Global Urban Mining Market

Global Urban Mining Market Size, Share, and COVID-19 Impact Analysis, By Material (Precious Metals, Non-Precious Metals others), By Waste Type (E-Waste, Construction & Demolition, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Urban Mining Market Summary

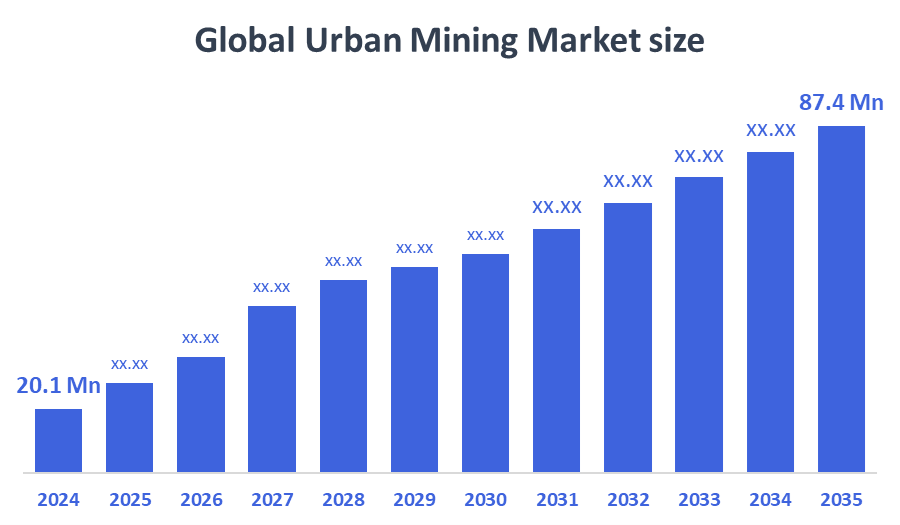

The Global Urban Mining Market Size Was Estimated at USD 20.1 Million in 2024 and is Projected to Reach USD 87.4 Million by 2035, Growing at a CAGR of 14.3% from 2025 to 2035. The market for urban mining is expanding as a result of growing e-waste production, increased demand for rare and critical metals, environmental concerns about traditional mining, and supportive government policies that encourage resource recovery, recycling, and sustainable methods of handling industrial and electronic waste.

Key Regional and Segment-Wise Insights

- In 2024, the European urban mining market held the largest revenue share of 34.6% and dominated the global market.

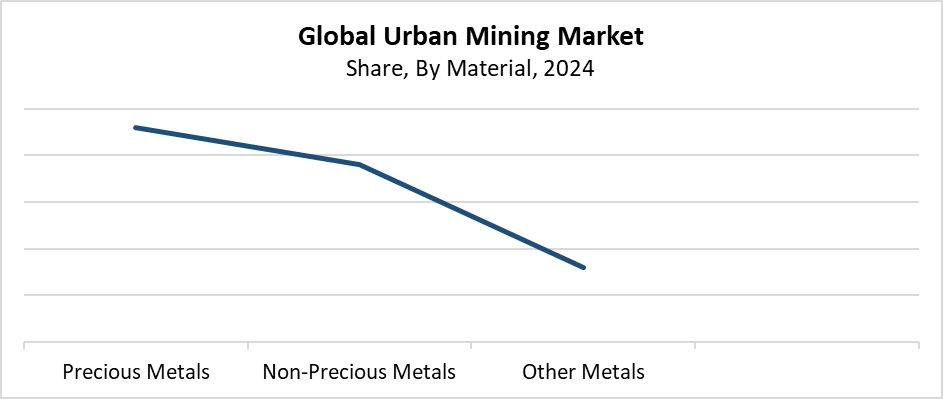

- In 2024, the precious metals segment held the highest revenue share of 46.2% and dominated the global market by material.

- With the biggest revenue share of 55.7% in 2024, the e-waste segment led the worldwide urban mining market by waste type.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 20.1 Million

- 2035 Projected Market Size: USD 87.4 Million

- CAGR (2025-2035): 14.3%

- Europe: Largest Market Region in 2024

The Urban Mining Market exists as a process which extracts valuable metals and commodities from electronic waste and end-of-life products, and old infrastructure found in urban areas. Gold, silver, lithium, cobalt, and rare earth elements form the essential raw materials which conventional mining techniques produce through environmentally harmful operations. The method provides an effective way to reach these requirements. The market grows because of increasing e-waste volumes, metal price increases, resource scarcity, and fast electronic device adoption. Urban mining supports the circular economy and global sustainability goals by reducing the environmental damage that traditional mining operations produce. Urban mining has become an essential solution for material requirements because governments, together with businesses, seek sustainable resource alternatives.

The urban mining industry has experienced rapid growth because of recent technological breakthroughs. The extraction of valuable resources from complex waste materials has become more cost-effective and efficient because of modern hydrometallurgical techniques, automated AI sorting systems, and advanced material recovery systems. Governments across the world have established laws and policies which support resource recovery and e-waste recycling initiatives. Market growth receives support from programs that provide financial rewards and establish stricter recycling targets, and extended producer responsibility (EPR) systems. The infrastructure and capacities for urban mining are developing quickly as a result of these initiatives. They are encouraging increased cooperation between private businesses, governments, and recycling operators.

Material Insights

What Factors Enabled the Precious Metals Segment to Capture a 46.2% Revenue Share in the Urban Mining Market in 2024?

The precious metals segment leads the urban mining market with the largest revenue share of 46.2% in 2024. Precious metals like gold, silver, and platinum, which are extracted from electronic waste, including discarded laptops and smartphones, drive this market dominance because of their high economic value. The need for recovering precious metals has increased dramatically as a result of rising e-waste and increasing worldwide electronics usage. Urban mining proves to be more cost-effective and environmentally friendly than traditional mining operations, which generate high operating expenses. They also cause environmental harm. The rising metal prices, together with restricted natural resources, have made urban recovery of precious metals an attractive business opportunity. The trend receives more validation because people now understand the importance of protecting the environment and saving resources.

The non-precious metals segment of the urban mining market will experience a substantial CAGR during the forecast period. The demand for metals, including copper, aluminium, nickel, and zinc, which serve as fundamental components for electronics and building materials and renewable energy systems, drives this market expansion. The growing volume of electronic waste and industrial waste provides an opportunity for urban mining to serve as an environmentally responsible method of extracting these valuable non-precious metals. The circular economy drive, together with mining dependency reduction requirements, helps recycling and recovery initiatives. The extraction of non-precious metals has become more cost-effective because technological advancements in material separation and processing have enhanced recovery rates. This thus attracts both public and private sector interest.

Waste Type Insights

Why did the E-Waste Segment dominate the Urban Mining Market and hold the Largest Revenue Share of 55.7% in 2024?

The e-waste segment led the urban mining market by holding the largest revenue share of 55.7% in 2024. The fast growth of global electronic use, together with short device lifespans, creates a rising waste problem, which explains this market dominance. E-waste stands as an attractive urban mining resource because it holds numerous valuable materials, which include precious metals and non-precious metals such as copper, silver, aluminium, and gold. The investment in recycling and recovery technology grows because electronic waste disposal rules become stricter and people learn about the environmental impacts of improper electronic waste disposal. The world has seen an increase in urban mining projects, which concentrate on e-waste. This is because nations seek environmentally friendly resource management.

The construction and demolition (C&D) segment of the Urban Mining Market will experience a substantial CAGR during the forecast period. The growth results from the rising volume of construction and demolition waste that emerges from rapid urban growth, infrastructure development and building refurbishment activities. The extraction of raw materials and landfill disposal create less environmental damage when materials such as steel, aluminium, copper, concrete, and glass undergo proper recovery and recycling processes. The requirement for C&D waste recovery continues to grow because governments now actively support waste reduction initiatives, circular economy programs, and sustainable building methods. The C&D sector will drive urban mining growth because technological progress in sorting, crushing, and material separation systems leads to improved operational efficiency and economic returns.

Regional Insights

The Europe region led the global urban mining market in 2024 by holding the largest revenue share of 39.5%. The area leads because of its strong legal system, its environmental sustainability goals, and its modern waste management systems. The European Union supports urban mining through its circular economy laws, which include the Critical Raw Materials Act and the Waste Electrical and Electronic Equipment (WEEE) Directive. The market expands because of strong recycling targets, high e-waste collection rates, and increasing costs for material recovery technology. The leading nations of Germany, the Netherlands, and Sweden support efficient resource recovery systems. These reduce their need for imported raw materials, thus maintaining Europe's top position in urban mining worldwide.

North America Urban Mining Market Trends

North America experiences steady growth in the urban mining market because of rising electronic waste generation, increasing metal requirements, and expanding environmental awareness. Electronic devices and renewable energy technology require lithium, cobalt, copper, and gold recovery from waste streams because of their increasing usage in the modern world. The government supports sustainable waste management through policies which enforce recycling and EPR programs for resource recovery. The United States, together with Canada, dedicate funds to develop advanced recycling systems through public-private sector partnerships. These secure domestic supply chains. North America leads the worldwide urban mining market because of its dedication to circular economy principles.

Asia Pacific Urban Mining Market Trends

The Asia Pacific urban mining market is growing significantly because of growing urban areas, increasing electronic device usage, and rising electronic waste and construction waste materials. China, Japan, South Korea, and India lead the collection of gold, copper, lithium, and rare earth elements from discarded electronics and infrastructure because they need these valuable resources. Environmental regulations that become stricter, along with government programs supporting circular economy models and increasing concerns about resource scarcity, create the primary factors that drive this growth. Research and development investments in recycling technology and material recovery systems have brought about improvements in both processing cost-effectiveness and operational efficiency. The Asia Pacific region has become the main centre for urban mining because sustainable resource management needs have expanded worldwide.

Key Urban Mining Companies:

The following are the leading companies in the urban mining market. These companies collectively hold the largest market share and dictate industry trends.

- Boliden Group

- Umicore

- ExxonMobil Corporation

- Chevron Corporation

- Materion Corporation

- The Royal Mint

- Excir

- Johnson Matthey

- Dow

- Urban Mining Company (UMC)

- Others

Recent Development

- In October 2024, to collect vital elements from discarded electronics and automotive trash, Elemental Holdings strengthened its global network and expanded its urban mining activities, putting it at the forefront of key metals recycling. By providing industrial customers with essential metals like lithium, cobalt, and platinum group metals, the company's strategic initiatives directly supported the expansion of the clean energy and electric car industries.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the urban mining market based on the below-mentioned segments:

Global Urban Mining Market, By Material

- Precious Metals

- Non-Precious Metals

- Other Metals

Global Urban Mining Market, By Waste Type

- E-Waste

- Construction & Demolition

- Others

Global Urban Mining Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 234 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |