United States Windows and Doors Market

United States Windows and Doors Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Door and Window), By Material Type (Wood, Metal, and Plastic), By End-User (Residential, Commercial, Industrial), and United States Windows and Doors Market Insights, Industry Trend, Forecasts To 2035

Report Overview

Table of Contents

United States Windows and Doors Market Insights Forecasts to 2035

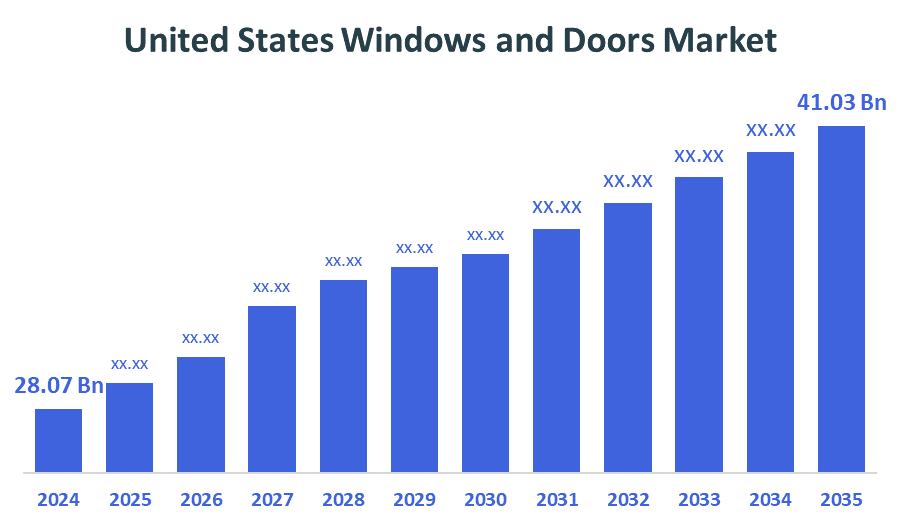

- The United States Windows and Doors Market Size Was Estimated at USD 28.07 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.51% from 2025 to 2035

- The United States Windows and Doors Market Size is Expected to Reach USD 41.03 Billion by 2035

According to a research report published by Decisions Advisors, The United States Windows And Doors Market Size?is anticipated to reach USD 41.03 Billion by 2035, growing at a CAGR of 3.51% from 2025 to 2035. The United States windows and doors Market is increasing due to rapid urbanization and industrialization, as well as a growing demand for advanced windows and doors that offer better insulation, soundproofing, and security features.

Market Overview:

All buildings, either residential or non-residential, have windows and doors. A door is a movable piece that is installed in the entrance of a building for the principal purpose of allowing control of the passage through the doorway. Conversely, windows are comprised of one or more movable pieces in an opening in the wall, allowing light, air, and view to transition to other spaces both inside and outside of the building. Beyond the functional nature of windows and doors are intrinsic promotional and aesthetic purposes. Furthermore, the windows and doors market has seen steady growth due to increased construction activity, renovations, and energy-efficiency standards that appear to keep rising. Demand is still dominantly residential because of the demand for quality, aesthetic, and environmentally-friendly items, while there is still commercial project-driven demand for scale and high-performance jobs. Market demand is also seeing tool advancement and developmental spikes such as smart windows, automated doors, and impact-resistant designs due to heightened safety and convenience expectations. Growing emphasis on sustainable building practice and consumer preference for contemporary designs and customization are driving competition among leading firms.

Report Coverage:

This research report categorizes the United States windows and doors market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States windows and doors market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States windows and doors market.

Driving Factor

The ongoing growth of both residential and commercial construction projects is a key factor driving the need for windows and doors. In addition to stricter building codes and environmental legislation, the growing consumer preference for energy-efficient and sustainable products, along with the advancement of technologies for smart windows, automated doors, and impact-resistant products that enhance convenience, safety, and performance, is accelerating growth in the market.

Restraining Factor

The market for windows and doors will face limitations from the inconsistent pricing of the necessary raw materials to produce the windows and doors. However, additional challenges in the market include competition and interruptions in supply chains that affect the growth of the market and potentially on-time deliveries.

Market Segmentation

The United States Windows and Doors Market share is classified into product type material type, and end-user.

- The windows segment is accounted for the highest market share in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The United States windows and doors market is segmented by product type into doors and windows. Among these, the windows segment is accounted for the highest market share in 2024 and is projected to grow at a substantial CAGR during the forecast period. Windows are designed to allow for the exchange of air and the flow of natural light into the building. The demand for windows that permit increased air and light entry is also sustained by the increasing trend of designing buildings for energy efficiency.

- The metal segment accounted for the highest market share in 2024 and is expected to grow at a remarkable CAGR during the projected timeframe.

The United States windows and doors market is segmented by material type into wood, metal, plastic, and others. Among these, the metal segment accounted for the highest market share in 2024 and is expected to grow at a remarkable CAGR during the projected timeframe. Metal is a popular material for windows and doors due to its strength, durability, and versatility. Metal doors can resist and deter forced entry. Additionally, window and door frames are made of metal.

- The residential segment dominated the market in 2024 and is projected to grow at a significant CAGR during the forecast period.

The United States windows and doors market is segmented by end-user into residential, commercial, and industrial. Among these, the residential segment dominated the market in 2024 and is projected to grow at a significant CAGR during the forecast period. This is due to the ongoing increase in housing demand and the rising popularity of home improvement and renovation projects. Homeowners are placing a greater premium on energy efficiency, security, and aesthetics, fueling the need for new windows and doors that satisfy these standards. The rise of smart houses, as well as the incorporation of technology into residential windows and doors, are all contributing to the segment's growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States windows and doors market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- JELD-WEN, Inc.

- ANDERSEN CORPORATION

- Pella Corporation

- Masonite

- SIERRA PACIFIC WINDOWS

- PGT INNOVATIONS

- Others

Recent Development

- In April 2024, Andersen Corporation has announced the expansion of its retractable screen line with a retractable screen specifically designed for Andersen patio doors. The new product integrates form and function to help optimize comfort and usability, while allowing easy access to fresh air, and uninterrupted views, while keeping insects at bay.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities?

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2025 to 2035. Decisions Advisors has segmented the United States. hair care market based on the below-mentioned segments:

United States Windows and Doors Market, By Product Type

- Doors

- Windows

United States Windows and Doors Market, By Material Type

- Wood

- Metal

- Plastic

- Others

United States Windows and Doors Market, By End-User

- Residential

- Commercial

- Industrial

FAQ’s

Q: What is the market size of the U.S windows and doors market in 2024?

A: The U.S. windows and doors market size was estimated at USD 27.71 billion in 2024.

Q: What is the forecasted CAGR of the U.S. windows and doors market from 2024 to 2035?

A: The market is expected to grow at a CAGR of around 3.49% during the period 2024–2030.

Q: Which product type held the largest market share in 2024?

A: In 2024, the windows segment held the largest market share in the United States windows and doors market.

Q: Who are the top companies operating in the U.S. windows and doors Market?

A: Key players include JELD-WEN, Inc., Andersen Corporation, Pella Corporation, Masonite, Sierra Pacific Windows, PGT Innovations, and others.

Q: Can you provide company profiles for the leading windows and doors in the U.S.?

A: Yes. For example, Andersen Corporation largest U.S. window and door manufacturer, serving residential, home improvement, and light commercial markets. Operates under brands including Andersen Windows & Doors, Renewal by Andersen, MQ, and Heritage.

Q: What are the main drivers of growth in the U.S windows and doors market?

A: Rising consumer preference for energy-efficient and sustainable solutions, supported by stricter building codes, environmental regulations, as well as technological advancements such as smart windows, automated doors.

Q: What are the major challenges or restraints facing the market?

A: The rapid change in the cost of raw materials required to construct windows and doors is anticipated to restrain the windows and doors market.

Q: Which regulations are affecting this market?

A: The U.S. Department of Energy (DOE) and the Environmental Protection Agency (EPA) affect the windows and doors market.

Q: Which application segment is expected to grow the largest over the next 10 years?

A: Over the next 10 years, the windows segment is expected to grow the largest in the U.S. windows and doors market.

Q: What are the latest trends in the U.S. windows and doors market?

A: The latest trends in the U.S. windows and doors market include energy-efficient glazing, smart automation, sustainable materials, and minimalist etc.

Q: What is the forecast period for this market analysis?

A: The report forecasts market trends and growth from 2025 to 2035, using 2024 as the base year and considering historical data from 2020 to 2023.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 217 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Aug 2025 |

| Access | Download from this page |