Global Ultrasound Needle Guides Market

Global Ultrasound Needle Guides Market Size, Share, and COVID-19 Impact Analysis, By Type (Disposable Needle Guides, and Reusable Needle Guides), By Application (Tissue Biopsy, Fluid Aspiration, Vascular Access Procedures, Nerve Block and Regional Anesthesia), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Global Ultrasound Needle Guides Market Size Insights Forecasts to 2035

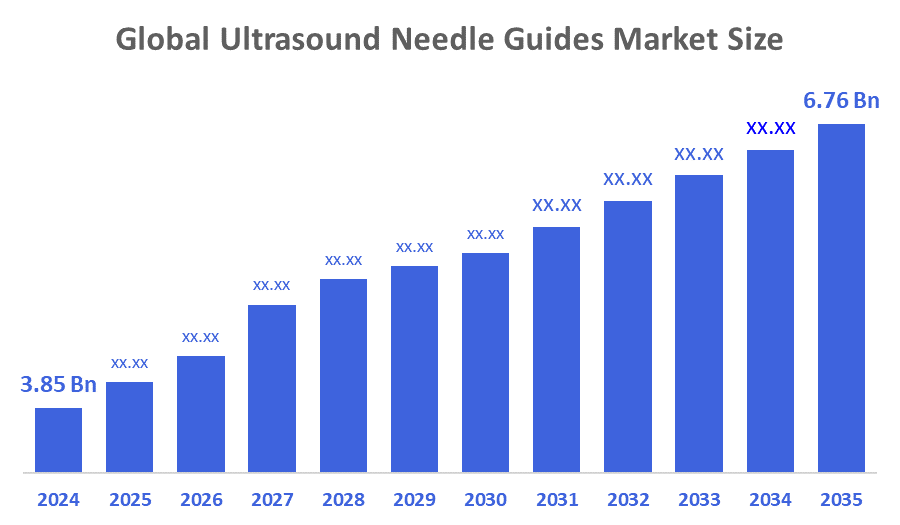

- The Global Ultrasound Needle Guides Market Size Was Estimated at USD 3.85 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.25% from 2025 to 2035

- The Worldwide Ultrasound Needle Guides Market Size is Expected to Reach USD 6.76 Billion by 2035

- North America is expected to Grow the fastest during the forecast period.

According to a Research Report Published by Decisions Advisors and Consulting, The Global Ultrasound Needle Guides Market Size was worth around USD 3.85 Billion in 2024 and is predicted to Grow to around USD 6.76 Billion by 2035 with a compound annual growth rate (CAGR) of 5.25% from 2025 to 2035. Ultrasound-guided procedures have been increasingly accepted by healthcare providers as their popularity has risen due to improved safety, accuracy, convenience and cost-effectiveness. Additionally, as the healthcare industry adopts more point-of-care ultrasound systems, the opportunity for increased use of ultrasound imaging technology will continue to increase. The increasing prevalence of chronic diseases among patients with Cancer, Diabetes and other chronic conditions, and the increase in the number of older patients requiring minimally invasive surgeries, will drive demand for the use of Ultrasound Needle Guides in clinical environments.

Market Overview

The ultrasound needle guides market consists of products and services used to assist healthcare providers with the precise placement of biopsy needles in conjunction with ultrasound-assisted procedures. Providers use needle guides to improve both the accuracy and safety of performing biopsies through a clearly defined path for inserting the biopsy needle. The development of ultrasound imaging technologies continues to fuel the growth of this market as improvements in the quality and resolution of ultrasonic images have enhanced providers' ability to see anatomical structures (and, thus, accurately position the needle). Advanced ultrasound imaging technology, incorporating, among other things, real-time imaging capabilities, 3D/4D capabilities (the ability to view images from multiple angles simultaneously), and fusion imaging (the ability to combine multiple types of diagnostic image into one), has allowed biopsies to be more efficiently and safely performed by increasing the number of healthcare providers using needle guide devices. The growing number of chronic diseases (e.g. cancer, cardiovascular disorders, and organ disorders) requiring biopsies as a means of accurately diagnosing the disease is also driving the increase in the use of needle guide devices.

RIVANNA awarded a $2.21 million NIH Small Business Innovation Research (SBIR) grant to develop an ultrasound guidance system for pediatric lumbar punctures on its Accuro® 3S platform. The funding, announced in September 2025, comes from the National Cancer Institute (NCI) and aims to improve the safety and accuracy of lumbar punctures in children, particularly those undergoing treatment for acute lymphoblastic leukaemia (ALL).

BURL Concepts announced that it successfully closed an oversubscribed $4.5 million investment round. The funding will support the launch of its non-invasive SONAS ultrasound system for Patent Foramen Ovale (PFO) detection, bringing total investment in the company to $28 million.

Report Coverage

This research report categorises the ultrasound needle guides market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the ultrasound needle guides market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the ultrasound needle guides market.

Driving Factors

The ultrasound needle guides market is evolving significantly as a result of technological advancements in medical imaging combined with an increasing focus on minimally invasive surgical procedures. The more healthcare players focus on improving the outcomes of their patients, the more providers are likely to use ultrasound needle guides in practice. The rise in the number of individuals with chronic diseases will require that healthcare providers efficiently diagnose and treat these conditions, which in turn will cause an increase in the demand for ultrasound needle guides. Moreover, an increase in the number of healthcare providers who understand the benefits associated with ultrasound-guided procedures, along with an increasing awareness and recognition of the advantages offered through real-time imaging, results in market-growth assets. This trend of increased use of ultrasound needle guides is anticipated to continue as research/development focus on enhancing the design and functionality of these devices.

Leapmed launched its latest version of the ultrasound-guided disposable biopsy guide, the X-Needle Guide, in March 2021. This new product emphasises precision, infection control, and versatility, offering both multi-angle and free-angle guidance options for clinicians performing biopsies, vascular access, and interventional procedures.

Restraining Factors

There is still a large training deficit in performing ultrasound-guided biopsy procedures in a number of professions, including emergency medicine and regional anaesthesia. Additionally, a lack of experts in a number of nations is causing delays in these treatments, which restricts the use of ultrasound needle guides. Further, hospitals must manage their supplies of disposable procedure kits and various probe-specific guidelines due to the intricacy of the supply chain and inventory.

Market Segmentation

The ultrasound needle guides market share is classified into type and application.

- The disposable needle guides segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the type, the ultrasound needle guides market is segmented into disposable needle guides, reusable needle guides. Among these, the disposable needle guides segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Disposable needle guides provide an easy way to simplify work processes without needing to optimise workflow; they are a time saver. Additionally, due to the single-use nature of these products, they improve infection prevention because they lower the risk of spreading contaminated needles or possible infectious diseases from one patient to another. Finally, disposable needle guides are highly flexible in their ability to be deployed at the point of care.

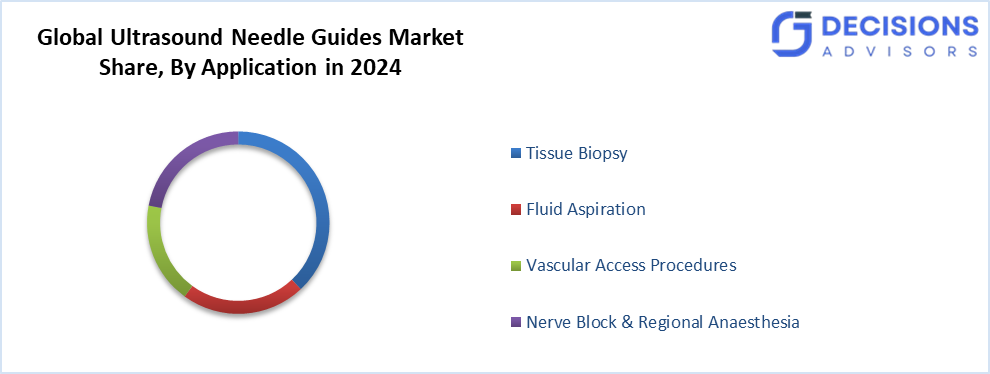

- The tissue biopsy segment accounted for the highest market share in 2024 and is projected to grow at a rapid pace over the forecast period.

Based on the application, the ultrasound needle guides market is divided into tissue biopsy, fluid aspiration, vascular access procedures, nerve block and regional anaesthesia. Among these, the tissue biopsy segment accounted for the highest market share in 2024 and is projected to grow at a rapid pace over the forecast period. The main reasons for the large volume in sales from this market are due to its high percentage of total surgical procedures performed in this category. The ultrasound needle guide category is dominated by tissue biopsies, as the ultrasound guidance is essential for accurate placement of the needle to provide good-quality tissue samples.

Regional Segment Analysis of the Ultrasound Needle Guides Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the ultrasound needle guides market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the ultrasound needle guides market over the predicted timeframe. Healthcare investment in the region, greater awareness of advanced healthcare technologies and rapid population growth are driving growth in the region. One of the most important factors driving growth in the market is the government's initiatives to improve the healthcare infrastructure and increase access to healthcare services. The major countries in this region are China, Japan and India, with a competitive market structure featuring companies such as Hitachi Medical Systems and Mindray. Further, the large population of patients and the increasing level of disposable income mean there is an increasing demand for ultrasound needle guides. Collaboration between local and international companies is facilitating an increasing level of innovation and market penetration into the region.

North America is expected to grow at a rapid CAGR in the ultrasound needle guides market during the forecast period. The regional market growth is supported by the development of advanced healthcare infrastructure, increasing incidence rates of chronic diseases, and a growing need for less invasive medical procedures. The support of federal regulatory agencies such as the U.S. FDA creates a favourable environment for continued growth, as it ensures that devices meet required safety standards and are effective. In addition, the presence of established health care organisations, combined with the focus on R&D, will strengthen the position of these companies in developing ultrasound needle guide products.

The United States has the largest share of North America as a whole, with Canada also providing a large contribution to this region. The ultrasound needle guides market will be led by companies such as GE Healthcare and Philips that are focused on technology development and building strategic alliances/relationships with other companies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the ultrasound needle guides market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Aspen Surgical

- Bard Access Systems (now part of BD)

- Besmed

- Biopsy Sciences

- CIVCO AIROS

- CIVCO Medical Solutions

- Cook Medical

- Innovative Trauma Care

- PBN Medicals

- Siemens Healthineers

- Veran Medical Technologies

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2025, RIVANNA announced that the U.S. Food and Drug Administration (FDA) granted 510(k) clearance for its Accuro 3S Needle Guide Kit. This kit is designed to improve the safety, accuracy, and efficiency of ultrasound-guided needle placement, particularly in anaesthesia and pain management procedures.

- In October 2025, RIVANNA awarded a $3 million grant from the Congressionally Directed Medical Research Program (CDMRP) to develop a military-optimised ultrasound guidance system for spinal interventions. The 36-month project aims to address the high burden of back pain and spinal injuries among U.S. armed forces personnel, which costs an estimated $2 billion annually.

- In July 2025, Mendaera announced that it received FDA 510(k) clearance for its handheld robotic system, the Focalist, designed to simplify and enhance precision in ultrasound-guided needle placement. This marks a major milestone in robotic-assisted medical procedures, particularly in specialities like urology, anaesthesia, and interventional medicine.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the ultrasound needle guides market based on the below-mentioned segments:

Global Ultrasound Needle Guides Market, By Type

- Disposable Needle Guides

- Reusable Needle Guides

Global Ultrasound Needle Guides Market, By Application

- Tissue Biopsy

- Fluid Aspiration

- Vascular Access Procedures

- Nerve Block

- Regional Anaesthesia

Global Ultrasound Needle Guides Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

- What is the current market size and projected growth?

The market was valued at USD 3.85 billion in 2024 and is expected to reach USD 6.76 billion by 2035, growing at a CAGR of 5.25% from 2025-2035.

- What drives growth in the ultrasound needle guides market?

Key drivers include rising chronic diseases (e.g., cancer), demand for minimally invasive procedures, advancements in ultrasound imaging like 3D/4D, and increasing adoption of point-of-care systems.

- Which type segment leads the market?

Disposable needle guides held the largest share in 2024 due to infection control, workflow efficiency, and point-of-care flexibility; they are expected to grow at a significant CAGR.

- What is the top application segment?

Tissue biopsy accounted for the highest market share in 2024 and is projected to grow rapidly, as ultrasound guidance ensures accurate needle placement for quality samples.

- Which region dominates or grows fastest?

Asia-Pacific holds the largest share, driven by healthcare investments, population growth, and government initiatives in countries like China, Japan, and India. North America is expected to grow fastest.

- Who are the key market players?

Major companies include Aspen Surgical, Bard Access Systems (BD), CIVCO Medical Solutions, Cook Medical, PBN Medicals, Siemens Healthineers, and others like RIVANNA and Mendaera.

- What are recent developments?

In 2025, RIVANNA received FDA clearance for the Accuro 3S Needle Guide Kit and grants for pediatric/military ultrasound systems; Mendaera got clearance for its robotic Focalist system.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 298 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |