United States Food Fortifying Agents Market

United States Food Fortifying Agents Market Size, Share, and COVID-19 Impact Analysis, By Type (Vitamins, Minerals, Proteins & Amino Acids, Carbohydrates, Prebiotics & Probiotics, Lipids, and Others), By Application (Dairy & Dairy-based Products, Infant Formula, Cereals & Cereal-based Products, Beverages, Dietary supplements, Fats & oils, and Others), and USA Food Fortifying Agents Market Insights, Industry Trend, Forecasts to 2035.

Report Overview

Table of Contents

United States Food Fortifying Agents Market Insights Forecasts to 2035

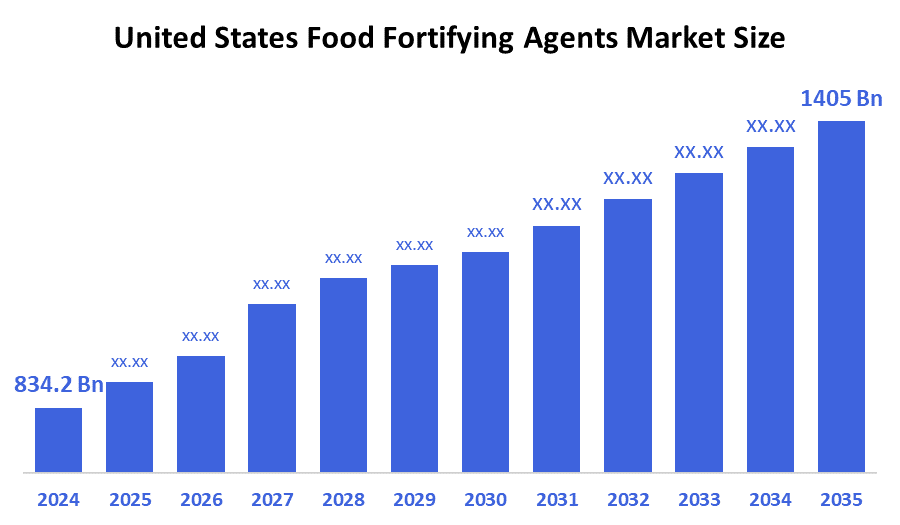

- The U.S. Food Fortifying Agents Market Size Was Estimated at USD 834.2 billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.85% from 2025 to 2035

- The USA Food Fortifying Agents Market Size is Expected to Reach USD 1405 billion by 2035

According to a research report published by decision advisor & Consulting, the U.S. Food Fortifying Agents market is anticipated to reach USD 1405 billion by 2035, growing at a CAGR of 4.85 % from 2025 to 2035. The U.S. food fortifying agents market is driven by rising health awareness, growing prevalence of nutrient deficiencies, and government support and regulations.

Market Overview

The food fortifying agents market refers to the industry that manufactures and applies nutrients such as vitamins, minerals, amino acids, and other vital substances to food and drink to improve their nutritional content. These substances are employed during food processing to avoid nutritional deficits, enhance public health and promote balanced nutrition. Fortifying agents are critical in resolving nutritional gaps, reducing malnutrition, and fulfilling consumer demand for functional health-oriented foods. In the US, increasing consumer focus on health, wellness, and preventive care is driving demand for fortified foods. People seek products enriched with essential vitamins, minerals, and nutrients to support immunity, bone health, and overall nutrition, boosting the US food fortifying agents market. The rising shift toward natural and plant-based fortifying agents is one of the key trends for this market. These trends present an opportunity for manufacturers to develop plant-based and clean-label fortified products.

Report Coverage

This research report categorizes the market for the United States food fortifying agents market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the USA food fortifying agents market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA food fortifying agents market.

Driving Factors

Rising cases of vitamin, mineral, and micronutrient deficiencies are boosting the demand for fortified products is one of the major contributors to this market. Rising consumer preference for functional and fortified products that deliver additional health benefits beyond basic nutrition is further driving growth in the US food fortifying agents market. Additionally, government support and regulations and technological advancements play an important role in market growth.

Restraining Factors

The high cost of manufacturing and incorporating fortifying agents, particularly natural or bioactive nutrients, is the primary restraint for this market. Additionally, excessive use of fortified nutrients from many sources might create health difficulties, restricting aggressive fortification and slowing development in the U.S. food fortifying agents market.

Market Segmentation

The United States food fortifying agents market share is classified into type and application.

- The vitamins segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The USA Food Fortifying Agents market is segmented by type into vitamins, minerals, proteins & amino acids, carbohydrates, prebiotics & probiotics, lipids, and others. Among these, the vitamins segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to rising awareness about nutrition and preventive health. Additionally, government fortification programs and innovations in vitamin formulations further drive the segmental growth.

- The dairy and dairy-based products segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The USA Food Fortifying Agents market is segmented by application into dairy & dairy-based products, infant formula, cereals & cereal-based products, beverages, dietary supplements, fats & oils, and others. Among these, the dairy and dairy-based products segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This segmental growth is attributed to its widespread consumption and compatibility with various fortifying agents.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States food fortifying agents market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cargill, Incorporated

- ADM

- Kalsec Inc.

- Kemin Industries, Inc.

- Eastman Chemical Company

- BASF SE

- DuPont

- DSM

- International Flavors & Fragrances Inc.

- Advanced Organic Materials, S.A.

- Others

Recent Developments

- In April 2024, PLANTSTRONG launched nutrient-fortified plant-based milk in the U.S., enriched with calcium, vitamin D, and B12, supporting health-conscious consumer demand.

- In March 2023, DFA introduced probiotics-fortified, lactose-free UHT milk in the U.S., combining vitamins, minerals, and probiotics to enhance immunity and digestive health.

Key Target Audience

- Market Playerss

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. decision advisor has segmented the U.S. Food Fortifying Agents market based on the below-mentioned segments:

United States Food Fortifying Agents Market, By Type

- Vitamins

- Minerals

- Proteins & Amino Acids

- Carbohydrates

- Prebiotics & Probiotics

- Lipids

- Others

United States Food Fortifying Agents Market, By Application

- Dairy & Dairy-based Products

- Infant Formula

- Cereals & Cereal-based Products

- Beverages

- Dietary supplements

- Fats & oils

- Others

Frequently Asked Questions (FAQs)

- What is the CAGR of the United States Food Fortifying Agents Market over the forecast period?

The United States Food Fortifying Agents Market is projected to expand at a CAGR of 4.85% during the forecast period.

- What is the market size of the United States Food Fortifying Agents Market?

The United States Food Fortifying Agents Market size is expected to grow from USD 834.2 Billion in 2024 to USD 1405 Billion by 2035, at a CAGR of 4.85% during the forecast period 2025-2035.

- Who are the top companies operating in the United States Food Fortifying Agents Market?

Key players in the USA Food Fortifying Agents market Cargill, Incorporated, ADM, Kalsec Inc., Kemin Industries, Inc., Eastman Chemical Company, BASF SE, DuPont, and DSM.

- What are the main drivers of growth in the USA Food Fortifying Agents Market?

Rising health awareness, increasing nutrient deficiencies, government fortification initiatives, growing demand for functional foods, and technological advancements drive the U.S. food fortifying agents market.

- What challenges are limiting the USA Food Fortifying Agents Market?

High production and formulation costs, ingredient stability issues, strict regulatory compliance, taste and consumer acceptance concerns, and risks of nutrient overconsumption limit growth in the U.S. food fortifying agents market.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 177 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |