United States Cold Storage Market

United States Cold Storage Market Size, Share, and COVID-19 Impact Analysis, By Warehouse Type (Private & Semi-private and Public), By Construction Type (Bulk Storage, Production Stores, and Ports), and USA Cold Storage Market Insights, Industry Trend, Forecasts to 2035.

Report Overview

Table of Contents

United States Cold Storage Market Insights Forecasts to 2035

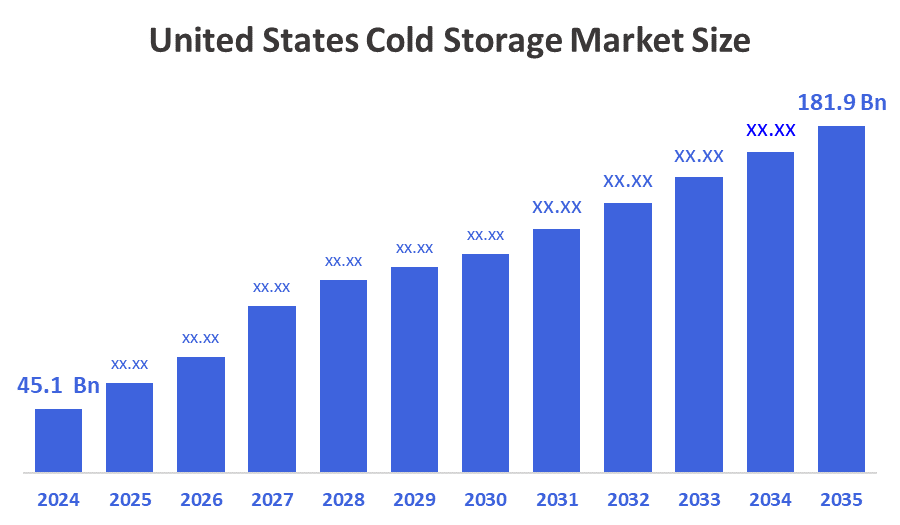

- The U.S. Cold Storage Market Size Was Estimated at USD 45.1 billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 13.52 % from 2025 to 2035

- The USA Cold Storage Market Size is Expected to Reach USD 181.9 billion by 2035

According to a research report published by Decision Advisors, the U.S. Cold Storage Market Size is Anticipated to Reach USD 181.9 Billion by 2035, growing at a CAGR of 13.52 % from 2025 to 2035. The U.S. cold storage market is driven by rising demand for frozen and processed foods, growth in the pharmaceutical and biotech sectors, and technological advancements.

Market Overview

The United States cold storage market is a network of temperature-controlled facilities and logistical systems that store and preserve perishable items such as food, drinks, medicines, and chemicals at particular temperatures. These facilities use controlled settings to avoid spoiling, increase shelf life, and ensure product quality and safety along the supply chain. Cold storage is an essential component of the cold chain logistics industry, ensuring that temperature-sensitive items remain stable from manufacturers to final usage. It includes public, private, and refrigerated warehouses that employ sophisticated technology such as automation, IoT sensors, and energy-efficient refrigeration systems to monitor and control temperature, humidity, and storage conditions. The growing consumer desire for easy, ready-to-eat, and long-lasting food products is one of the major driving factors for this market. A key trend in the US cold storage market is the increasing adoption of automation and IoT technologies to enhance operational efficiency, accuracy, and real-time temperature monitoring.

Report Coverage

This research report categorizes the market for the United States cold storage market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the USA cold storage market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA cold storage market.

Driving Factors

Growth in vaccine and biological production increases demand for advanced cold storage facilities, ensuring safe, efficient pharmaceutical distribution. The integration of automation, IoT monitoring, and data analytics is driving greater efficiency, precision, and real-time temperature control across US cold storage facilities. The busy urban lifestyles and rising disposable incomes are increasing dependence on frozen and ready-to-cook food products, boosting the market growth.

Restraining Factors

Cold storage facilities require continuous refrigeration, leading to high electricity usage and increased operational expenses, especially with rising energy prices. Additionally, the shortage of trained personnel in cold chain logistics, maintenance, and automation management impacts efficiency and operational safety.

Market Segmentation

The United States cold storage market share is classified into warehouse type and construction type.

- The public segment holds a dominant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The USA cold storage market is segmented by warehouse type into private & semi-private and public. Among these, the public segment holds a dominant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This segmental growth is attributed to its widespread popularity among customers for leased or short-term applications at reasonable prices. Furthermore, public cold storage providers are conveniently placed near transportation hubs, providing efficient logistics and last-mile delivery.

- The production stores segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The USA cold storage market is segmented by construction type into bulk storage, production stores, and ports. Among these, the production stores segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This segmental growth is attributed to increasing emphasis on the protection of commodities, which include both raw materials and finished food items, throughout the manufacturing process at the facility.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States cold storage market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Americold Logistics, Inc.

- Burris Logistics

- Henningsen Cold Storage Co.

- Preferred Freezer Services

- United States Cold Storage

- Wabash National Corporation

- Others

Recent Developments

- In September 2022, U.S.-based Lineage Logistics acquired Spain’s Grupo Fuentes to expand its global cold storage and logistics network.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the U.S. cold storage market based on the below-mentioned segments:

United States Cold Storage Market, By Warehouse Type

- Private & Semi-private

- Public

United States Cold Storage Market, By Construction Type

- Bulk Storage

- Production Stores

- Ports

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Regional |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |