Global Veterinary Services Market

Global Veterinary Services Market Size, Share, and COVID-19 Impact Analysis, By Animal Type (Companion Animals, Production Animals), By Service Type (Medical Services, Non-Medical Services), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035.

Report Overview

Table of Contents

Veterinary Services Market Summary

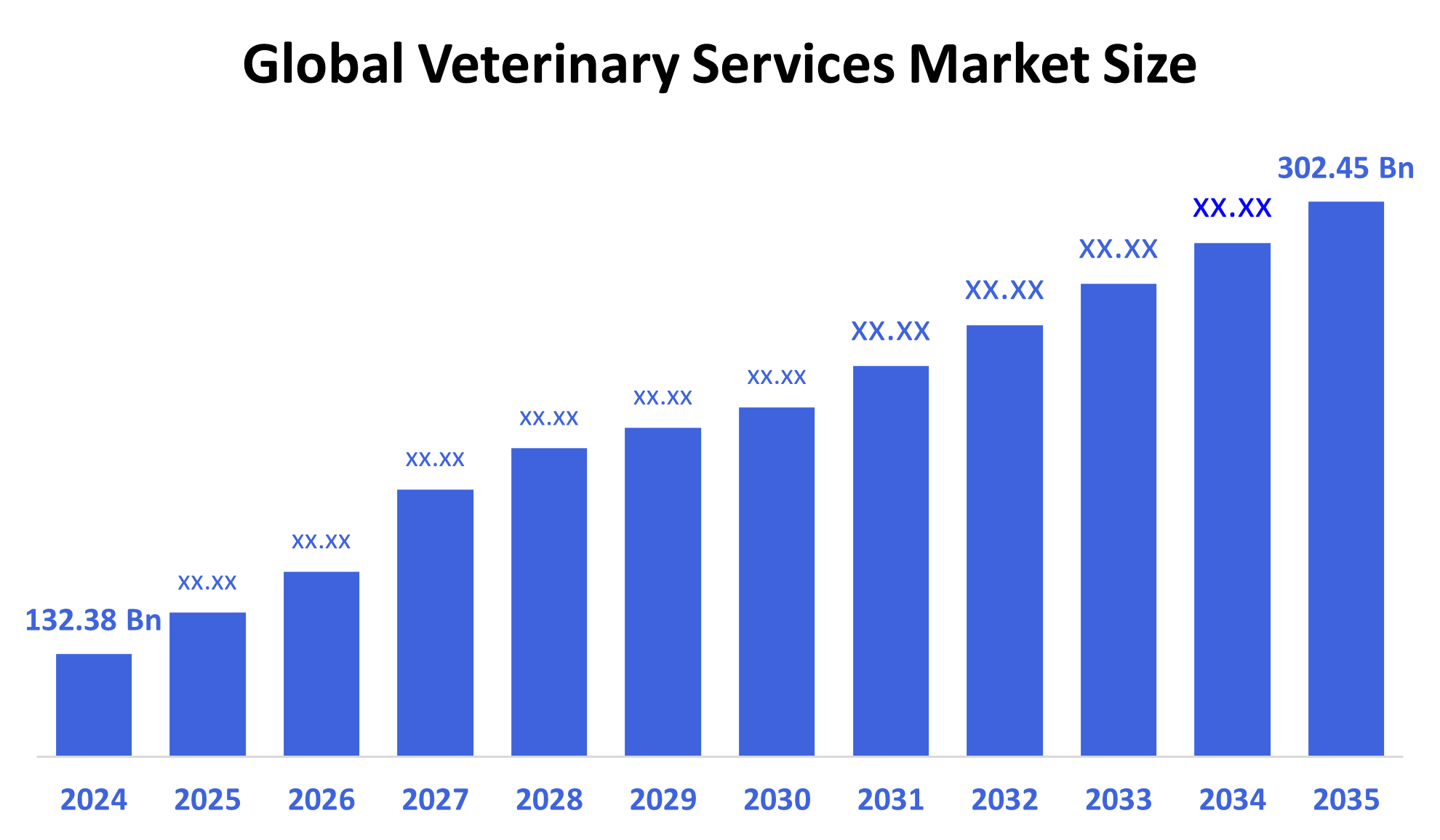

The Global Veterinary Services Market Size Was Estimated at USD 132.38 Billion in 2024 and is Projected to Reach USD 302.45 Billion by 2035, Growing at a CAGR of 7.8% from 2025 to 2035. The market for veterinary services is expanding due to several important factors, such as the growing humanization of pets and the rise in pet ownership, the emphasis on preventative care, the development of veterinary technology and diagnostics, the rising demand for animal protein, and the growing knowledge of zoonotic diseases and how they affect human health.

Key Regional and Segment-Wise Insights

- In 2024, North America held the greatest revenue share of 35.72%, dominating the veterinary services market.

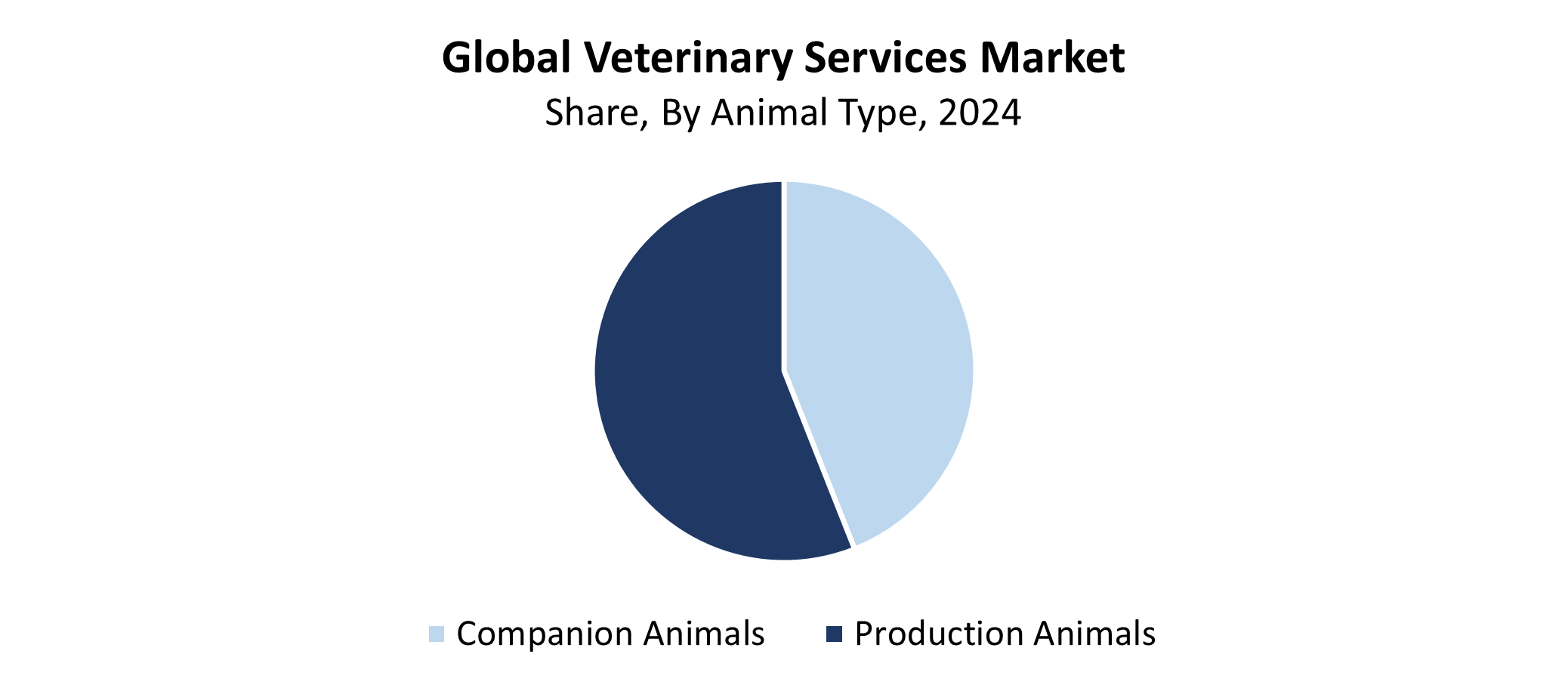

- With the highest revenue share of 56.35% in 2024, the production animals segment dominated the market by animal type.

- With the highest revenue share of 69.37% in 2024, the medical services segment dominated the market by service type.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 132.38 Billion

- 2035 Projected Market Size: USD 302.45 Billion

- CAGR (2025-2035): 7.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The veterinary service market provides an extensive range of animal medical and healthcare solutions, which include emergency care, treatment, diagnostics, prevention, and surgery for pets and livestock. The veterinary industry expands because of increasing pet ownership, alongside improved understanding of animal health together with rising requirements for advanced veterinary care. The worldwide population growth creates rising food demand, which drives the livestock industry expansion, leading to increased veterinary service requirements. The market growth stems mainly from elevated zoonotic disease prevalence alongside escalating pet healthcare expenses. Urbanization, together with changing lifestyles, has led to more people getting pets, which drives the need for superior veterinary care services.

The veterinary services industry experiences a major transformation through technological innovations, which include wearable health monitors and robotic-assisted surgeries and telemedicine, and advanced diagnostic tools. The application of AI for diagnostic tools, along with digital record-keeping systems, makes medical treatments more precise and effective. Veterinary market growth receives support from government programs that provide funding for animal health studies and immunization projects while working to stop animal diseases from spreading. Service quality and accessibility experience growth through regulatory systems that focus on food safety standards and animal healthcare regulations. Veterinary service usage across the world is experiencing growth because of these technological advancements.

Animal Type Insights

The production animals segment holds the largest market share of 56.35% in 2024 and leads the veterinary services market. Veterinary care is essential for maintaining animal health along with production efficiency of sheep, cattle, pigs, and poultry, which makes this category the dominant force. The escalating international need for animal-derived food products demands enhanced medical prevention approaches, along with nutritional management systems and therapeutic solutions for production animals. The market for veterinary services receives a boost because of regulations that focus on animal welfare and food safety standards. Market growth occurs through financial support directed at improving animal health, which results in higher production yields and reduced monetary damages. The production animal group establishes a major influence on the veterinary services market, which sustains its dominance.

The companion animal segment of the veterinary services market is anticipated to grow at the fastest CAGR during the forecast period. The veterinary services industry experiences rapid expansion through increased global pet ownership, combined with rising knowledge about pet health and wellness, and growing pet owner investment in advanced veterinary services. Healthcare prevention initiatives, including vaccination programs and regular medical assessments, together with diagnostic services and specialized treatment, support the segment's expansion. Lifestyle modifications, along with pet humanization trends, drive consumers to invest more in premium veterinary services. The veterinary services industry experiences rapid growth through the companion animals segment because of advanced veterinary technologies, including telemedicine and wearable health monitoring devices for dogs.

Service Type Insights

The medical services segment led the veterinary services market in 2024 by generating the highest revenue share of 69.37%. The extensive healthcare services provided by this sector to companion animals and production animals through diagnosis, treatment, surgery, and preventative care explain its market leadership. The substantial requirement for medical services stems from increasing animal disease rates and the necessity of quick medical treatment, and expanding animal health understanding among the public. Medical advancements in veterinary care, along with better medications and diagnostic tools, lead to more successful treatments, which extend service accessibility. The essential role of medical services in protecting animal welfare and production strengthens the dominant market position of this segment within the veterinary services industry.

The veterinary services market's non-medical services segment is expected to grow at the fastest CAGR throughout the projection period. The growing trend of pet humanization translates into rising demand for grooming, training, boarding, and pet daycare services. The demand for non-medical services continues to increase because pet owners need holistic care beyond medical treatment. The rising disposable income and changing lifestyles of consumers support this market expansion. Technology implementation through online booking platforms and mobile grooming applications provides better access and convenience to customers. The non-medical services segment of veterinary services will expand rapidly because pet owners increasingly emphasize total care for their animals.

Regional Insights

In 2024, North America led the veterinary services market by holding the largest revenue share of 35.72%. The region leads because of its high pet ownership numbers as well as increasing public awareness about animal health and advanced veterinary facilities. The market growth stems primarily from increasing demand for specialized veterinary services, including surgery alongside diagnostics and preventative care. Strong business support comes from government restrictions and widespread advanced technologies like digital diagnostics and telemedicine, and an extensive network of hospitals and veterinary clinics. The leading position of this region is strengthened through expanding investments in both cattle production and companion animal health services. The world continues to see North America as the leading provider of veterinary services because of its advanced healthcare system, combined with continuous innovation.

Europe Veterinary Services Market Trends

The European veterinary services market grows significantly because pet ownership expands and people become more aware of animal health and welfare. The veterinary market sees rising patient numbers of both pets and livestock for their diagnostic and preventive care and specialized medical services. Market growth receives additional support from stringent regulations about food safety and animal welfare, particularly in Western and Northern European countries. Technological progress in veterinary services advances both quality and effectiveness through telemedicine and digital diagnostics, and electronic health records. The veterinary services market experiences growth due to government initiatives that focus on enhanced animal welfare, sustainable farming practices, and disease control measures. The European veterinary services market remains a leading and growing sector worldwide because of its strong healthcare infrastructure and animal protection initiatives.

Asia Pacific Veterinary Services Market Trends

The veterinary services market in the Asia Pacific region is anticipated to grow at the fastest rate during the forecast period because of rising pet ownership and increased animal production, alongside a better understanding of animal health and welfare. The demand for companion animal veterinarian services continues to rise because people lead different lives and cities grow quickly, while earnings increase. The meat and dairy industries, expanding their production capacities through increased animal husbandry efficiency and disease control measures, drive the need for veterinary services in production animals. The market speed increases because of technological breakthroughs alongside the growing acceptance of present-day veterinary methods. Government initiatives supporting sustainable livestock management alongside animal health improvement and zoonotic disease control push the sector's expansion forward.

Key Veterinary Services Companies:

The following are the leading companies in the global veterinary services market. These companies collectively hold the largest market share and dictate industry trends.

- CVS Group Plc

- PetSmart LLC

- Fetch! Pet Care

- Mars Incorporated

- IVC Evidensia

- Pets at Home Group PLC

- A Place for Rover, Inc.

- National Veterinary Associates

- Greencross Vets

- Airpets International

- Others

Recent Developments

- In September 2025, to simplify veterinary diagnostics, SignalPET unveiled SignalPET 360°, a complete radiology solution. In one system, the platform combines board-certified radiologists' 24/7 availability, AI-powered instant triage, and a Complete AI Report that is based on radiologist reports.

- In May 2025, Global animal health business Vetanco teamed up with Saudi Arabia's Arasco through its veterinary division, Al-Emar International, which was given the sole right to distribute Vetanco's portfolio in Saudi Arabia.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the veterinary services market based on the below-mentioned segments:

Global Veterinary Services Market, By Animal Type

- Companion Animals

- Production Animals

Global Veterinary Services Market, By Service Type

- Medical Services

- Non-Medical Services

Global Veterinary Services Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |