United States Ethanol Market

United States Ethanol Market Size, Share, and COVID-19 Impact Analysis, By Feedstock Source (Grain-based, Cellulosic, Sugar based), By Product Grade (Fuel Grade, Industrial Grade, Food and Beverage Grade, Pharmaceutical Grade), By Application (Fuel and Energy, Solvent, Medical and Pharmaceutical use, Chemical Synthesis and Manufacturing, Beverages, Laboratory and Environmental use), Analysis and Forecast 2024-2035

Report Overview

Table of Contents

United States Ethanol Market Insights Forecasts to 2035

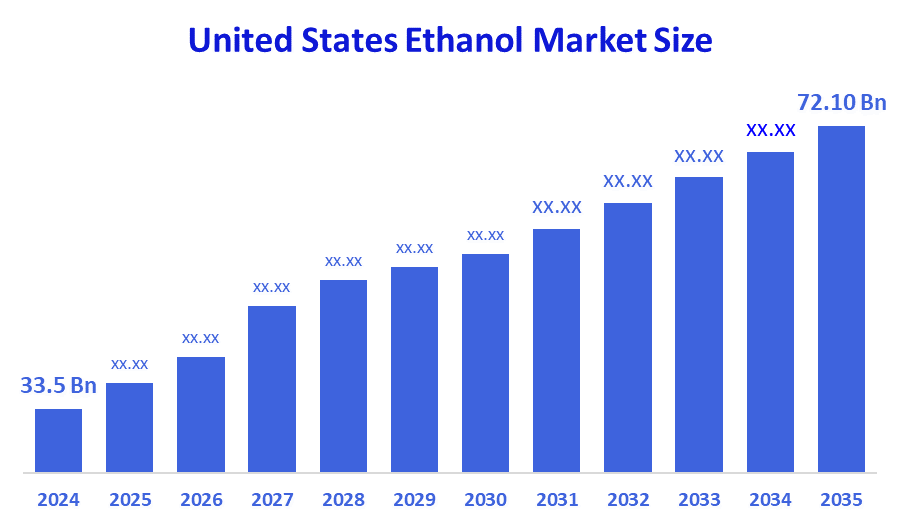

- The U.S. Ethanol Market Size Was Estimated at USD 33.5 Billion in 2024.

- The US Ethanol Market Size is Expected to Grow at a CAGR of around 7.40% from 2024 to 2035

- The U.S. Ethanol Market is expected to reach USD 72.10 Billion in 2035.

According to a research report published by Spherical Insights & Consulting, the United States Ethanol Market is anticipated to reach USD 72.10 Billion by 2035, growing at a CAGR of 7.40% from 2024 to 2035. The ethanol market in the USA is driven by various factors, rising demand as biofuel, the rising demand as a solvent in chemical industries, rising environmental awareness and technological advancements.

Market Overview

Ethanol is a colorless alcohol made from grain and sugar, which is volatile in nature. The United States ethanol market has seen a drastic growth in the years 2024 and 2025, mainly due to a rise in export demand, which is backed up by government biofuel regulations. Irrespective of low domestic consumption, higher exports and market-suitable conditions and natural gas prices have kept high margins. Key players in the market include POET, Green Plains Inc., and Archer Daniels Midland Company (ADM). The US ethanol market is the largest in the region, which is incentivized from government, a continues supply of corn, regular use as a transportation fuel and blending with other fuels that reduces air pollution. After facing challenges such as varying demand and a strong export market, the US is a dominating country, with record number of export and large investment in domestic production. The focus is now shifted towards increasing efficiency, maintaining low carbon emissions and awareness for sustainable aviation fuel. The US ethanol market industry has a significant contribution in the US economy. For instance, in 2024, the US ethanol industry has generated thousands of jobs, so it has contributed significantly to GDP and tax revenue.

Report coverage

This research report categorizes the US ethanol market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the U.S. ethanol market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the USA ethanol market.

Driving factors

Growing demand on the international level is the main factor in the U.S. market, despite having a very low domestic requirement. As per the US Energy Information Administration, from January to July 2025, the U.S. has exported a record amount of ethanol, which averages to 1,38,000 barrels per day. The U.S. Energy Information Administration (EIA) projected that this phenomenon will remain constant for 2026 as well. A large quantity of this export is due to demand in the Netherlands. Europe is also seeing a rise in demand. Other major countries that demand Ethanol are Canada, India and the United Kingdom. All these countries have their own blending mandates. The RFS program requires that a certain amount of renewable fuel be added to the transportation fuel system, which boosts regular demand.

Restraining factors

The U.S. ethanol market faces restraints such as fluctuating corn prices, high production costs, limited blending infrastructure, competition from electric vehicles, and strict environmental regulations, which collectively hinder expansion, profitability, and long-term sustainability in the renewable fuels sector.

Segmentation of Ethanol

The United States ethanol market share is classified into feedback source, product grade and product application.

- The grain-based segment held the dominant share of the market in 2024 and is expected to grow at a rapid CAGR during the forecast period.

The United States ethanol market is segmented by feedback source into grain-based, cellulosic and sugar-based form. Among these, the grain-based segment held the dominant share in 2024 and is anticipated to grow at a rapid CAGR during the forecast period. This segmental growth due to the abundant availability of corn, well-established production infrastructure, and government support for biofuel blending. Its cost-effectiveness, technological maturity, and extensive use in transportation fuel further strengthen its market position and drive continuous growth during the forecast period.

- The fuel grade segment held the significant share of the market in 2024 and is expected to grow during the period.

The United States ethanol market is segmented by product grade into fuel grade, industrial grade, food and beverage grade and pharmaceutical grade. Among these, fuel grade ethanol segment held the significant share of the market in 2024 and is expected to grow during the period. This growth is due to its extensive use as a biofuel additive in gasoline, driven by government mandates for renewable fuel blending. Rising demand for cleaner energy, reduced carbon emissions, and energy independence initiatives further propel its growth during the forecast period.

- The fuel and energy segment held the dominant share of the market in 2024 and is expected to grow at a rapid CAGR during the forecast period.

The United States ethanol market is segmented by product application into fuel and energy, solvent, medical and pharmaceutical, chemical synthesis and manufacturing, beverages, laboratory and environmental uses. Among those, fuel and energy segment held the largest market share in 2024 with a significant market CAGR during the forecast period. Ethanol is used for better combustion of fuel. It helps increase in fuel’s octane rating and reduce certain emissions. The pharmaceutical and medical segment is rising because of Increase in integration of ethanol in biopharmaceutical manufacturing. The U.S. personal care market continues to grow so that formulation trends will continue prefer ethanol, this segment could grow its share of non?fuel ethanol demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States ethanol market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies:

- POET LLC

- Valero Renewable Fuels Company

- Archer Daniels Midland Company

- Green Plain Inc.

- The Andersons Inc.

- Flint Hills Resources

- Cargill, incorporated

- Marquis energy

- Guardian energy

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2025, Gevo, Inc. has acquired Red Trail Energy, LLC’s assets, which included an ethanol production plant and carbon capture assets for approximately USD 215 Million. The acquisition benefited Gevo to expand into sustainable aviation fuels (SAF) and low-carbon ethanol.

- In November 2025, ICM, Inc. which is a U.S. ethanol-process technology provider and Mitsubishi Heavy Industries, Ltd. have formed a strategic alliance November to integrate Mitsubishi Heavy Industries’ membrane dehydration system (MMDS™) with ICM’s ethanol-process design. The goal is to increase ethanol purity (>99.5 vol.%) and reduce energy that is utilized in dehydration.

Market Segment

This study forecasts revenue at U.S, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States Ethanol Market based on the below-mentioned segments:

United States Ethanol Market, By Feedstock Source

- Food-grain

- Cellulosic

- Sugar-based

United States Ethanol Market, by product grade

- Fuel Grade

- Industrial Grade

- Food and Beverage Grade

- Pharmaceutical Grade

United States Ethanol Market, by application

- Fuel and Energy

- Solvent

- Medical and Pharmaceutical

- Chemical Synthesis and Manufacturing

- Beverages

- Laboratory and Environmental uses

Frequently Asked Questions (FAQs)

- What is the primary use of ethanol in the United States?

The vast majority of ethanol produced in the U.S. is blended with gasoline to create biofuel for vehicles. Blends like E10 (10% ethanol, 90% gasoline) and E85 (flex-fuel) are common. The transportation sector was the leading application segment for the global market in 2023.

- What is the status of the U.S. ethanol market?

The U.S. is the world's largest producer and exporter of ethanol. North America is a dominant force in the global ethanol market, largely driven by the U.S. The market is influenced by demand for biofuels, government policies, and exports.

- Where is most US ethanol production located?

93% of US fuel ethanol production capacity is located in the Midwest region, close to corn-growing areas.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Regional |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |