Global Urology Supplements Market

Global Urology Supplements Market Size, Share, and COVID-19 Impact Analysis, By Type (Multi ingredient, and Single ingredient), By Formulation (Capsules, Softgels, Tablets, Powder, and Others), By Distribution Channel (Brick & mortar, and E-commerce), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

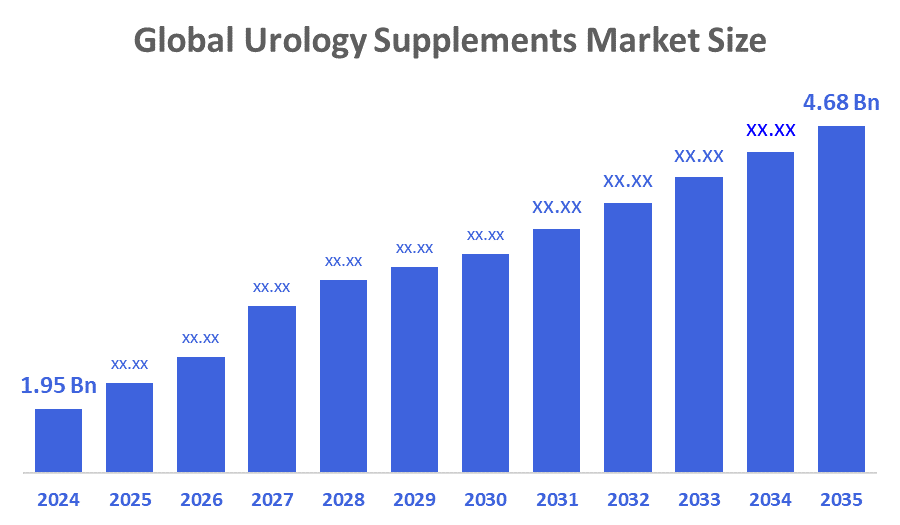

Global Urology Supplements Market Size Insights Forecasts to 2035

- The Global Urology Supplements Market Size Was Estimated at USD 1.95 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.28% from 2025 to 2035

- The Worldwide Urology Supplements Market Size is Expected to Reach USD 4.68 Billion by 2035

- North America is expected to Grow the fastest during the forecast period.

According to a Research Report Published by Decisioins Advisors and Consulting, The Global Urology Supplements Market Size was worth around USD 1.95 Billion in 2024 and is predicted to Grow to around USD 4.68 Billion by 2035 with a compound annual growth rate (CAGR) of 8.28% from 2025 to 2035. The market is anticipated to grow due to the rising need for safe and efficient substitutes for conventional drugs. Growing prostate health issues, urinary diseases, self-care awareness, e-commerce platform accessibility, desire for natural ingredients, and preventative healthcare acceptance are driving the market.

Market Overview

The urology supplements market comprises several products geared towards the maintenance of urinary tract health, prostate health, as well as general urological health. Such products may be dietary supplements, herbal medicines, vitamins, minerals, and other nutritional formulations that are specially designed to help with urological problems. Depending on the urological condition to be treated or managed, urology supplement products may be designed for different target groups like men, women, and elderly people. For instance, prostate health supplements are mostly aimed at elderly men, whereas urinary tract health products can be used by a wider range of consumers. The urology supplements industry is gaining popularity at a faster pace as a result of the growing kidney problems in the health sector of the global market. Urology is the branch of medicine that is concerned with the urinary tract, urinary bladder, kidney, ureters, and urethra. Greater access to healthcare facilities, along with increasing government efforts to promote healthcare services for several diseases, is resulting in the increased demand for healthcare supplements. The market growth is being positively impacted by the players' strategic expansion moves.

Asia Healthcare Holdings (AHH) announced in August 12, 2025, that it will invest ?400 crore in the Asian Institute of Nephrology and Urology (AINU) to double its hospital network over the next 4–5 years, focusing on Tier-2 cities such as Patna and Bhubaneswar. This brings AHH’s total commitment to AINU to ?1,000 crore by FY30, making it one of India’s largest single-speciality hospital investments.

Cook Medical officially announced a strategic investment in Zenflow, backing its minimally invasive device for urinary obstruction caused by enlarged prostate (benign prostatic hyperplasia, BPH). This investment strengthens Cook’s urology portfolio and supports Zenflow’s efforts to bring its Spring System to market. F-Prime Capital, Medical Technology Venture Partners, Invus Opportunities, and other current investors participated in Zenflow's US$24 million series C financing round.

Report Coverage

This research report categorises the urology supplements market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the urology supplements market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the urology supplements market.

Driving Factors

The rise in occurrences of urological disorders, which include benign prostatic hyperplasia, urinary tract infections, and kidney stones, especially in elderly populations, is creating a strong necessity for supportive supplementation. Ageing population trends in developed countries are driving the need for products that support prostate health and urinary function. The growing use of online retail platforms is helping supplement manufacturers to communicate directly with their customers, give comprehensive product education, and personalise recommendations. E-commerce platforms provide the ease of shopping, detailed information about ingredients, and customer feedback, all play a role in purchasing decisions. Digital marketing tactics and partnerships with healthcare professionals are generating brand recognition and product usage, in particular, among consumers who are very careful about their health and prefer to use supplements based on research. Bigger pharmaceutical, healthcare, and wellness firms are working with or purchasing speciality supplement brands in order to broaden their product offerings, penetrate new markets, and take advantage of well-established distribution networks.

Restraining Factors

Limited clinical validation, regulatory obstacles, safety concerns, and competition from traditional medications are the primary problems limiting the market for urology supplements. Further, cell and gene therapies do not require oral tablets or liquid supplements; their increasing usage in treating many disorders is projected to restrict the market for urology supplements.

Market Segmentation

The urology supplements market share is classified into type, formulation, and distribution channel.

- The multi ingredient segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

Based on the type, the urology supplements market is divided into multi ingredient, and single ingredient. Among these, the multi ingredient segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. In single dosage forms, multi-ingredient formulations provide all-encompassing support for kidney health, prostate health, and urinary tract function. Customers are becoming more aware of the synergistic advantages of mixing several active substances that concurrently target different aspects of urological health.

- The capsules segment accounted for the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the formulation, the urology supplements market is segmented into capsules, softgels, tablets, powder, and others. Among these, the capsules segment accounted for the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. One of the easiest ways to take supplements is in capsule form. They are more palatable to customers than other forms like pills or powders since they are easy to swallow and don't have a strong taste or odour. This is due to they are so simple to use, and capsules are quite popular among customers, which helps them dominate the market.

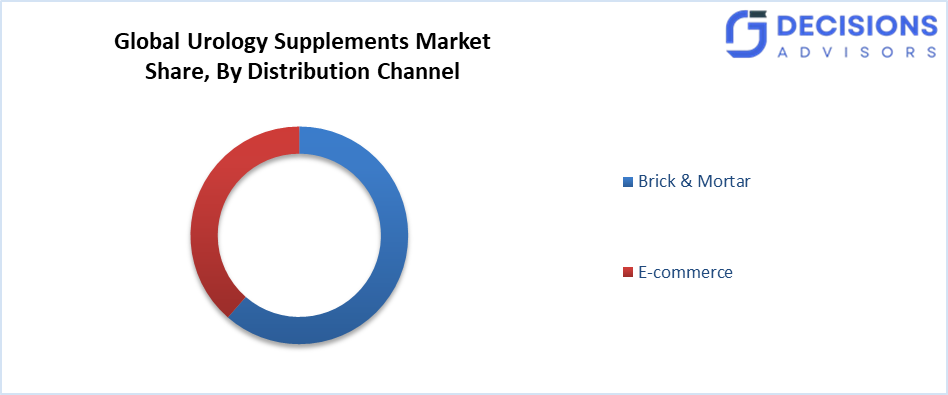

- The brick & mortar segment dominated in 2024 and is projected to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the urology supplements market is differentiated into brick & mortar, and e-commerce. Among these, the brick & mortar segment dominated in 2024 and is projected to grow at a significant CAGR during the forecast period. This segment still holds a great share in the market as consumers continue to prefer having stores physically accessible to them, where they can see and touch the products before buying. A visit to Pharmacies, health stores, or supermarkets can get you direct consultation with pharmacists or the store personnel, which in turn builds consumer trust and helps them make informed decisions. Furthermore, this sector experienced the advantage of a well-established retail infrastructure and a returning customer base, mostly senior citizens, who are more likely to use urological supplements.

Regional Segment Analysis of the Urology Supplements Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the urology supplements market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the urology supplements market over the predicted timeframe. Demographic shifts, lifestyle changes, as well as altered healthcare priorities have led to strong growth in the Asia Pacific urology supplements market. The rapid ageing of the population in countries like Japan, South Korea, China, and India has resulted in a higher occurrence of urological diseases, including benign prostatic hyperplasia, urinary tract infections, and kidney-related problems, thus driving the demand for preventive and supportive supplements. The increase in health consciousness and the emphasis on preventive healthcare have led consumers to choose nutraceutical products for maintaining their urinary, prostate, and kidney health. Moreover, the development of modern retail sectors along with the rapid growth of e, e-commerce and digital health platforms has significantly increased the availability of products even in semi-urban and remote areas, thus facilitating extensive market penetration.

Morgan Stanley Private Equity Asia invested in an Indian urology hospital chain, signalling a stronger push into the country’s healthcare sector. The deal highlights growing investor interest in speciality care, particularly urology, where rising demand from ageing populations and lifestyle-related conditions is creating attractive opportunities.

North America is expected to grow at a rapid CAGR in the urology supplements market during the forecast period. The U.S. market is largely influenced by the increasing occurrence of urological health problems, especially in the middle-aged and elderly groups. Cases like benign prostatic hyperplasia, urinary tract infections, and kidney disorders have resulted in the need for highly specific dietary supplements to support urinary and prostate health. Increasing awareness among consumers about preventive healthcare and wellness lifestyles has been a major factor behind the surge in the adoption of nutraceuticals. The U.S. is powered by highly developed research and development and therefore sees a large number of companies offering clinically validated formulations including multi, ingredient and single-ingredient products. The FDA make sure that manufacturing and labelling are standardised, which in turn increases the consumer's trust.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the urology supplements market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Amway

- Better Being

- Biotexlife

- dsm-firmenich

- Himalaya Wellness

- Natrol

- Nature's Bounty

- Nestlé

- NOW Foods

- Puritan's Pride

- Solaray

- Szio+

- Theralogix

- ZAHLER

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2026, Uqora® launched Flush Advanced+ as a science-backed supplement designed to reduce the risk of recurrent urinary tract infections (UTIs) in healthy women. It is now available online at Uqora.com. Flush Advanced+'s hero ingredients, d-mannose and whole-fruit cranberry powder, are designed with dual-action anti-adhesion activity. They bind to harmful germs and aid in their removal from the urinary system in different but complementary ways.

- In December 2025, the FDA approved Blujepa (gepotidacin) oral tablets for the treatment of uncomplicated urogenital gonorrhea in patients aged 12 years and older, marking the first new oral antibiotic option for gonorrhea in decades. A 750 mg pill of Lujepa is provided. Patients with uncomplicated urogenital gonorrhea should take 3000 mg (four 750 mg tablets) orally, followed by another dose of 3000 mg (four 750 mg tablets) around 12 hours later.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the urology supplements market based on the below-mentioned segments:

Global Urology Supplements Market, By Type

- Multi ingredient

- Single ingredient

Global Urology Supplements Market, By Formulation

- Capsules

- Softgels

- Tablets

- Powder

- Others

Global Urology Supplements Market, By Distribution Channel

- Brick & mortar

- E-commerce

Global Urology Supplements Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

- What is the current size and projected growth of the global urology supplements market?

The market was valued at USD 1.95 billion in 2024 and is expected to reach USD 4.68 billion by 2035, growing at a CAGR of 8.28% from 2025 to 2035.

- What are the main drivers behind the market's growth?

Rising urological disorders like benign prostatic hyperplasia, urinary tract infections, and kidney stones—especially in ageing populations—fuel demand. Increased awareness of preventive healthcare, preference for natural ingredients, and e-commerce accessibility also boost the market.

- Which segment leads by type, and why?

Multi-ingredient supplements dominated in 2024 and are projected to grow fastest. They offer comprehensive support for prostate, kidney, and urinary health through synergistic ingredients targeting multiple issues.

- What formulation holds the largest market share?

Capsules led in 2024 with significant projected growth. They are easy to swallow, tasteless, and odourless, making them more consumer-friendly than tablets or powders.

- Which distribution channel is dominant?

Brick & mortar (pharmacies, health stores) held the top share in 2024 and will grow steadily. Consumers value in-person advice from pharmacists and the ability to inspect products, especially older users.

- Which region will have the largest market share?

Asia-Pacific is expected to dominate due to rapid ageing in countries like Japan, China, and India, rising health consciousness, and expanded retail/e-commerce access in urban and remote areas.

- Who are some key players in the market?

Major companies include Amway, Himalaya Wellness, Nature's Bounty, NOW Foods, Nestlé, Puritan's Pride, and Theralogix, alongside recent innovators like Uqora for UTI supplements.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 245 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |