United States Property Management Services Market

United States Property Management Services Market Size, Share, and COVID-19 Impact Analysis, By Service (Rent Collection, Mortgage & Utility Payment, Leasing, Legal & Accounting Services, Repair & Maintenance, and Other), By Property Type (Residential, Commercial, Industrial, and Others), By End-user (Property Managers or Agents, Housing Association, and Others), and United States Property Management Services Market Insights, Industry Trend, Forecasts To 2035

Report Overview

Table of Contents

United States Property Management Services Market Insights Forecasts to 2035

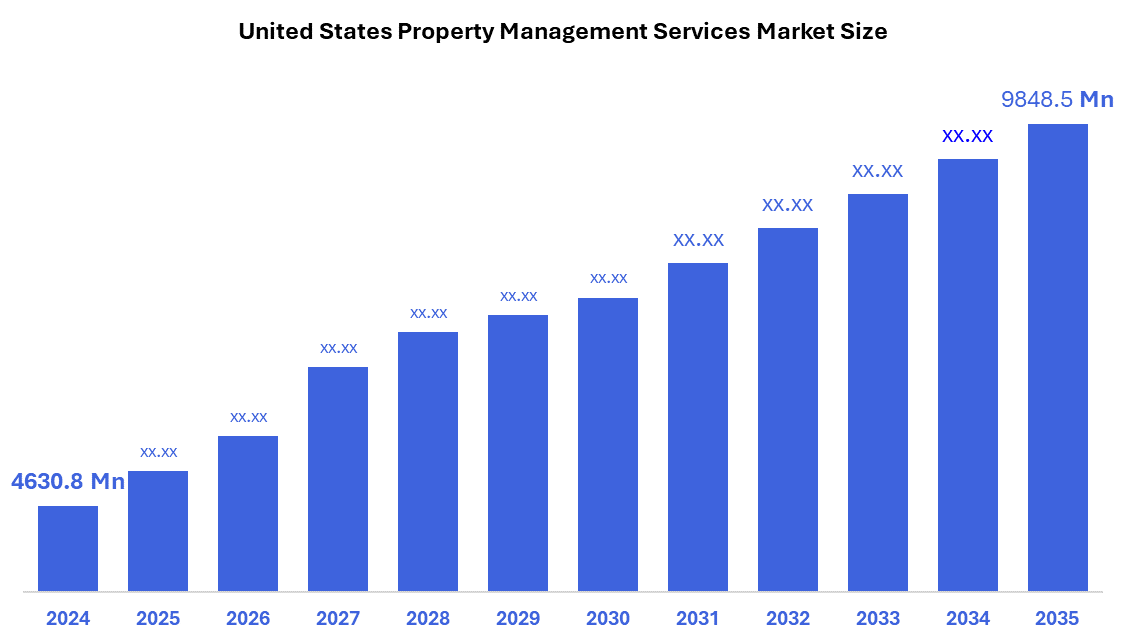

- The United States Property Management Services Market Size Was Estimated at USD 4630.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.1% from 2025 to 2035

- The United States Property Management Services Market Size is Expected to Reach USD 9848.5 Million by 2035

According to a research report published by Spherical Insights & Consulting, the United States property management services market?Size is Anticipated to reach USD 9848.5 Million by 2035, Growing at a CAGR of 7.1% from 2025 to 2035. The U.S. property management services market is being driven by a rising rental demand, urban expansion, and the incorporation of digital technologies. Improved operational efficiency and a shift toward professional management solutions are accelerating market growth.

Market Overview

Property management services include professional supervision, operations, and administration of real estate assets from the owner. The purpose of these services is to guarantee that residential, commercial, or industrial properties are maintained efficiently, while raising the income from rent, protecting the property value, and assuring tenant happiness. The property management business works as a go-between for landlords and tenants, who complete day-to-day functions that would otherwise be time-consuming and effort-intensive for the owners of the property. Property management services often cover rent, tenant acquisitions and screening, lease interaction, property maintenance, and financial reporting. They also take care of repairs, work with contractors, and continuously inspect property to guarantee safety and legal compliance. In addition, property managers handle the tenant's complaints, disputes, and renewal of lease or eviction. They also provide market analysis for investment properties, allowing them to determine competitive fare prices and optimize the occupancy. Commercial property management services may include convenience management, general field maintenance, assurance of compliance with health and safety laws, and long-term asset plan assistance. On the other hand, residential property management, related to tenant relationships, maintains a standard of living and guarantees regular fare payment flow.

Report Coverage

This research report categorizes the USA property management services market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the U.S. property management services market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States property management services market.

Driving Factor

The United States property management services market is driven by the demand for rising fare, urbanization, and an increase in commercial real estate investment. Increased dependence on professional management by absent landlords, tenant communication, rent collection, and the implementation of digital platforms for future maintenance improves joint efficiency, tenant satisfaction, and property value, resulting in market expansion.

Restraining Factor

The United States property management services market has to face restrictions due to competition from high service costs, regulatory barriers, and DIY property management platforms all bordering expansion. In addition, the issues of fragmented market structures, various state-level rent laws, and maintaining the quality of equal service in areas make it difficult for property management organizations to scale their operations efficiently.

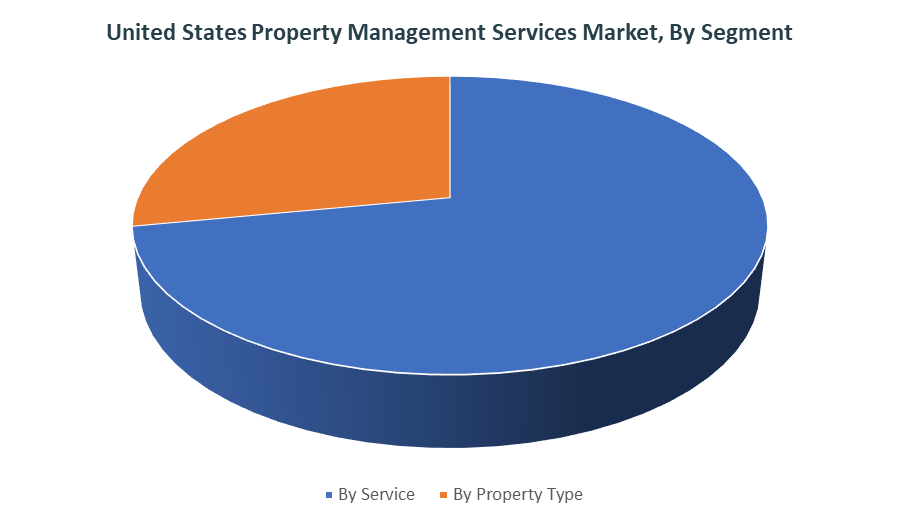

The United States property management services market share is classified into service, property type, and end-user.

- The repair & maintenance segment dominated the market?in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The United States property management services market is segmented by service into rent collection, mortgage & utility payment, leasing, legal & accounting services, repair & maintenance, and other. Among these, the repair & maintenance segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. This is due to the growing requirement for properties that are well-built, safe, and code-compliant. Increasing infrastructure in many American cities, increasing demand for tenants for high-quality living conditions, and hard municipal construction requirements all contribute to a continuous demand for repair and maintenance services.

- The residential segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the projected timeframe.

The United States property management services market is segmented by property type into residential, commercial, industrial, and others. Among these, the residential segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the projected timeframe. This is due to an increase in investor interest in rental housing demand, rising urban population, and multifamily development. Property owners are rapidly relying on professional managers for tenant screening, renting, and maintenance services, resulting in the ongoing innovation and expansion of residential property management options.

- The property managers or agents segment dominated the market in 2024 and is estimated to grow at a remarkable CAGR during the forecast period.

The United States property management services market is segmented by end-user into property managers or agents, housing associations, and others. Among these, the property managers or agents segment dominated the market in 2024 and is estimated to grow at a remarkable CAGR during the forecast period. This is due to increasing demand for special outsourced services in both residential and commercial areas. As the property portfolio expands, the manager is implementing digital solutions to streamline the manager's operations, improve tenant communication, and maintain regulatory compliance, intensifying infections towards professional property management services.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the United States property management services market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Greystar

- Lincoln Property

- Asset Living

- FPI

- Alliance Residential

- FirstService Residential

- Evernest

- Darwin HomesOthers

Recent Development

- In May 2025, Lincoln Property Company expanded its property management services in Southern California with a strategic investment in Unire Real Estate Group. This move strengthens its regional presence, expands its service offerings, and fosters growth in the competitive Southern California real estate market.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the United States property management services market based on the below-mentioned segments:

United States Property Management Services Market, By Service

- Rent Collection

- Mortgage & Utility Payment

- Leasing

- Legal & Accounting Services

- Repair & Maintenance

- Other

United States Property Management Services Market, By Property Type

- Residential

- Commercial

- Industrial

- Others

United States Property Management Services Market, By End-User

- Property Managers or Agents

- Housing Association

- Others

FAQ’s

Q: What is the market size of the United States Property Management Services market in 2024?

A: The U.S. property management services market was valued at USD 4,630.8 million in 2024.

Q: What is the expected market size by 2035?

A: The market is projected to reach USD 9,848.5 million by 2035.

Q: What is the growth rate (CAGR) of the U.S. property management services market?

A: The market is expected to grow at a CAGR of 7.1% during 2025–2035.

Q: What are the key driving factors of the U.S. property management services market?

A: Rising rental demand, urbanization, adoption of digital property management solutions, and growing reliance on professional management services are key drivers.

Q: What are the major restraints faced by the U.S. property management services market?

A: High service costs, regulatory barriers, fragmented market structures, and competition from DIY management platforms restrain growth.

Q: Which service segment dominated the U.S. property management services market in 2024?

A: The repair & maintenance segment led the market in 2024 and is expected to grow at a significant CAGR.

Q: Which property type held the largest U.S. property management services market share in 2024?

A: The residential segment accounted for the largest share in 2024 due to increasing rental housing demand and multifamily developments.

Q: Which end-user segment dominates the U.S. property management services market?

A: Property managers or agents dominated the market in 2024 and are projected to maintain strong growth during the forecast period.

Q: Who are the key players in the United States property management services market?

A: Major players include Greystar, Lincoln Property, Asset Living, FPI, Alliance Residential, FirstService Residential, Evernest, and Darwin Homes.

Q: What is the forecast period covered in this report?

A: The report covers historical data from 2020–2023, with forecasts from 2025 to 2035.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |