United States Spirits Market

United States Spirits Market Size, Share, By Product (Vodka, Whiskey, Rum, Brandy & Cognac, Gin, And Others), By Price (Economy, Mid-Premium, Super-Premium, And Ultra-Premium), By Distribution Channel (On-Trade And Off-Trade), By End Use (Men And Women), And US Spirits Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

United States Spirits Market Size Insights Forecasts to 2035

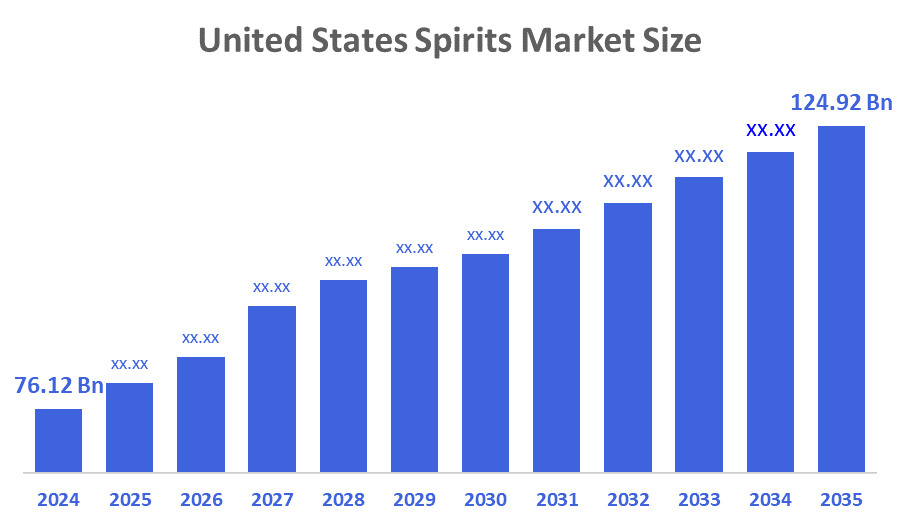

- United States Spirits Market Size 2024: USD 76.12 Bn

- United States Spirits Market Size 2035: USD 124.92 Bn

- United States Spirits Market CAGR 2024: 4.61%

- United States Spirits Market Segments: Product, Price, Distribution Channel, and End Use

The US Spirit Market Size encompasses all aspects of the manufacture, distribution as well as consumption of distilled spirits. The US spirits market differs from both beer and wine, in that alcoholic beverages (spirits) contain a higher level of alcohol than both beer and wine, and are subject to their own set of rules and regulations at the local, state and federal levels. The continued expansion of the US spirits market is due, in part, to the movement towards premiumization, with more consumers opting for premium-quality products. Additionally, the growing popularity of ready-to-drink cocktails, coupled with the increasing use of e-commerce as a channel for purchasing spirits, allows consumers to access more brands in more locations than ever before. Finally, consumers' focus on health and sustainability impacts the market by leading to innovation in terms of using cleaner ingredient and more eco-friendly packaging.

The spirits in US are backed by government support, including the Craft Beverage Modernization and Tax Reform Act, and also through the actions taken by the Alcohol and Tobacco Tax and Trade Bureau (TTB) to provide tax breaks to craft distilleries and to facilitate packaging of labels. Through these efforts, the government has decreased barriers to entry into the market and increased the operating efficiencies of craft producers. The amount of tax revenue that was collected by the U.S. Treasury on distilled spirits during FY 2023 of approximately USD 15.9 billion is indicative of the continued strong production and sales of distilled spirits in the U.S. marketplace.

As technology advances, US spirits providers are now using special flavors & botanical spirits while focusing not only on premium RTDS but also on the addition of unique flavour profiles. Sustainable production techniques are becoming more prevalent such as eco-friendly packaging and unique applications for byproducts of production such as creating alternative proteins from whiskey. E-commerce and digital marketing technology platforms can be used to reach consumers directly and enhance brand engagement in US.

Market Dynamics of the United States Spirits Market:

The US spirits market is driven by the surge in premium quality products, urban lifestyles and preferences for small batch products, increasing levels of consumer demand for tequila and mescal, trends towards convenience and pre-mixed cocktails, growing e-commerce infrastructure and the rise of digital platforms, growing awareness of health and sustainable choices, and rise in use of eco-friendly packaging and sustainable sourcing of raw materials.

The US spirits market is restrained by the high price points on products, consumer spending reductions, public health trends which encourage lower alcohol use, competition with beer and non-alcohol options and complicated regulatory environments.

The future of US spirits market is bright and promising, with versatile opportunities emerging from the expansion into premium and super premium segments, also the opportunity to diversify in low and no-alcohol options for health conscious consumers. Additionally, the growing international market opportunities where U.S.-based spirits gain traction will create additional benefits for continued success. The continued growth of the Ready to Drink (RTD) category, supported by sustainability-driven product innovation and differentiation, offers an abundance of opportunities for evolving business models and companies to further grow their respective portfolios.

Market Segmentation

The United States Spirits Market share is classified into product, price, distribution channel, and end use.

By Product:

The US spirits market is divided by product into vodka, whiskey, rum, brandy & cognac, gin, and others. Among these, the whiskey segment held the largest revenue market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Powerful trend of premiumization, demand for high quality product, signifies sophistication, luxury, and status, appealing to consumers for special occasions, wide spectrum of Flavors , and rise in disposable income and lifestyle changes all contribute to the whiskey segment largest share and higher spending in spirits market as compared to other product.

By Price:

The US spirits market is divided by price into economy, mid-premium, super-premium, and ultra-premium. Among these, the economy segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The economy segment dominates because of its affordability and accessibility for everyday consumers, offering consistent quality at lower price points, widespread availability, and ideal for regular consumption and value-seeking buyers.

By Distribution Channel:

The US spirits market is divided by distribution channel into on-trade and off-trade. Among these, the off-trade segment held the largest market share in 2024 and is predicted to grow at a significant CAGR during the forecast period. Convenient and accessible choice, booming trend of at-home consumption, diverse brand and price points allowing price comparison and growth in e-commerce platforms all contribute to the off-trade segment largest share and higher spending in spirits market as compared to other distribution channel.

By End Use:

The US spirits market is divided by end use into men and women. Among these, the men segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The men segment dominates because of its long established traditional consumption patterns, higher volume of consumption, historical social norms that have encourage male drinking, increase in disposable income, increase in corporate work culture, historically shown strong demand for traditional spirits like whiskey and rum.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the US spirits market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in United States Spirits Market:

- Sazerac Company, Inc.

- Heaven Hill Brands

- Brown-Forman Corporation

- Constellation Brands Inc.

- E. & J. Gallo Winery

- Diageo Plc

- Pernod Ricard SA

- Beam Suntory

- Tito’s Handmade Vodka

- MGP Ingredients Inc.

- Ole Smoky Distillery LLC

- Cutwater Spirits

- Next Century Spirits

- Breckenridge Distillery

- St. George Spirits Inc.

- Others

Recent Developments in United States Spirits Market:

In October 2025, Heaven Hill Brands, Kentucky-based distillery launched a trio of whiskies (Bourbon, rye, and wheat) aged in chinquapin oak barrels as the first part of a new series.

In June 2025, Diageo India , a subsidiary of Diageo Plc, announced it was taking a majority controlling stake in NAO Spirits, the maker of premium Indian craft gins ‘Greater Than’ and ‘Hapusa’, to explore growth opportunities in the craft spirits segment.

In November 2024, Sazerac Company, Inc. announced plans to expand its bourbon offerings in India, including the Buffalo Trace Distillery bourbons.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United states, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the US spirits market based on the below-mentioned segments:

United States Spirits Market, By Product

- Vodka

- Whiskey

- Rum

- Brandy & Cognac

- Gin

- Others

United States Spirits Market, By Price

- Economy

- Mid-Premium

- Super-Premium

- Ultra-Premium

United States Spirits Market, By Distribution Channel

- On-Trade

- Off-Trade

United States Spirits Market, By End Use

- Men

- Women

FAQ

Q: What is the US spirits market size?

A: US spirits market is expected to grow from USD 76.12 billion in 2024 to USD 124.92 billion by 2035, growing at a CAGR of 4.61% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the strong premiumization, urbanization and lifestyle changes, consumers preference for high-quality, craft, and small-batch products, growing demand for agave-based spirits like tequila and mescal, rising popularity of ready-to-drink cocktails that offer convenience, expansion of e-commerce and digital platforms, and trends toward health-conscious and sustainable choices are encouraging innovation in cleaner ingredients and eco-friendly packaging.

Q: What factors restrain the US spirits market?

A: Constraints include the high product costs dampen consumer spending, tariff uncertainty on exports, public health trends toward reduced alcohol consumption, competition from beer and non?alcoholic alternatives, and complex regulatory environments.

Q: How is the market segmented by product?

A: The market is segmented into vodka, whiskey, rum, brandy & cognac, gin, and others.

Q: Who are the key players in the US spirits market?

A: Key companies include Sazerac Company, Inc., Heaven Hill Brands, Brown-Forman Corporation, Constellation Brands Inc., E. & J. Gallo Winery, Diageo Plc, Pernod Ricard SA, Beam Suntory, Tito’s Handmade Vodka, MGP Ingredients Inc., Ole Smoky Distillery LLC, Cutwater Spirits, Next Century Spirits, Breckenridge Distillery, St. George Spirits Inc., and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 144 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |