United States Gastrointestinal Therapeutics Market

United States Gastrointestinal Therapeutics Market Size, Share, and COVID-19 Impact Analysis, By Drug Class (Amino salicylates, Digestive enzymes, Proton Pump Inhibitors, Laxatives, Anti-Emetics, H2 Antagonists, Biologics/Biosimilar, and Others), By Route of Administration (Oral, Injectable, Others), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies), and United States Gastrointestinal Therapeutics Market Insights, Industry Trend, Forecasts To 2035

Report Overview

Table of Contents

United States Gastrointestinal Therapeutics Market Insights Forecasts to 2035

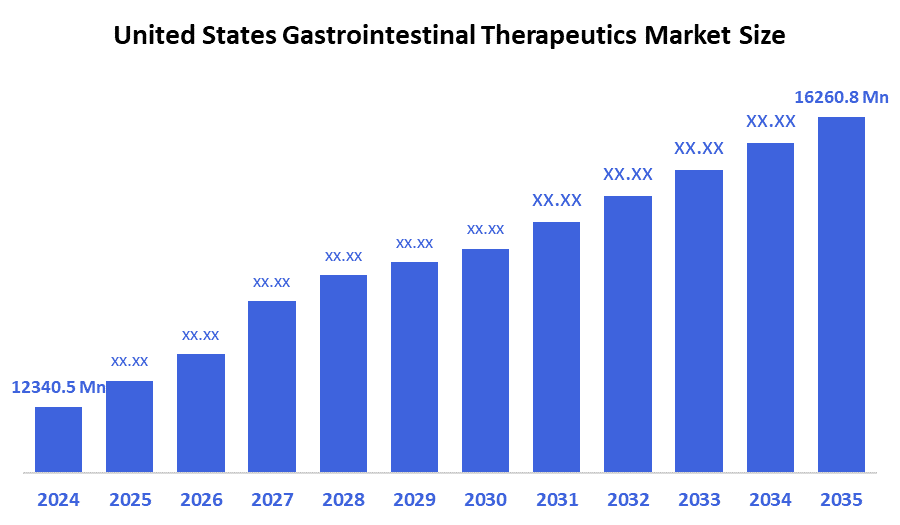

- The United States Gastrointestinal Therapeutics Market Size Was Estimated at USD 12340.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 2.54% from 2025 to 2035

- The United States Gastrointestinal Therapeutics Market Size is Expected to Reach USD 16260.8 Million by 2035

According to a research report published by Decision Advisors & Consulting, The United States Gastrointestinal Therapeutics Market Size is anticipated to reach USD 16260.8 Million by 2035, growing at a CAGR of 2.54% from 2025 to 2035. The U.S. gastrointestinal therapeutics market is being driven by an increasing prevalence of gastrointestinal illnesses such as IBS, Crohn's disease, and ulcerative colitis, as well as increased demand for gastrointestinal (GI) medications, which are the primary drivers of market expansion.

Market Overview

Gastrointestinal (GI) therapeutics is a branch of pharmaceuticals and medical therapies that focuses on managing, preventing, and treating problems of the gastrointestinal system. This comprises disorders affecting the esophagus, stomach, small and large intestines, liver, pancreas, and gallbladder. GI treatments include a wide spectrum of medicines, biologics, and innovative therapies that treat both common and chronic digestive illnesses. Proton pump inhibitors (PPIs), H2 receptor antagonists, laxatives, anti-diarrheal medicines, antiemetics, prokinetics, biologics, and antibiotics used to treat infections like Helicobacter pylori are all examples of GI therapies. Monoclonal antibodies, immunomodulators, and microbiome-based therapeutics are among the more sophisticated treatments for chronic and immune-related gastrointestinal disorders such as Crohn's disease and ulcerative colitis. Healthcare investments and continuing clinical studies for innovative medicines are bolstering the pipeline of advanced GI medications. With the advancement of precision medicine and microbiome research, gastrointestinal medicines are evolving away from symptomatic alleviation and toward targeted, disease-modifying treatments. As a result of this shift, the GI therapies market has become a crucial component in modern healthcare, covering both common and difficult digestive illnesses.

Report Coverage

This research report categorizes the USA gastrointestinal therapeutics market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States gastrointestinal therapeutics market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. gastrointestinal therapeutics market.

Driving Factor

The US gastrointestinal therapeutics market is driven by rising rates of digestive illnesses such as GERD, IBD, and IBS, combined with changing lifestyles and dietary choices. Growing research and development in biologics, microbiome-based therapeutics, and targeted medication delivery drives innovation. Increased healthcare spending, improved diagnostic technologies, and greater awareness of gastrointestinal health all help to drive market growth.

Restraining Factor

The US gastrointestinal therapeutics market has to face restrictions due to high costs, particularly for biologics. Adverse side effects and long-term dependency risks deter uptake of certain pharmacological types. Furthermore, tight regulatory requirements and hurdles in drug development timeframes impede the rapid commercialization of new GI treatments.

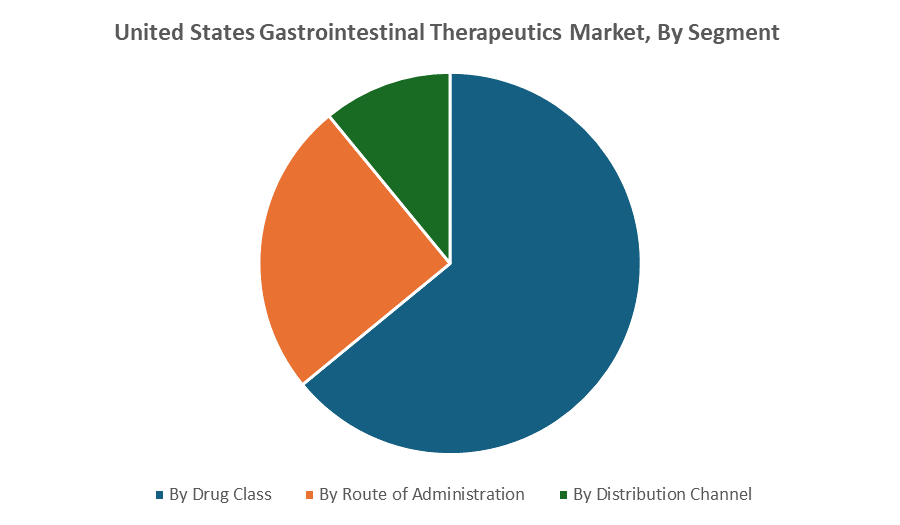

The United States gastrointestinal therapeutics market share is classified into drug class, route of administration, and distribution channel.

- The biologics/biosimilar segment dominated the market in 2024 and is expected to grow at a significant CAGR during the projected timeframe.

The United States gastrointestinal therapeutics market is segmented by drug class into amino salicylates, digestive enzymes, proton pump inhibitors, laxatives, anti-emetics, H2 antagonists, biologics/biosimilars, and others. Among these, the biologics/biosimilar segment dominated the market in 2024 and is expected to grow at a significant CAGR during the projected timeframe. This is due to their high prescription rate for biologic and biosimilar preparations, together with the great efficacy of medications in the treatment of gastrointestinal illnesses such as Crohn's disease, ulcerative colitis, GERD, and others, which is boosting segment demand. Adalimumab, certolizumab, infliximab, natalizumab, and other biologics are examples of common treatments for gastrointestinal diseases.

- The injectable segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States gastrointestinal therapeutics market is segmented by route of administration into thermal diffusion, plasma diffusion, and rapid thermal processing. Among these, the injectable segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to high adoption rate of biological therapies, along with higher pricing, increased bioavailability of injectable drugs, rapid beginning of action, and a lower chance of first-pass metabolism in the case of injectable drugs. Furthermore, the emergence of numerous intravenous medications for the treatment of gastrointestinal illnesses has raised the segment share.

- The online pharmacies segment is projected to witness the fastest growth over the forecast period.

The United States gastrointestinal therapeutics market is segmented by distribution channel into hospital pharmacies, retail pharmacies, and online pharmacies. Among these, the online pharmacies segment is projected to witness the fastest growth over the forecast period. Rising internet penetration, increasing trend of online pharmacies, increased adoption of telemedicine, and various discounts offered by online pharmacy players.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the United States gastrointestinal therapeutics market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Allergan

- Johnson & Johnson

- Novartis

- Pfizer

- Merck

- F. Hoffmann-La Roche

- Eli Lilly

- AstraZeneca

- Procter & Gamble

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the United States gastrointestinal therapeutics market based on the below-mentioned segments:

United States Gastrointestinal Therapeutics Market, By Drug Class

- Amino salicylates

- Digestive enzymes

- Proton Pump Inhibitors

- Laxatives

- Anti-Emetics

- H2 Antagonists

- Biologics/Biosimilar

- Others

United States Gastrointestinal Therapeutics Market, By Route of Administration

- Oral

- Injectable

- Others

United States Gastrointestinal Therapeutics Market, By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 178 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |