United States Lactic Acid Market

United States Lactic Acid Market Size, Share, and COVID-19 Impact Analysis, By Raw Material (Corn, Sugarcane, Cassava, and Yeast Extract), By Application (Industrial, Food & Beverages, Pharmaceuticals, Personal Care, Polylactic Acid, and Other Applications), and USA Lactic Acid Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

United States Lactic Acid Market Insights Forecasts to 2035

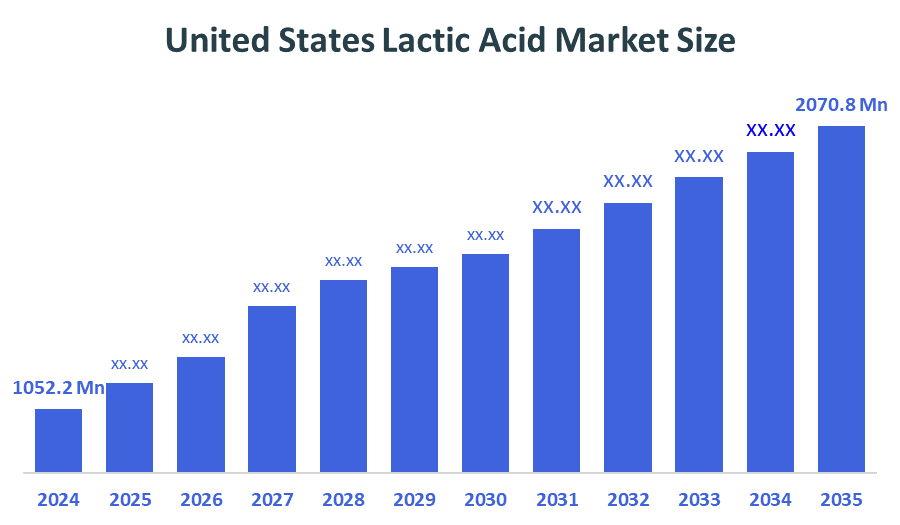

- The U.S. Lactic Acid Market Size Was Estimated at USD 1052.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.35 % from 2025 to 2035

- The USA Lactic Acid Market Size is Expected to Reach USD 2070.8 Million by 2035

According to a research report published by Decision Advisors, the U.S. Lactic Acid market is anticipated to reach USD 2070.8 Million by 2035, growing at a CAGR of 6.35% from 2025 to 2035. The U.S. Lactic Acid market is driven by growth in the food and beverage industry, a shift towards sustainable production, and expanding industrial applications.

Market Overview

The USA lactic acid market refers to the industry that focuses on the production, distribution, and application of lactic acid. Lactic acid is primarily driven by the fermentation of carbohydrates such as corn, sugarcane, or starch. Lactic acid is used as a key raw material across multiple industries, such as food and beverages, pharmaceuticals, cosmetics, and biodegradable plastic. It is recognized for its qualities such as a pH regulator, preservation, and precursor to polylactic acid, a sustainable substitute for traditional plastic. Increasing environmental awareness and stringent government regulations on single-use plastic are major contributors to this market. The rising shift toward sustainable packaging is one of the key trends for this market. This trend presents an opportunity for lactic acid producers in the bioplastics sector.

Report Coverage

This research report categorizes the market for the United States lactic acid market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the USA lactic acid market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA lactic acid market.

Driving Factors

The USA lactic acid market is driven by the growing demand for biodegradable plastics and sustainable materials. The expanding food and beverage industry also contributes significantly, as lactic acid is widely used as a preservative and an acid regulator. Technological advancements in fermentation and the use of renewable feedstocks like corn and sugarcane enhance production efficiency and cost-effectiveness, driving lactic acid market growth across multiple US industries.

Restraining Factors

High production and raw material costs from corn and sugarcane feedstocks increase manufacturing expenses, limiting profitability and hindering lactic acid market growth. Additionally, competition from petrochemical alternatives is also hindering the market growth.

Market Segmentation

The United States lactic acid market share is classified into raw material and application.

- The sugarcane segment held the dominant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States lactic acid market is segmented by raw material into corn, sugarcane, cassava, and yeast extract. Among these, the sugarcane segment held the dominant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This segmental growth is attributed to its abundant biomass material availability. Additionally, one of the main feedstocks for the production of lactic acid is raw sugar, which is derived from sugarcane or sugar beet.

- The food & beverages segment held the highest share in 2024 and is expected to grow at a substantial CAGR during the forecast period.

The United States lactic acid market is segmented by application into industrial, food & beverages, pharmaceuticals, personal care, polylactic acid, and other applications. Among these, the food & beverages segment held the highest share in 2024 and is expected to grow at a substantial CAGR during the forecast period. This segmental growth is attributed to its ability to enhance flavors and increase the shelf life of food and beverage forms.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States lactic acid market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- NatureWorks LLC

- Dow Inc.

- Danimer Scientific

- BASF SE

- Corbion NVGalactic SA

- Galactic SA

- Futerro

- TEIJIN LIMITED

- Others

Recent Developments

- In August 2022, LG Chem and Archer Daniels Midland Company (ADM) announced a U.S. joint venture to produce high-purity lactic acid and PLA bioplastics.

Key Target Audience

- Market Playerss

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the U.S. Lactic Acid market based on the below-mentioned segments:

United States Lactic Acid Market, By Equipment Type

- Cheese

- Processed Milk

- Yogurt

- Protein Ingredients

- Milk Powder

- Others

United States Lactic Acid Market, By Application

- Cheese

- Processed Milk

- Yogurt

- Protein Ingredients

- Milk Powder

- Others

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Regional |

| Pages | 250 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |