United States Gaming Instruments Market

United States Gaming Instruments Market Size, Share, and COVID-19 Impact Analysis, By Type (Consoles, Controllers, Gaming Accessories, and Audio Systems), By Application (Residential, Commercial, and E-Sports), and United States Gaming Instruments Market Insights, Industry Trend, Forecasts to 2035,

Report Overview

Table of Contents

United States Gaming Instruments Market Insights Forecasts to 2035

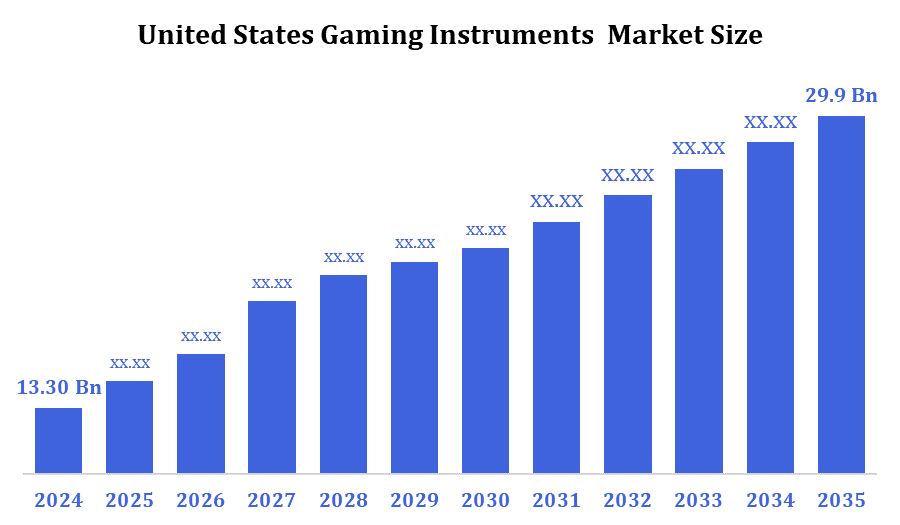

- The United States Gaming Instruments Market size is USD 13.30 Billion in 2024.

- The U.S. Gaming Instruments Market size is estimated to grow at a CAGR of 7.64% in 2035.

- The US Gaming Instruments Market is estimated to grow at a market size of USD 29.9 Billion in 2035.

According to a research report published by Spherical Insights & Consulting, the United States Gaming Instruments Market is anticipated to reach USD 29.9 Billion by 2035, growing at a CAGR of 7.64% from 2024 to 2035. The gaming instruments market in the USA is driven by various factors, rising demand for online games, the demand for E-Sports rising and technological advancements.

Market Overview

Gaming instruments are electronic consoles and peripherals that are used to play video games. The gaming instruments market in the United States has experienced significant growth in recent years, grown by technological advancements, the entry of online gaming, and a rise in consumer expense on entertainment devices. Gaming instruments such as consoles, controllers, and accessories, have become essential components of American households. The launch of next-generation consoles and immersive gaming technologies, such as virtual reality (VR) and augmented reality (AR), is advancing the market. The entry of e-sports and streaming platforms has gained the demand for high-performance gaming accessories and professional-grade equipment. Major companies such as Microsoft, Sony, and Logitech lead the market with their cutting-edge product offerings. The pandemic has changed consumer habits towards indoor entertainment, which also hiked in gaming instrument sales. The ongoing incorporation of AI, haptic feedback, and cross-platform gaming experiences is expected to further drive market growth in the coming years.

Report Coverage

This research report categorizes the United States gaming instruments market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States gaming instruments market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the United States gaming instruments market.

Driving Factors

The primary factors propelling the U.S. gaming instruments market consist of a rising demand for sophisticated gaming technologies, the growth of the e-sports industry, and an increase in disposable income among younger consumers. The presence of high-speed internet and cloud gaming platforms like Xbox Cloud and PlayStation Plus has rendered high-quality gaming more accessible to a broader audience. Technological advancements, including haptic feedback systems, adaptive triggers, and immersive multi-sensory gaming environments, significantly enhance the user experience. Additionally, the increasing popularity of online multiplayer and cross-platform gaming plays a vital role in the expansion of the market. Furthermore, enhanced collaboration between gaming hardware and software developers guarantees smooth performance and user satisfaction. These advancements are anticipated to lead to substantial revenue generation throughout the gaming ecosystem.

Restraining Factors

The U.S. gaming instruments market faces specific limitations such as elevated equipment costs and a restricted supply of semiconductor components. The reginal chip shortage has interrupted production cycles for leading console manufacturers, resulting in postponed product launches and increased retail prices. Moreover, health issues associated with extended screen exposure and gaming addiction present obstacles to market growth. The industry is required to strike a balance between innovation and responsible gaming initiatives, as well as affordability, to ensure sustainable long-term expansion.

Market Segmentation

The United States gaming instruments market is classified as type and application.

- The console segment held the dominant share of the market in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States gaming instruments market is classified as type into consoles, controllers, gaming accessories and audio systems. Among these, the consoles segment held the dominant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to strong consumer demand for next-generation hardware, exclusive game releases, and enhanced graphics and processing capabilities. Continued innovation by major manufacturers, robust online gaming ecosystems, and rising adoption of cloud-enabled features further strengthen console sales, supporting rapid CAGR growth throughout the forecast period.

The gaming accessories and audio systems segments are also expected to witness steady growth, fueled by demand for immersive gaming experiences and streaming setups.

- The residential segment held the largest share in 2024 and is expected to grow during the forecast period.

The United States gaming instruments market is segmented by application includes residential, commercial, E-sports, and streaming/content creation setups. Among these, residential segment holds the largest share in 2024 and is expected to grow during the forecast period. This segment supported by the growing penetration of gaming consoles, VR/AR devices, and advanced accessories in households. The increasing preference for interactive entertainment and online multiplayer experiences has strengthened this segment’s dominance.

The E-sports segment has emerged as one of the fastest-growing applications, driven by expanding professional tournaments, sponsorship investments, and partnerships between gaming hardware producers and event organizers.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the USA gaming instruments market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key companies

- Microsoft Corporation

- Sony Interactive Entertainment LLC

- Logitech International S.A.

- Razer Inc.

- Corsair Gaming Inc.

- HP Inc. (HyperX)

- Turtle Beach Corporation

- Nintendo Co., Ltd.

- SteelSeries ApS

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firms

- Venture Capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2025, Microsoft has revealed its plans to increase production of next-generation console controllers in response to the growing demand from e-sports teams and retail outlets.

- In July 2025, Logitech has introduced a premium series of wireless headsets designed specifically for low-latency competitive gaming and streaming, incorporating cutting-edge microphone technology and extended battery life.

- In September 2025, Razer, in collaboration with a prominent streaming platform, has announced a partnership aimed at integrating device telemetry to improve viewer engagement during tournaments.

Market Segment

This study forecasts revenue at the United States from 2024 to 2035. Spherical Insights has segmented the United States gaming instruments market based on the below-mentioned segments:

United States Gaming Instruments Market, By Type

- Consoles

- Controllers

- Gaming Accessories

- Audio Systems

United States Gaming Instruments Market, By Application

- Residential

- Commercial

- E-sports

- Streaming and Content Creation

Frequently Asked Questions (FAQs)

- What are gaming instruments?

Gaming instruments refer to hardware devices such as consoles, controllers, headsets, and other peripherals used to enhance gaming experience. These products are essential for both casual and professional gamers.

- Which companies dominate the U.S. gaming instruments market?

The U.S. gaming instruments market is dominated by Microsoft, Sony, and Logitech, with strong competition from Razer, Nintendo, and Corsair. These brands lead through innovation, design, and technology integration.

- How has the growth of e-sports influenced the market?

E-sports has greatly increased the demand for high-performance gaming equipment. Professional tournaments and streaming services have opened up new avenues for equipment manufacturers, enhancing market reach and profitability.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 166 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |