United States Packaged Food Market

United States Packaged Food Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Bakery & Confectionery Products, Snacks & Nutritional Bars, Beverages, Sauces, and Others), By Packaging Type (Plastic Packaging, Tetra Pack, Metal Cans, and Others) By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Specialty Stores, and Others), and United States Packaged Food Market Insights, Industry Trend, Forecasts To 2035

Report Overview

Table of Contents

United States Packaged Food Market Insights Forecasts to 2035

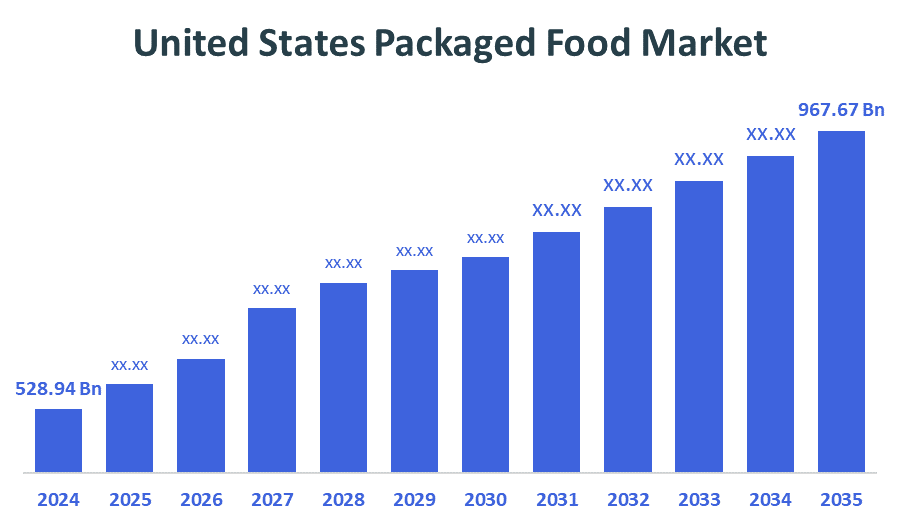

- The United States Packaged Food Market Size Was Estimated at USD 528.94 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.64% from 2025 to 2035

- The United States Packaged Food Market Size is Expected to Reach USD 967.67 Billion by 2035

According to a research report published by Decisions Advisors, The United States Packaged Food Market Size?is anticipated to reach USD 967.67 Billion by 2035, growing at a CAGR of 5.64% from 2025 to 2035. Increasing developments in food packaging, plant-based goods, robust flavors, and healthful ingredients have all contributed to the rise in United States packaged food in the upcoming years.

Market Overview:

Packaged food is defined as any food product that has been processed, prepared, and packed in containers, cartons, cans, pouches, or other protective packaging to maintain its freshness, safety, and shelf life. These foods are often ready-to-eat, ready-to-cook, or simple to prepare, making them ideal for people with hectic schedules. Examples include snacks, frozen meals, morning cereals, dairy products, canned goods, bakery items, sauces, and beverages. Packaging not only improves food's shelf life, but it also assures hygiene, protects the product from contamination, and gives important information like ingredients, nutritional value, and expiration dates. Packaged food can range from highly processed foods like instant noodles to healthier alternatives like organic granola bars or lightly processed frozen vegetables. Consumers are increasingly drawn to items that provide functional benefits, contain clean ingredients, and are organic or plant-based. Innovations in food packaging, plant-based goods, robust flavors, and healthful ingredients have all contributed to the industry's rise. As the vegan population in the country grows, there is an increasing need for plant-based products.

Report Coverage:

This research report categorizes the United States packaged food market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States packaged food market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States packaged food market.

Driving Factor

Busy lifestyles are driving up demand for convenience, as is customer desire for ready-to-eat and easy-to-prepare meals, and there is a growing trend for healthier, organic, and clean-label items. Furthermore, growing e-commerce platforms and packaging advancements that ensure safety, freshness, and sustainability are driving market expansion.

Restraining Factor

The increased health worries about processed ingredients, preservatives, and high sugar or sodium levels deter health-conscious shoppers. Additionally, supply chain disruptions, fluctuating raw material costs, and growing preference for fresh and locally sourced foods pose challenges to market expansion.

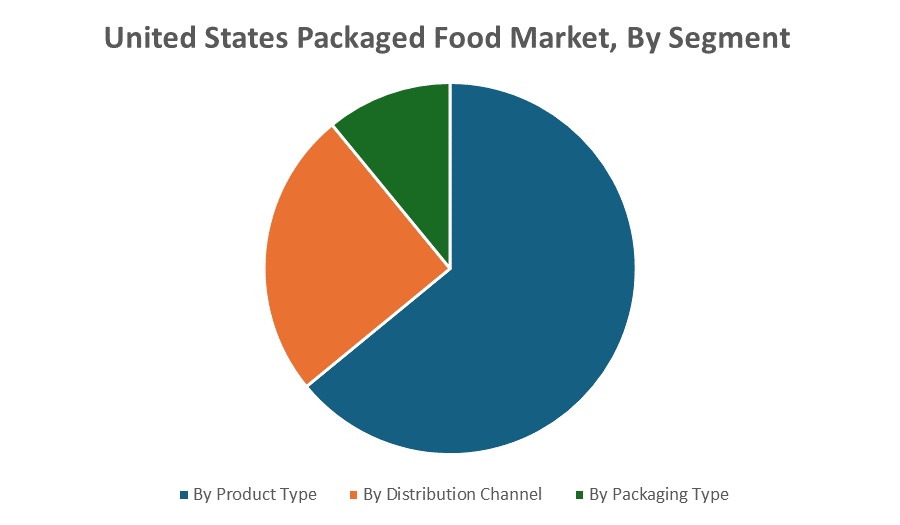

Market Segmentation

The United States packaged food market share is classified into product type, packaging type, and distribution channel.

- The beverages segment dominated the market in 2024 and is projected to grow at a significant CAGR during the forecast period.

The United States Packaged Food market is segmented by product type into bakery & confectionery products, snacks & nutritional bars, beverages, and sauces. Among these, the beverages segment dominated the market in 2024 and is projected to grow at a significant CAGR during the forecast period. Beverages with unusual flavors and important minerals are gaining popularity among US consumers. Furthermore, the growing demand for functional drinks and sports drinks among the country's health-conscious consumers and athletes is propelling the market forward.

- The plastic packaging segment dominated the market in 2024 and is projected to grow at a significant CAGR during the forecast period.

The United States Packaged Food market is segmented by packaging type into Plastic Packaging, Tetra Pack, Metal Cans, and Others. Among these, the plastic packaging segment held the largest share in 2024 and is expected to grow substantial CAGR during the forecast period. This is due to lightweight, easily available, and less fuel is consumed, which results in lower emissions and cost benefits for distributors, retailers, and consumers. Plastic packaging can withstand harsh settings and does not disintegrate quickly in hot or cold climates, retaining the freshness of the food or beverage inside.

- The supermarket/ hypermarkets segment dominated the market in 2024 and is expected to grow at a remarkable CAGR during the projected timeframe.

The United States Packaged Food market is segmented by distribution channel into supermarkets/hypermarkets, convenience stores, online retail, specialty stores, and others. Among these, the supermarket segment dominated the market in 2024 and is expected to grow at a remarkable CAGR during the projected timeframe. A big proportion of consumers choose to buy food at supermarkets because of the shopping experience they provide. The ability to physically verify a product, combined with expert help, is a crucial factor contributing to this distribution channel's popularity in the marketplace.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States packaged food market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nestlé

- The Coca-Cola Company

- PepsiCo

- Tyson Foods, Inc.

- Mars, Incorporated

- Cargill, Incorporated

- General Mills Inc.

- Conagra Brands Inc.

- Kellogg Co.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities?

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2025 to 2035. Decisions Advisors has segmented the United States Packaged Food market based on the below-mentioned segments:

United States Packaged Food Market, By Product Type

- Bakery & Confectionary Products

- Snacks & Nutritional Bars

- Beverages

- Sauces

- Others

United States Packaged Food Market, By Packaging Type

- Plastic Packaging

- Tetra Pack

- Metal Cans

- Others

United States Packaged Food Market, By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Specialty Stores

- Others

FAQ’s

Q: What is the market size of the U.S. Packaged Food market in 2024?

A: The U.S. Packaged Food market size was estimated at USD 528.45 billion in 2024.

Q: What is the forecasted CAGR of the U.S. Packaged Food market from 2024 to 2035?

A: The market is expected to grow at a CAGR of around 5.63% during the period 2024–2030.

Q: Which product type held the largest market share in 2024?

A: In 2024, the Beverages segment held the largest market share in the United States packaged food market.

Q: Who are the top companies operating in the U.S. Packaged Food Market?

A: Key players include Nestlé, The Coca-Cola Company, PepsiCo, Tyson Foods, Inc., Mars, Incorporated, Cargill, Incorporated, General Mills Inc., Conagra Brands Inc., Kellogg Co., and others.

Q: Can you provide company profiles for the leading Packaged Food in the U.S.?

A: Yes. For example, Nestlé, the company, operates across multiple categories, including frozen and prepared meals, coffee, creamers, confectionery, dairy products, bottled water, and pet care.

Q: What are the main drivers of growth in the U.S. Packaged Food market?

A: Rising demand for convenience due to busy lifestyles, increasing consumer preference for ready-to-eat and easy-to-prepare meals, and the growing trend toward healthier, organic, and clean-label products.

Q: What are the major challenges or restraints facing the market?

A: supply chain disruptions, fluctuating raw material costs, and growing preference for fresh and locally sourced foods pose challenges to market expansion.

Q: Which regulations are affecting this market?

A: Food Safety Modernization Act (FSMA) – Overseen by the FDA, it emphasizes preventive controls across the food supply chain to reduce contamination risks.

Q: Which application segment is expected to grow the largest over the next 10 years?

A: In the United States Packaged Food market, the beverages segment is expected to grow the largest over the next 10 years (2025–2035).

Q: What is the forecast period for this market analysis?

A: The report forecasts market trends and growth from 2025 to 2035, using 2024 as the base year and considering historical data from 2020 to 2023.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 189 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Aug 2025 |

| Access | Download from this page |