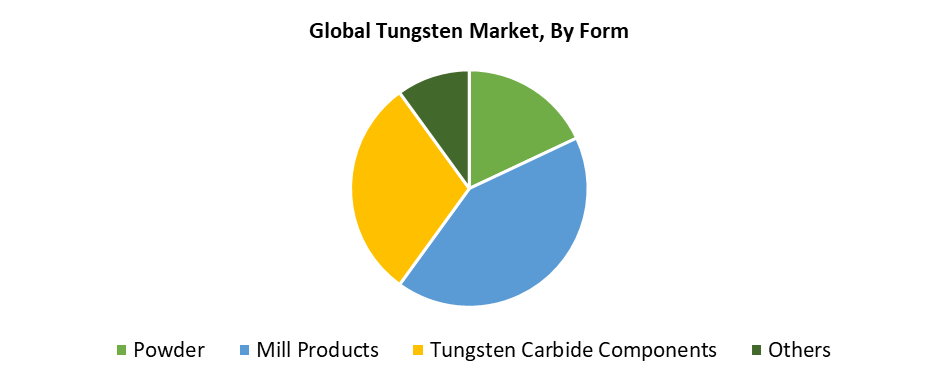

- With a revenue share of more than 42.7%, the mill products segment held the biggest market share by form.

- With a revenue share of more than 24.1%, the automotive segment held the biggest market share by end use.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 1.67 Billion

- 2035 Projected Market Size: USD 2.83 Billion

- CAGR (2025-2035): 4.91%

- Asia Pacific: Largest market in 2024

The tungsten market encompasses all activities which include tungsten extraction alongside processing and end-use applications of this dense metal with exceptional hardness, high melting point, excellent thermal, and electrical conductivity. The aerospace and automotive sectors, together with electronics manufacturing and military and manufacturing industries, extensively utilise tungsten in their heavy metal alloys and filaments and electrical connections and cutting tools. Market growth is driven by expanding automotive and aerospace component manufacturing and increasing electronics production, and rising requirements for tungsten-based hard metals in machining and metalworking applications. The metal maintains consistent demand because it plays an essential role in creating durable, high-performance products. The industrial and defence sectors select this material because it withstands both high temperatures and material degradation.

Sustainable mining practices, together with tungsten recycling technologies, are expanding the market by improving resource utilisation while minimising environmental damage. The growing number of renewable energy projects, including solar panels and wind turbines, which use tungsten components, drives additional market demand. Worldwide governments implement protective supply chain regulations to safeguard tungsten resources while supporting domestic manufacturing because they view tungsten as a strategic asset. The tungsten mining and processing industry receives support from trade regulations and investment incentives in key producing nations, including China, Russia and Canada. The tungsten alloy production innovations for electric vehicles and defence applications open new market potential, which ensures stable long-term growth independent of raw material supply variations.

Form Insights

The mill products segment held the largest revenue share of 42.7% within the worldwide tungsten market during 2024. The high-density strength combined with thermal and mechanical durability of tungsten makes mill products, including rods, sheets, wires, bars and plates applicable across multiple sectors, starting from manufacturing to aerospace and automotive, defence and electronics. These goods hold essential applications for cutting tools, along with heating elements and electrical contacts and structural components. Precision machining requires both durability and dimensional stability, so these products experience peak demand in this market. The segment maintains its position as a leader because of two main factors: rising production of high-performance components and increased investment in advanced manufacturing technology. The durability and recyclability of tungsten mill products enable environmentally friendly production, which helps maintain their ongoing industrial demand.

The tungsten carbide components segment will demonstrate the fastest growth during the forecast period because various industries require extremely hard and wear-resistant materials. Tungsten carbide, which consists of tungsten combined with carbon, exhibits outstanding hardness that makes it ideal for precision components and drill bits, cutting tools, as well as mining equipment and wear parts. The rising industrialisation in emerging markets drives increasing tungsten carbide usage across metalworking and construction sectors, as well as oil and gas and automotive industries. The market growth receives additional support from the expanding applications of tungsten carbide in electronic devices and medical equipment because of reliability needs and product miniaturisation trends. This product gains more consumer acceptance because it provides long-lasting durability and strong resistance to tough environmental conditions.

End Use Insights

The automotive industry acquired the highest revenue share of 24.1% in the worldwide tungsten market in 2024 because of the metal's essential role in creating durable, high-performance components. Tungsten carbide tools for machining automotive components use tungsten extensively in engine parts as well as braking systems, turbochargers and fuel injectors. The automotive manufacturing sector requires tungsten for its high melting point and strength, and resistance to wear during metalworking and tooling procedures. The worldwide rise in vehicle production, especially for electric and hybrid cars, creates increased demand for tungsten-based parts and tools. High-strength materials receive increased demand because the automotive industry seeks durable, efficient systems, which bolsters tungsten's leading position in this market segment.

Electronics and robotics represent the fastest-growing segment in the tungsten market throughout the forecast period because consumer electronics and automation, and next-generation technologies advance quickly. Tungsten possesses the perfect characteristics for semiconductor applications and electronic components because it delivers outstanding mechanical strength together with thermal resistance, and electrical conductivity. The robotic industry uses tungsten for precise tools and actuators, and counterweights because its density and strength properties make it essential. The growing industrial automation needs, together with IoT technologies and AI systems and smart devices, have led to increased tungsten consumption. The segment growth across the globe will be driven by rising robotics and automation industry investments, together with ongoing electronic component miniaturisation.

Regional Insights

The Asia Pacific tungsten market held the largest revenue share of 52.9% through 2024 because of strong mining operations and rising industrial output, and expanding market applications in key economies such as China, Japan, India and South Korea. The production and consumption of tungsten exist predominantly within China because it maintains the biggest reserves and advanced processing operations. The industrial sector, along with aerospace and automotive and electronics sectors, extensively utilises tungsten and its alloy derivatives throughout their continuous development in the region. Market growth also receives a boost from government financial support toward infrastructure construction and industrial modernisation efforts, and renewable energy initiatives. The Asia Pacific region maintains its position as the worldwide leader in tungsten markets because of rising exports of advanced tungsten products and growing domestic market requirements.

North America Tungsten Market Trends

The tungsten market of North America experienced substantial growth in 2024 because industrial sectors, including electronics, automotive, aerospace, defence and oil and gas, needed more tungsten. The United States leads regional growth through its advanced manufacturing capabilities and rising investments in strategic minerals, which decrease its dependence on Chinese imports. The market growth stems from rising tungsten applications in manufacturing cutting tools, as well as electronic components and high-performance alloy materials. The region focuses on recycling technology and domestic mining, and reindustrialisation, which bolsters its supply chain resilience. The future growth of tungsten-based material demand in North America appears strong because government programs back infrastructure development and energy, and defence industry innovation.

Europe Tungsten Market Trends

The European tungsten market experiences steady growth because various industries, including electronics and medical devices and aerospace and automotive, and military, require increasing quantities of tungsten. European nations, including Germany, Austria UK and France, dedicate investments to precision engineering and advanced manufacturing because tungsten serves essential roles in cutting tools and wear-resistant components and high-density alloys. The European Union established tungsten as a key raw material, which triggered increased efforts to establish local supply chains and promote recycling practices and support ethical sourcing methods. Tungsten-based components experience growing demand because the automobile industry drives its electrification and sustainable technology initiatives. The region is making progress in tungsten processing and end-use operations through strategic partnerships, along with research and development funding.

Key Tungsten Companies:

The following are the leading companies in the tungsten market. These companies collectively hold the largest market share and dictate industry trends.

- China Minmetals Corporation

- Buffalo Tungsten Inc.

- Cleveland Tungsten, Inc.

- BETEK GMBH & CO. KG

- Almonty Industries Inc.

- Kennametal Inc.

- Element Six UK Ltd.

- TUNGSTEN WEST

- Sandvik AB

- EQ Resources Limited

- Others

Recent Development

- In November 2024, Kazakhstan's mining industry made a major stride forward with the opening of its first tungsten processing plant in the Almaty Region, strengthening its position in the world market for rare earth metals. It is anticipated that the USD 300 million facility will provide up to 1,000 jobs for local experts. 3.3 million tons of ore will be processed annually at full capacity, yielding 65% pure tungsten concentrate.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the tungsten market based on the below-mentioned segments:

Global Tungsten Market, By Form

- Powder

- Mill Products

- Tungsten Carbide Components

- Others

Global Tungsten Market, By End Use

- Aerospace & Defense

- Construction

- Automotive

- Mining & Energy

- Electronics & Robots

- Others

Global Tungsten Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 218 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |