United Arab Emirates Cloud Computing Market

United Arab Emirates Cloud Computing Market Size, Share, By Service Model (Infrastructure as a Service (IaaS), Platform as a Service (PaaS), Software as a Service (SaaS)), By Deployment Model (Public Cloud, Private Cloud, Hybrid Cloud), By Organization Size (SMEs, Large Enterprises), By Industry Vertical (BFSI, Government & Public Sector, IT & Telecom, Healthcare, Retail & E-commerce, Energy & Utilities), United Arab Emirates Cloud Computing Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

United Arab Emirates Cloud Computing Market Size Insights Forecasts to 2035

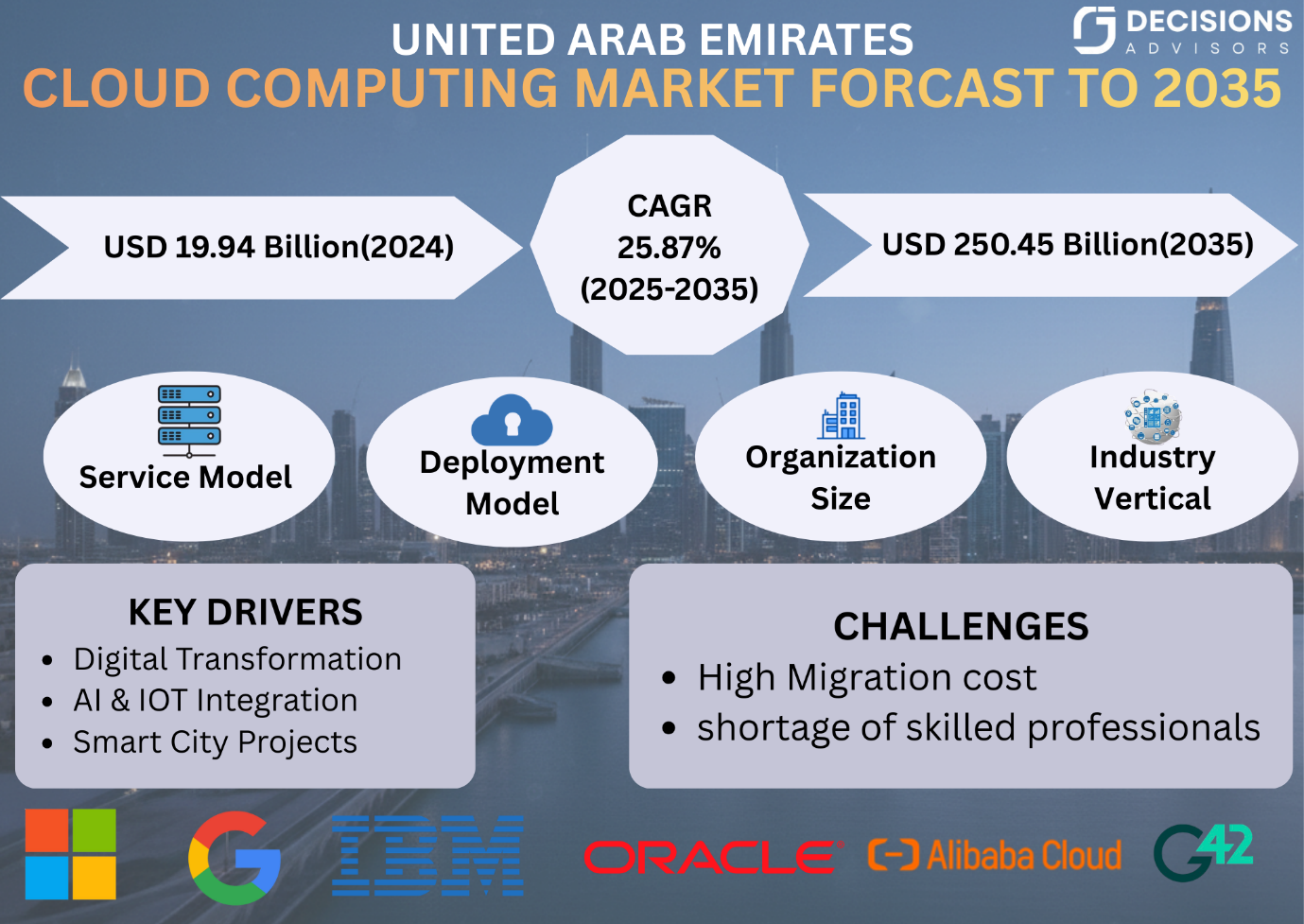

- United Arab Emirates Cloud Computing Market Size 2024: USD 19.94 Billion

- United Arab Emirates Cloud Computing Market Size 2035: USD 250.45 Billion

- United Arab Emirates Cloud Computing Market CAGR 2024: 25.87%

- United Arab Emirates Cloud Computing Market Segments: By Service Model, By Deployment Model, By Organization Size, and By Industry Vertical.

The UAE cloud computing industry can be defined as the provision of cloud computing services, including services such as servers, storage, database systems, networking and analytics, software applications, and various computing resources on demand through internet platforms. The services of cloud computing are utilized in sectors such as the financial industry, government, telecom, health, retail, and energy.

The market is moving forward as cloud migrations by enterprises, robust government initiatives on cloud, development of 5G infrastructure, data center build-out, as well as growth in AI and Big Data technologies, are driving forces for growth. Establishment of hyperscale cloud regions by global cloud providers such as Amazon Web Services, Microsoft Corporation, Google LLC, and Oracle Corporation has enhanced regional cloud infrastructure.

The UAE government's initiatives, such as the UAE Digital Government Strategy 2025 and Smart Dubai, are leading to more rapid embracement of cloud-first strategies within government institutions. Data localization regulations are also playing a vital role in influencing growth.

Market Dynamics of the United Arab Emirates Cloud Computing Market:

The UAE cloud computing market is driven by strong government initiatives for digital transformation, fast expansion of SMEs, increasing AI and IoT integration, growth of fintech, smart city projects, and escalating demand for scalable IT infrastructure. The public sector has emerged as one of the biggest drivers of cloud adoption under various national digital agendas. In addition, high enterprise-level hybrid cloud strategy adoptions due to regulatory policy compliance and data sovereignty concerns are driving the growth.

The market faces challenges such as data security, high cost of initial migration, risks of vendor lock-in, shortage of skilled cloud professionals, and complexities in ensuring compliance with the evolving regulations for protection of data.

The integration of AI, deployment of edge computing, applications enabled by 5G, hyperscale data center growth, and digitalization of government and financial services all these factors set a strong prospect for the future of the UAE cloud computing market.

Market Segmentation

The United Arab Emirates Cloud Computing Market share is service model, deployment model, organization size, and industry vertical.

By Service Model:

The market is divided into Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS). Among these, the IaaS segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The dominance of IaaS is attributed to rising demand for scalable storage, disaster recovery, virtualization, and enterprise workload migration to cloud environments.

By Deployment Model:

The market is divided into public cloud, private cloud, and hybrid cloud. Among these, the hybrid cloud segment dominated in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Hybrid cloud leads due to regulatory compliance requirements, data localization mandates, and enterprise's need for flexibility between on-premise and cloud environments.

By Organization Size:

The market is divided into SMEs and large enterprises. Among these, large enterprises dominated the share in 2024 and are anticipated to grow at a remarkable CAGR during the forecast period. Large enterprises are leading due to higher IT budgets, digital transformation initiatives, ERP migration, and AI deployment strategies.

By Industry Vertical:

The market is divided into BFSI, government & public sector, IT & telecom, healthcare, retail & e-commerce, and energy & utilities. Among these, BFSI dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The BFSI sector is driving demand due to fintech expansion, digital banking adoption, cybersecurity investment, and real-time data analytics implementation.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the United Arab Emirates Cloud Computing Market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in United Arab Emirates Cloud Computing Market:

- Amazon Web Services

- Microsoft Corporation

- Google LLC

- Oracle Corporation

- IBM Corporation

- Alibaba Cloud

- SAP

- Salesforce

- e&

- G42

- Injazat

- Huawei Cloud

- Rackspace Technology

Recent Developments in United Arab Emirates Cloud Computing Market:

In April 2024, Microsoft Corporation announced a strategic collaboration and USD 1.5 billion investment in G42 to accelerate AI infrastructure, sovereign cloud deployment, and advanced digital transformation initiatives in the UAE and global markets.

In May 2023, Oracle Corporation launched its second cloud region in the UAE (Dubai), enhancing disaster recovery capabilities and supporting sovereign cloud and regulatory compliance requirements for public and private sector organizations.

In October 2022, Amazon Web Services launched its Middle East (UAE) cloud region with three Availability Zones, enabling local data residency, lower latency services, and regulatory compliance for enterprises and government entities across the UAE.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the UAE, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the United Arab Emirates Cloud Computing Market based on the below-mentioned segments:

United Arab Emirates Cloud Computing Market, By Service Model

- Infrastructure as a Service (IaaS)

- Platform as a Service (PaaS)

- Software as a Service (SaaS)

United Arab Emirates Cloud Computing Market, By Deployment Model

- Public Cloud

- Private Cloud

- Hybrid Cloud

United Arab Emirates Cloud Computing Market, By Organization Size

- SMEs

- Large Enterprises

United Arab Emirates Cloud Computing Market, Industry Vertical

- BFSI

- Government & Public Sector

- IT & Telecom

- Healthcare

- Retail & E-commerce

- Energy & Utilities

FAQ

1. What is the size of the United Arab Emirates Cloud Computing Market in 2024?

The United Arab Emirates Cloud Computing Market size was valued at USD 19.94 billion in 2024 and is projected to reach USD 250.45 billion by 2035, reflecting strong digital transformation across industries.

2. What is the CAGR of the UAE Cloud Computing Market from 2025 to 2035?

The UAE Cloud Computing Market is expected to grow at a compound annual growth rate (CAGR) of 25.87% during 2025–2035, driven by enterprise cloud migration, government cloud-first policies, and AI integration.

3. What factors are driving the growth of the UAE Cloud Computing Market?

Key growth drivers include:

- Government digital transformation initiatives

- UAE Digital Government Strategy 2025

- Smart Dubai initiatives

- Expansion of 5G infrastructure

- Growth of fintech and digital banking

- Increasing AI and Big Data adoption

- Data localization regulations

- Rise in hybrid cloud deployment

4. Which service model dominates the UAE Cloud Computing Market?

Among Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS), the IaaS segment dominated in 2024, due to increasing demand for scalable storage, disaster recovery, virtualization, and enterprise workload migration.

5. Which deployment model leads the UAE Cloud Market?

The hybrid cloud model dominated the UAE Cloud Computing Market in 2024, driven by regulatory compliance requirements, data sovereignty concerns, and enterprise flexibility needs.

6. Which industry vertical contributes the most to the UAE Cloud Computing Market?

The BFSI sector holds the largest market share, supported by fintech expansion, digital banking adoption, cybersecurity investments, and real-time analytics implementation.

7. Who are the top companies operating in the UAE Cloud Computing Market?

Major companies in the United Arab Emirates Cloud Computing Market include:

- Amazon Web Services

- Microsoft Corporation

- Google LLC

- Oracle Corporation

- IBM Corporation

- Alibaba Cloud

- SAP

- Salesforce

- e&

- G42

- Injazat

- Huawei Cloud

- Rackspace Technology

8. How is the UAE government influencing cloud adoption?

The UAE government promotes cloud adoption through initiatives such as:

- UAE Digital Government Strategy 2025

- Smart Dubai

- Cloud-first public sector policies

- Data localization and cybersecurity regulations

These initiatives are accelerating cloud deployment across public and private sectors.

9. What challenges affect the UAE Cloud Computing Market?

Major challenges include:

- Data security concerns

- High initial migration costs

- Vendor lock-in risks

- Shortage of skilled cloud professionals

- Regulatory compliance complexities

10. What are the future opportunities in the UAE Cloud Computing Market?

Future growth opportunities include:

- AI-powered cloud services

- Edge computing integration

- 5G-enabled cloud applications

- Hyperscale data center expansion

- Smart city cloud infrastructure

- Government and financial services digitalization

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 173 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Feb 2026 |

| Access | Download from this page |