Global Video As A Service Market

Global Video As A Service Market Size, Share, and COVID-19 Impact Analysis, By Application (Corporate Communications, Training and Development, Marketing and Client Engagement, Broadcast Distribution, Content Creation and Management, Others), By Vertical (BFSI, Healthcare and Life Sciences, Retail and E-commerce, IT and Telecom, Education, Government and Public Sector, Media and Entertainment, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

Video As A Service Market Summary

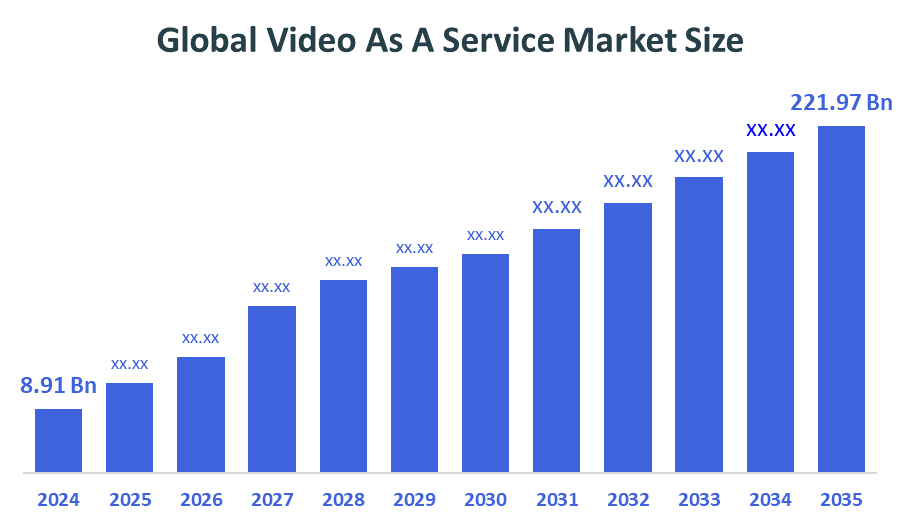

- The Global Video As A Service Market Size Was Estimated at USD 8.91 Billion in 2024 and is Projected to Reach USD 221.97 Billion by 2035, Growing at a CAGR of 33.95% from 2025 to 2035.

- Rising demand for remote communication, increasing cloud adoption, enhanced video quality, cost-effective solutions, growing need for real-time collaboration, and expanding use in sectors like education, healthcare, and enterprise drive Video As A Service market growth.

Key Regional and Segment-Wise Insights

- In 2024, North America held the largest revenue share of over 37.7% and dominated the market globally.

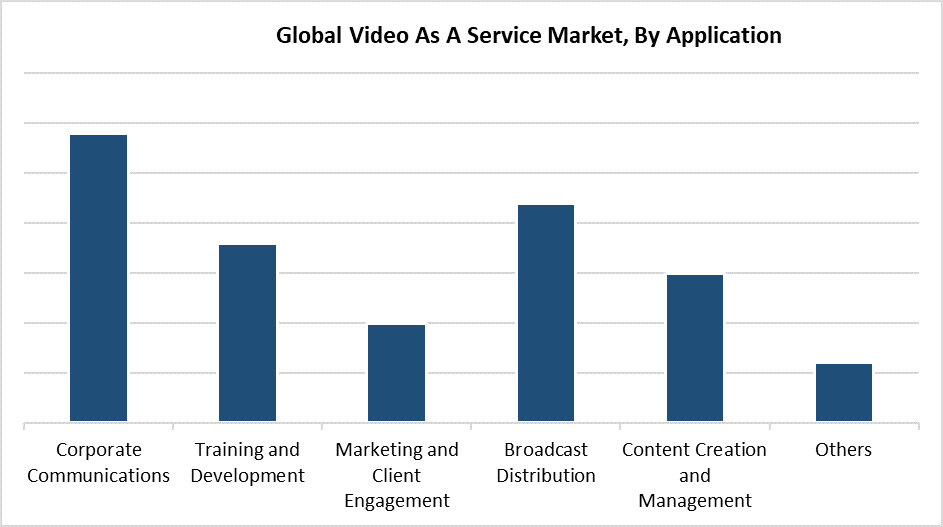

- In 2024, the corporate communications segment had the highest market share by application, accounting for 29.4%.

- In 2024, the education segment had the biggest market share by vertical.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 8.91 Billion

- 2035 Projected Market Size: USD 221.97 Billion

- CAGR (2025-2035): 33.95%

- North America: Largest market in 2024

The Video as a Service (VaaS) market includes cloud-based video solutions that enable businesses to operate and broadcast video content through remote hosting without needing physical equipment at their facilities. Multiple industries heavily depend on these services for their internal communication needs and marketing initiatives, as well as training activities and webinars, and video conferencing. The Video as a Service market experiences growth because organizations need affordable, scalable video solutions and hybrid work environments, and increasing remote collaboration requirements. The adoption of VaaS by companies continues to increase as it helps organizations enhance their communication systems while reducing travel expenses and streamlining operational activities. The corporate educational and governmental sectors experience powerful market expansion because e-learning solutions and virtual events, and online customer engagement strategies continue to develop.

The VaaS market experiences major changes because of recent technological developments. Artificial intelligence, together with machine learning, enhances personalized content delivery systems and automatic transcription capabilities, and video analytics tools. The deployment of 5G networks reduces latency while enhancing video quality, which enables smoother real-time communication. Scalability, together with performance, receives additional improvements when edge technologies combine with cloud computing systems. Governments support digital transformation through investments in broadband infrastructure and their promotion of remote work and education-friendly policies. The widespread adoption of VaaS becomes possible through initiatives that enhance digital access and security while concentrating on emerging nations.

Application Insights

The corporate communications segment dominated the Video as a Service (VaaS) market with 29.4% revenue share in 2024. The expanding need for efficient business communication both internally and externally within organizations, especially in remote and hybrid work environments, drives this substantial market dominance. Organizations employ VaaS platforms to deliver stakeholder communications and conduct training sessions and host town halls, and hold virtual meetings because these platforms drive better engagement and increased productivity. Businesses now achieve operational continuity across dispersed teams because of the growing requirement for high-quality real-time video communication solutions. Businesses choose VaaS solutions as their preferred option to improve collaboration because these platforms offer affordable pricing models along with scalable deployment capabilities and simple infrastructure requirements.

Throughout the forecast period, the broadcast distribution segment within the Video as a Service (VaaS) market will expand significantly because of rising cloud-based video delivery needs, which will generate a notable compound annual growth rate (CAGR). Media businesses and broadcasters adopt VaaS platforms to distribute content through live and on-demand channels and devices while maintaining low latency and high dependability. The shift from traditional broadcasting to digital streaming has accelerated this trend because viewers demand flexible on-the-go viewing experiences. The quality and efficiency of video dissemination improve due to ongoing enhancements in content delivery networks (CDNs) and adaptive bitrate streaming and video compression technologies. Broadcast distribution stands to experience major expansion because content consumption continues to increase.

Vertical Insights

The education segment led the Video as a Service (VaaS) market and accounted for the largest revenue share in 2024. The primary reason behind this revenue growth stems from the widespread adoption of online and hybrid learning approaches within educational training facilities and academic institutions, including colleges and universities. Educational institutions deploy VaaS platforms to deliver recorded classes and real-time lectures as well as virtual classrooms and interactive learning sessions for students across all global locations. Remote education demands have caused the market to increase its demand for video solutions that offer flexibility and scalability at affordable prices. The market position of VaaS has solidified through its cloud storage capabilities combined with real-time collaboration and LMS integration features, which now serve as essential components for modern educational practices.

During the forecasted period, the media and entertainment segment of the Video as a Service (VaaS) market will demonstrate the growth at fastest CAGR. The fast shift between traditional media distribution and digital and over-the-top (OTT) streaming platforms drives this market growth. Content creators, together with broadcasters, utilize VaaS solutions to deliver live streaming and video-on-demand services while expanding their worldwide reach at reduced infrastructure expenses. The increasing demand for premium on-demand video content across mobile and connected devices drives faster adoption rates. Improvements in cloud computing technology, together with AI-powered content recommendation systems and 4K and 8K video support, enhance user experiences. The media and entertainment sector drives the expansion of the VaaS business through these technological advancements.

Regional Insights

North America led the global video as a service (VaaS) market with the largest revenue share of 37.7% during 2024. The region's sophisticated IT infrastructure, widespread use of cloud-based solutions, and robust presence of significant VaaS providers are all factors contributing to this supremacy. Companies across all sectors have rapidly adopted remote work while using video for business needs, which has caused VaaS demand to surge. The VaaS platform serves multiple industries, including media & entertainment, healthcare, and education, by enabling real-time information delivery and collaboration tools. North America maintains its leading position in the global VaaS market because of both government backing for digital transformation initiatives and extensive internet connectivity throughout the region.

Europe Video As A Service Market Trends

The European video as a service (VaaS) market continues to grow significantly because of the fast digital transformation that various sectors undergo, including media, corporate healthcare, and education. Businesses increasingly adopt cloud-based video solutions for distributing online content while supporting remote work and virtual educational platforms. The market experiences rapid growth because flexible communication tools have a rising demand and 5G implementation, as well as high-speed internet infrastructure improvements. The secure adoption of VaaS platforms receives support through strong cybersecurity and data protection laws, which form the foundation for safe platform use. International cooperation and digital infrastructure development programs implemented by governments play a major role in driving the fast acceleration of market adoption. The European region has established itself as a major force within the worldwide VaaS market.

Asia Pacific Video As A Service Market Trends

The Asia Pacific Video as a Service (VaaS) market will grow at a significant CAGR because of rising remote communication needs and expanding internet accessibility and digital adoption. Organizations from China, India, Japan, and South Korea swiftly integrate VaaS solutions into their corporate and media, and educational sectors. The market grows because companies shift to hybrid work environments and educational services expand online, and video content becomes more popular. The market growth receives additional support from government initiatives that promote cloud adoption and digital infrastructure development. The Asia Pacific region leads global VaaS market expansion because of its vast population base and growing technological development, and increasing cloud-based communication investments.

Key Video As A Service Companies:

The following are the leading companies in the video as a service market. These companies collectively hold the largest market share and dictate industry trends.

- Adobe

- Zoho Corporation Pvt. Ltd.

- Alphabet, Inc.

- HP Development Company, L.P.

- Avaya, LLC

- GoTo

- RingCentral, Inc.

- Amazon Web Services, Inc.

- Cisco Systems, Inc.

- Zoom Communications, Inc.

- Others

Recent Development

- In October 2024, Cisco unveiled new AI-powered products, such as Webex AI Agent and AI Agent Studio, to improve customer service in the Webex Contact Center. These technologies increase customer happiness and expedite problem-solving by utilizing automation and sophisticated conversational intelligence. The Webex AI Agent is a self-service concierge that expedites resolutions, cuts down on wait times, and responds to consumer questions through natural interaction.

- In September 2024, Zoom Video Communications, Inc. and Mitel announced a strategic partnership to provide enterprises worldwide with a hybrid cloud solution integrating Zoom AI Companion and Zoom Workplace with Mitel's flagship communications platform. This collaboration seeks to meet the increasing demand for hybrid Unified Communications (UC) by offering a solution that combines security and control for critical communications with enhanced collaboration capabilities.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Dicision Advisors has segmented the video as a service market based on the below-mentioned segments:

Global Video As A Service Market, By Application

- Corporate Communications

- Training and Development

- Marketing and Client Engagement

- Broadcast Distribution

- Content Creation and Management

- Others

Global Video As A Service Market, By Vertical

- BFSI

- Healthcare and Life Sciences

- Retail and E-commerce

- IT and Telecom

- Education

- Government and Public Sector

- Media and Entertainment

- Others

Global Video As A Service Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |