United Kingdom Student Accommodation Market

United Kingdom Student Accommodation Market Size, Share, And COVID-19 Impact Analysis, By Accommodation Type (Halls Of Residence, Rented Houses Or Rooms, And Private Student Accommodation), By Rent Type (Basic Rent And Total Rent), By Location (City Centre And Periphery), By Mode (Online And Offline), And United Kingdom Student Accommodation Market Insights, Industry Trend, Forecast To 2035

Report Overview

Table of Contents

United Kingdom Student Accommodation Market Insights Forecasts to 2035

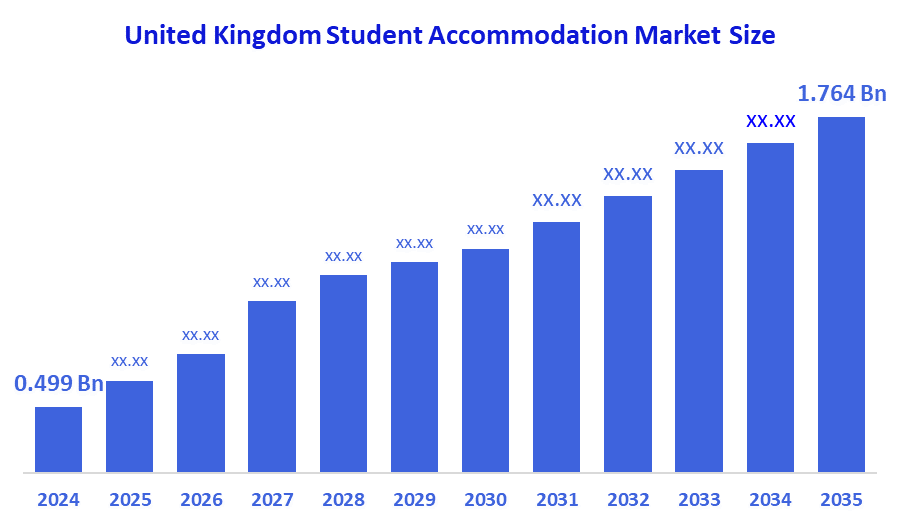

- United Kingdom Student Accommodation Market Size 2024: USD 0.499 Bn

- United Kingdom Student Accommodation Market Size 2035: USD 1.764 Bn

- United Kingdom Student Accommodation Market CAGR 2024: 12.16%

- United Kingdom Student Accommodation Market Segments: Accommodation Type, Rent Type, Location, and Mode

Student accommodation has been built specifically for students who are attending college or university. There are many different types of accommodation such as those provided by universities and colleges, private accommodation designed for students developed by private companies, and private rental properties, including shared houses or studio apartments. These are often located near to college or university campuses and provide accommodation that is appropriate for the price range and lifestyle of students. The United Kingdom has millions of domestic and international students studying at universities and colleges within the United Kingdom. The majority of this market is composed of student rental properties (PSBAs), which, due to their amenities, have grown to become the largest and fastest-growing segment of the United Kingdom accommodation market.

The student accommodation in United Kingdom is backed by government support, including the Erasmus programme, and the introduction of student exchange programmes (from 2027) provides greater opportunities for students to study abroad while indirectly increasing the demand for student accommodation in the United Kingdom. According to official Higher Education Statistics Agency (HESA) data published via the United Kingdom government, there were about 2.99 million students in United Kingdom higher education in 2023-24 across universities and colleges. This large student population is the core demand base for the United Kingdom student accommodation market.

As technology advances, United Kingdom student accommodation support providers are rapidly evolving with tech, driven by digital natives demanding seamless experiences, featuring AI for personalized booking, 3D tours, smart building IoT for energy efficiency, mobile apps for management, and data analytics for dynamic pricing, all boosting efficiency, sustainability, and tenant satisfaction.

Market Dynamics of the United Kingdom Student Accommodation Market:

The United Kingdom student accommodation market is driven by rising student population growth, increase in United Kingdom university enrolments, post-study work visa to stay longer, rise in preference for PSBA with all facilities, shift away from home, creating consistent local demand, and supportive government policies for student accommodations

The United Kingdom student accommodation market is restrained by the high costs impacting student welfare, competition and vacancy risks; rising development costs, potential rent stagnation, volatile student numbers, and need for better quality

The future of United Kingdom student accommodation market is bright and promising, with versatile opportunities emerging from the consistent student demand from both domestic and international students, a significant undersupply of quality beds, and high investment yields, particularly in regional cities like London, Birmingham and Manchester, with growth areas in all-inclusive packages and long-term stays.

Market Segmentation

The United Kingdom Student Accommodation Market share is classified into Accommodation Type, Rent Type, Location, and Mode.

By Accommodation Type:

The United Kingdom student accommodation market is divided by accommodation type into halls of residence, rented houses or rooms, and private student accommodation. Among these, the private student accommodation segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. High demand from growing student numbers, its provision of modern amenities, city-centre locations, all-inclusive packages, and flexible leases that appeal to students, making PBSA a financially attractive, reliable, and professionally managed sector for students all contribute to the private student accommodation segment's dominance and higher spending on student accommodation when compared to other type.

By Rent Type:

The United Kingdom student accommodation market is divided by rent type into basic rent and total rent. Among these, the total rent segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The total rent segment dominates due to soaring demand especially from international students, its leading rent structure for all-inclusive and premium packages; students seek cost certainty amid volatility, often exceeding government loans.

By Location:

The United Kingdom student accommodation market is divided by location into city centre and periphery. Among these, the periphery segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Lower cost and affordability making housing more accessible for students facing rising costs, shifting of investors to these suburban areas for higher growth, and growing student populations all contribute to the periphery segment's dominance and higher spending on student accommodation when compared to other location.

By Mode:

The United Kingdom student accommodation market is divided by mode into online and offline. Among these, the online segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The online segment dominates due to convenience and efficiency saving time and effort, global reach for international students, and tech-driven experiences, using platforms for easy searching, virtual tours and seamless booking, and international arrivals seeking clarity and ease in a competitive market.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the United Kingdom student accommodation market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in United Kingdom Student Accommodation Market:

- Unite Students

- IQ Student Accommodation

- Student Roost

- Vita Student

- Global Student Accommodation

- Scape United Kingdom

- Campus Living Villages United Kingdom

- Collegiate

- CRM Students

- Downing Students

- Fresh Student Living

- Host Student Housing

- Nido Student

- Urbanest

- Yugo

- Others

Recent Developments in United Kingdom Student Accommodation Market:

In June 2024, Vita Student, United Kingdom’s experience-led student accommodation provider, has officially launched in India, extending its commitment to offering luxurious and practical living spaces to students seeking International education opportunities.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United Kingdom, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the United Kingdom student accommodation market based on the below-mentioned segments:

United Kingdom Student Accommodation Market, By Accommodation Type

- Halls of Residence

- Rented Houses or Rooms

- Private Student Accommodation

United Kingdom Student Accommodation Market, By Rent Type

- Basic Rent

- Total Rent

United Kingdom Student Accommodation Market, By Location

- City Centre

- Periphery

United Kingdom Student Accommodation Market, By Mode

- Online

- Offline

FAQ

Q: What is the United Kingdom student accommodation market size?

A: United Kingdom student accommodation market is expected to grow from USD 0.499 Billion in 2024 to USD 1.764 Billion by 2035, growing at a CAGR of 12.16% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the rising student population growth, increase in United Kingdom university enrolments, post-study work visa to stay longer, rise in preference for PSBA with all facilities, shift away from home, creating consistent local demand, and supportive government policies for student accommodations.

Q: What factors restrain the United Kingdom student accommodation market?

A: Constraints include the high costs impacting student welfare, competition and vacancy risks, rising development costs, potential rent stagnation, volatile student numbers, and need for better quality

Q: How is the market segmented by accommodation type?

A: The market is segmented into Halls of Residence, Rented Houses or Rooms, and Private Student Accommodation.

Q: Who are the key players in the United Kingdom student accommodation market?

A: Key companies include Unite Students, IQ Student Accommodation, Student Roost, Vita Student, Global Student Accommodation, Scape United Kingdom, Campus Living Villages United Kingdom, Collegiate, CRM Students, Downing Students, Fresh Student Living, Host Student Housing, Nido Student, Urbanest, Yugo, and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 210 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |