United States Agricultural Fumigants Market

United States Agricultural Fumigants Market Size, Share, and COVID-19 Impact Analysis, By Product (1,3 Dichloropropene, Chloropicrin, Dimethyl Disulfide, Methyl Bromide, Metam Potassium, Metam Sodium, Phosphine, and Others), By Form (Solid, Liquid, and Gas), and USA Agricultural Fumigants Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

United States Agricultural Fumigants Market Insights Forecasts to 2035

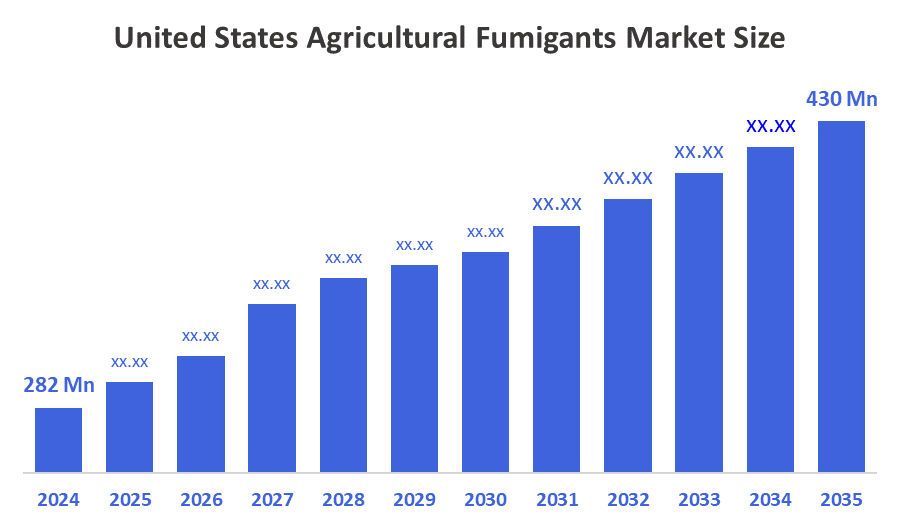

- The U.S. Agricultural Fumigants Market Size Was Estimated at USD 282 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 3.91% from 2025 to 2035

- The USA Agricultural Fumigants Market Size is Expected to Reach USD 430 Million by 2035

According to a research report published by Decision Advisor, the U.S. Agricultural Fumigants market is anticipated to reach USD 430 million by 2035, growing at a CAGR of 3.91% from 2025 to 2035. The U.S. agricultural fumigants market is driven by rising demand for high crop yields, expansion of commercial agriculture, and increased adoption of advanced application techniques.

Market Overview

The agricultural fumigants market focuses on the production, distribution, and application of chemical agents used to control pests, insects, nematodes, fungi, weeds, and rodents in soil and stored agricultural products. They are available in various forms such as solid, liquid, and gas. Common fumigants include 1,3-dichloropropene, chloropicrin, dimethyl disulfide, methyl bromide, metam potassium, metam sodium, phosphine, and others. These chemicals are essential for controlling pests both before and after harvest, maintaining product quality, extending storage life, and adhering to Phyto-sanitary export regulations. One of the main factors driving the market is the increasing demand to increase agricultural production in the US. Farmers are adopting cutting-edge fumigation solutions to protect crops, improve soil health, and guarantee steady, high-quality yields across large agricultural operations as a result of growing populations and rising food demands. The growing environmental awareness and regulatory restrictions on chemical fumigants create opportunities for developing bio-based and low-toxicity formulations that offer effective pest control with minimal ecological impact.

Report Coverage

This research report categorizes the market for the United States agricultural fumigants market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the USA agricultural fumigants market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA agricultural fumigants market.

Driving Factors

The USA agricultural fumigants market is primarily driven by the growing need for enhanced agricultural productivity and pest management efficiency. The expansion of commercial and mechanized farming further boosts the use of fumigants in soil treatment and post-harvest protection. Additionally, technological advancements and regulatory support play an important role in market growth.

Restraining Factors

The rising awareness of soil and groundwater contamination reduces the acceptance of chemical fumigation methods. Additionally, fluctuations in raw material availability and prices impact production and market stability.

Market Segmentation

The United States agricultural fumigants market share is classified into product and form.

- The phosphine segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The USA agricultural fumigants market is segmented by product into 1,3-dichloropropene, chloropicrin, dimethyl disulfide, methyl bromide, metam potassium, metam sodium, phosphine, and others. Among these, the phosphine segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This segmental growth is attributed to its high efficiency, low residue levels, and broad-spectrum pest control properties. Additionally, they are widely used for fumigating stored grains, cereals, and processed food products.

- The liquid segment holds a dominant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The USA agricultural fumigants market is segmented by form into solid, liquid, and gas. Among these, the liquid segment holds a dominant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This segmental growth is attributed to its high penetration efficiency and ease of application across various crops and storage facilities.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States agricultural fumigants market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Dow Inc.

- AMVAC Chemical Corporation

- Bayer AG

- Arkema SA

- Syngenta AG

- Trinity Manufacturing, Inc.

- BASF SE

- Others

Recent Developments

- In January 2024, Degesch America, Inc. launched U-Phos®, a cylinderized phosphine fumigant offering a safe, cost-effective solution for U.S. grain storage.

Key Target Audience

- Market Playerss

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the U.S. Agricultural Fumigants market based on the below-mentioned segments:

United States Agricultural Fumigants Market, By Product

- 1,3 Dichloropropene

- Chloropicrin

- Dimethyl Disulfide

- Methyl Bromide

- Metam Potassium

- Metam Sodium

- Phosphine

- Others

United States Agricultural Fumigants Market, By Form

- Solid

- Liquid

- Gas

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Regional |

| Pages | 210 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |