Global Vascular Access Device Market

Global Vascular Access Device Market Size, Share, and COVID-19 Impact Analysis, By Product (Peripheral Vascular Access Devices, and Central Vascular Access Devices), By Application (Drug Administration, Fluid And Nutrition Administration, Blood Transfusion, Diagnostic Testing, And Other Applications), By End Use (Hospitals and clinics, Ambulatory surgical centers, Homecare settings, and Other end user), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

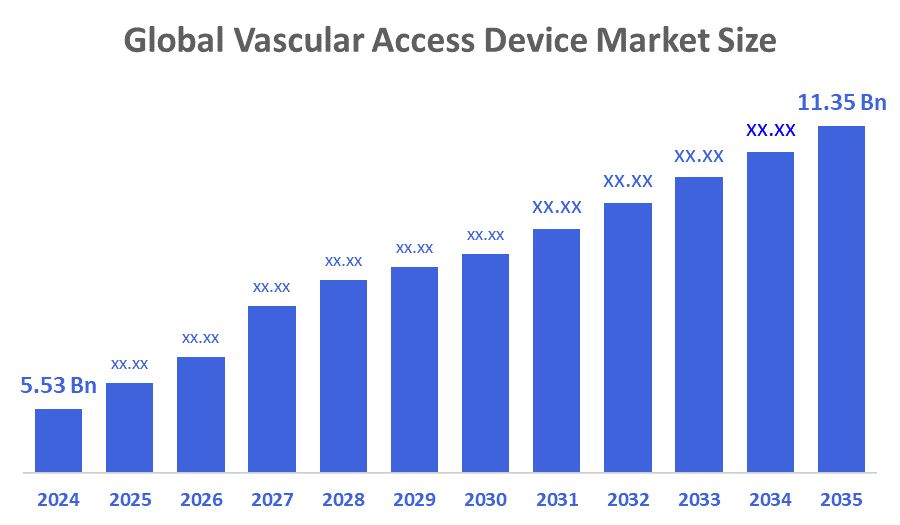

Global Vascular Access Device Market Size Insights Forecasts to 2035

- The Global Vascular Access Device Market Size Was Estimated at USD 5.53 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.76 % from 2025 to 2035

- The Worldwide Vascular Access Device Market Size is Expected to Reach USD 11.35 Billion by 2035

- Europe is expected to grow the fastest during the forecast period.

According to a research report published by Decisions Advisors and Consulting, The Global Vascular Access Device Market Size Was Worth Around USD 5.53 Billion In 2024 And Is Predicted To Grow To Around USD 11.35 Billion By 2035 With A Compound Annual Growth Rate (CAGR) Of 6.76 % From 2025 To 2035. The increasing prevalence of chronic diseases such as cancer, kidney failure, and cardiovascular diseases worldwide which needs the use of vascular access devices. The World Health Organisation (WHO) projected 20 million new cases of cancer and 9.7 million deaths in 2022. Patients in oncology have long intravenous treatments such as chemotherapy, dialysis, and antibiotic administration, thus requiring a reliable vascular access.

Market Overview

The Global Vascular Access Device Market Size is basically the industry that includes all those medical devices that have been designed specifically for providing a patient's vascular system. This is done for different purposes such as drug administration, fluid delivery, and blood sampling. These devices, which are mainly catheters, ports, and needles, are widely used in different healthcare settings, such as hospitals, clinics, and home care. Vascular access devices (VADs) are medical instruments employed for ensuring dependable access to a patients Veins for the purpose of delivering fluids, medications, blood products, or for drawing blood samples. They comprise a variety of instruments such as peripheral intravenous (IV) catheters, central venous catheters (CVCs), peripherally inserted central catheters (PICCs), and implantable ports. Depending on the duration of the treatment and the clinical conditions, VADs are highly significant in the management of both acute and chronic conditions, thus offering efficient therapy and reduction of repeated needle pricks. Besides that, ongoing technological developments such as the creation of more reliable, user-friendly, and safer devices are also playing a part in the market expansion. Vascular access device (VAD) market trends, for example, the transition to home healthcare, concentration on infection prevention, and the rising demand.

Access Vascular, Inc. (AVI) closed a $22 million Series C financing round to expand production of its MIMIX hydrophilic biomaterial vascular access devices, accelerate R&D, and broaden its product portfolio. The funding comes from a consortium of new and existing investors and will help scale solutions aimed at reducing catheter-related complications.

Report Coverage

This research report categorises the vascular access device market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the vascular access device market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the vascular access device market.

Driving Factors

The growing elderly population worldwide, along with the increasing incidence of cancer and other chronic, cardiovascular, respiratory, and metabolic diseases are likely to raise the number of patients in need of vascular access devices during their treatment. The rising adoption of PICC, CVC, and dialysis catheters was driven by an increased demand for vascular access devices used in the treatment and management of chronic and its related patients. Besides, the market is also being driven by the awareness of healthcare institutions of the high costs of complications related to catheters. Clinical studies have revealed that incorrect handling and maintenance of vascular access devices can lead to serious complications. Moreover, the major manufacturers can differentiate their offerings for the end user and develop brand loyalty by providing online or in-person training sessions. Besides, home-based treatment processes are contributing significantly to the market as a result of rising value, based care emphasis. PICCs and implantable ports are examples of devices that enable patients to receive intravenous therapy in the outpatient or home setting, thus decreasing hospital admissions.

Restraining Factors

The vascular access devices market is hampered by a few restraining factors that directly limit the widespread usage of these devices in hospitals and clinics despite the strong demand. Infection risk, high costs, and regulatory hurdles are the major concerns pointed out by the critics in this field.

Market Segmentation

The vascular access device market share is classified into product, application, and end use.

- The central vascular access devices segment accounted for the largest market share in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

Based on the product, the vascular access device market is divided into peripheral vascular access devices and central vascular access devices. Among these, the central vascular access devices segment accounted for the largest market share in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. Central vascular access devices are very important in repeated or continuous infusion administrations, particularly in cancer therapy. The global increase in cancer patients and chemotherapy usage as a major treatment method has resulted in a high demand for tunnelled catheters, implantable ports, and PICCs. There have been tremendous advances made towards CVADs safety profiles through product innovations such as antimicrobial coatings, anti-thrombogenic materials, and closed system connectors.

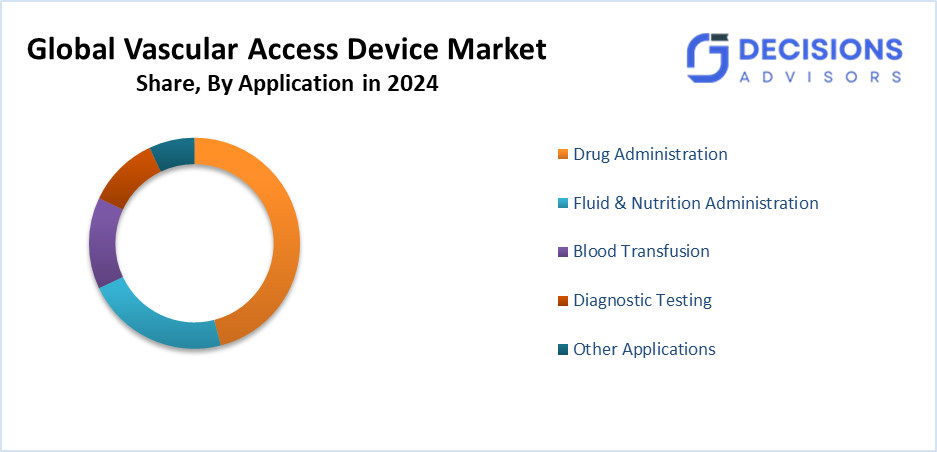

- The drug administration segment accounted for the highest revenue share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

Based on the application, the vascular access device market is divided into drug administration, fluid and nutrition administration, blood transfusion, diagnostic testing, and other applications. Among these, the drug administration segment accounted for the highest revenue share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. This segment is driven by the incidence of chronic illnesses, such as cancer, infectious diseases, autoimmune diseases, and cardiovascular disease needs, such as devices in long-term drug therapy. Continuous or chronic drug infusion for antibiotics, chemotherapy drugs, immunotherapies, and biologics is one of the most common approaches in treatments for these diseases.

- The hospitals and clinics segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end user, the vascular access device market is divided into hospitals and clinics, ambulatory surgical centres, homecare settings, and other end users. Among these, the hospitals and clinics segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The rise in elective and advanced surgical procedures at speciality clinics and hospitals is continually creating the demand for vascular access products. Medical establishments like hospitals and clinics need short-term products such as peripheral IVs and midlines, as well as long-term ones for prolonged recovery periods. Hospitals and clinics are under clinical and regulatory pressures to bring down catheter, related bloodstream infections (CRBSIs) and other complications.

Regional Segment Analysis of the Vascular Access Device Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the vascular access device market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the vascular access device market over the predicted timeframe. The main reasons behind this growth are rapid economic development, increased healthcare expenditure, and the rising number of elderly people. China, India, and Japan, for example, are experiencing a growth in the number of patients suffering from chronic diseases, which, in turn, increases the demand for VADs. Besides that, the market keeps growing due to the betterment in healthcare infrastructure, more people getting access to medical services, and adoption of up, to, date medical technologies. In the case of peripherally inserted central catheters (PICC) and dialysis catheters, their demand is increasing as the population of patients requiring long-term treatments is growing. With healthcare reaching more and more people and the trend of technology adoption going upwards, there is a huge potential for the Asia Pacific market to grow very quickly during the forecast period.

Europe is expected to grow at a rapid CAGR in the vascular access device market during the forecast period. The ageing population and the well-established healthcare systems in countries like Germany, the UK, and France are the major factors contributing to Europe's market share. The increased incidence of chronic diseases such as cardiovascular diseases, diabetes, and cancer has led to the demand for vascular access devices. Besides this, more outpatient procedures and the increase of home healthcare services are making the VADs market more promising in the region. Nonetheless, the European market growth rate is more or less stable when compared to other regions, as the main emphasis is set on the enhancement of the efficiency and safety of vascular access technologies. Moreover, the European market is also affected by the regulatory frameworks that are meant to ensure that medical devices meet high standards. This has an effect on the introduction and the use of new VADs in the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the vascular access device market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Access Vascular, Inc.

- AngioDynamics

- B. Braun

- BD

- Cook Medical

- Cook Medical

- Medical Components, Inc.

- Medtronic

- Smith’s Medical (ICU Medical, Inc)

- Teleflex Medical

- Terumo Medical Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2025, PatenSee received FDA Breakthrough Device Designation for its non-contact vascular access management technology, designed to improve monitoring and outcomes for patients undergoing hemodialysis. This designation accelerates regulatory review and adoption of the company’s AI-driven optical monitoring system.

- In November 2024, Xeltis received FDA Breakthrough Device Designation for its aXess™ vascular access conduit and has already treated the first patient in its U.S. pivotal trial. This milestone positions aXess as a potentially transformative option for hemodialysis patients requiring long-term vascular access.

- In November 2023, BD (Becton, Dickinson and Company) launched the SiteRite™ 9 Ultrasound System, designed to improve clinician efficiency and first-attempt success rates in vascular access procedures such as PICCs, central venous catheters, and IV lines. The system received FDA 510(k) clearance in September 2023 and is now commercially available in the U.S.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the vascular access device market based on the below-mentioned segments:

Global Vascular Access Device Market, By Product Type

- Peripheral Vascular Access Devices

- Central Vascular Access Devices

Global Vascular Access Device Market, By Application

- Drug Administration

- Fluid And Nutrition Administration

- Blood Transfusion

- Diagnostic Testing

- Other Applications

Global Vascular Access Device Market, By End User

- Hospitals and clinics

- Ambulatory surgical centres

- Homecare settings

- Other end user

Global Vascular Access Device Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

- What is the current size of the global vascular access device market?

It was valued at USD 5.53 billion in 2024.

- What is the projected market size by 2035?

The market is expected to reach USD 11.35 billion by 2035.

- What is the growth rate of the market?

It is projected to grow at a CAGR of 6.76% from 2025 to 2035.

- Which product segment leads the market?

Central vascular access devices held the largest share in 2024, driven by demand in cancer therapy and long-term infusions.

- What application generates the most revenue?

Drug administration accounted for the highest share in 2024, fueled by chronic disease treatments like chemotherapy.

- Which end-user segment is dominant?

Hospitals and clinics led revenue in 2024, due to high surgical volumes and the need for both short- and long-term devices.

- Which region will grow the fastest?

Europe is expected to grow at the fastest CAGR, supported by ageing populations and advanced healthcare systems.

- Who are some key players in the market?

Major companies include BD, Medtronic, Teleflex, B. Braun, AngioDynamics, and Access Vascular, Inc.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 230 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Feb 2026 |

| Access | Download from this page |