Vietnam Hospitality Market

Vietnam Hospitality Market Size, Share, By Type (Chain Hotels And Independent Hotels), By Accommodation Class (Luxury, Mid & Upper-Mid Scale, And Other), By Booking Channel (Direct Digital, OTAs, And Other), And Vietnam Hospitality Market Insights, Industry Trend, Forecasts to 2035.

Report Overview

Table of Contents

Vietnam Hospitality Market Insights Forecasts to 2035

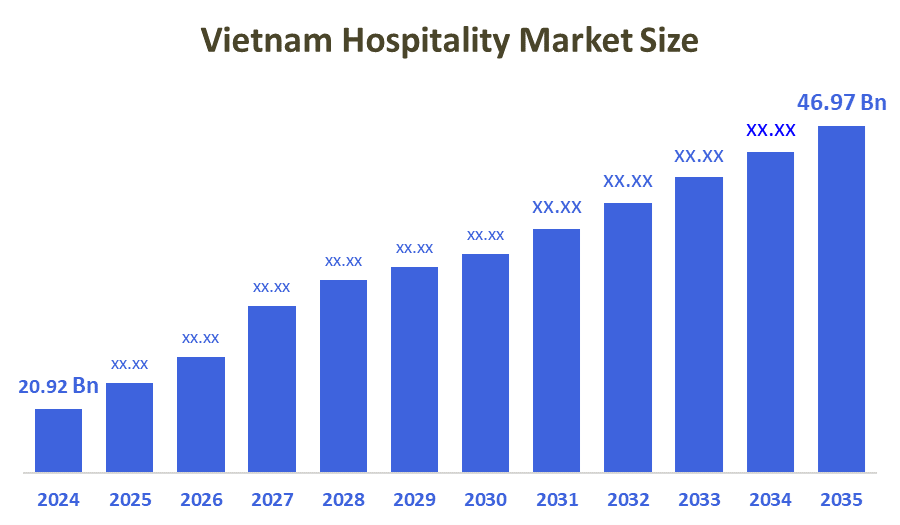

- Vietnam Hospitality Market Size 2024: USD 20.92 Bn

- Vietnam Hospitality Market Size 2035: USD 46.97 Bn

- Vietnam Hospitality Market CAGR 2024: 7.63%

- Vietnam Hospitality Market Segments: Type, Accommodation Class, and Booking Channel

The Vietnam hospitality sector encompasses The industry providing comfort and convenience to guests, tourists and travellers, through providing services to domestic and international customers. The Vietnam Hospitality Market Size is evolving rapidly due to the growth of domestic and international tourism, increasing disposable income levels, enhanced transport infrastructure and government support for tourism through the opening up of visa policies and promoting tourism. In addition, as a result of increasing global investment in the hospitality sector, the rapid growth of digital booking technologies and smart hospitality systems are further driving the demand for and the growth of the hospitality market.

The hospitality in Vietnam are backed by government support, including the implementation of the e-visa extension of an existing program to allow for visa-free travel by many different countries and an expansion of the e-Visa system for foreigners at 83 points of entry, including all major airports common crossings at land and sea will simplify the procedures required to enter Vietnam from several of the neighbouring countries. In the first 8 months of 2025, Vietnam has received almost 14 million foreign tourists, a 21.7% increase year over year, generating total revenues from tourism of VND 707 trillion. The increased accessibility of tourism through improved visa policies has increased the number of guests staying at hotels and resorts and has produced growth within the hospitality industry.

As technology advances, Vietnam hospitality providers now utilize Online Travel Agents (OTAs) as well as mobile booking applications to provide customers with accessibility for travel planning and booking, to collect and store their data for analysis, better prediction and operation, and to implement emerging technologies such as SMART technology in the hospitality industry through mobile check-in, digital concierge, and current emerging technology trends that are benefiting from government digitalization initiatives like IoT, AI, big data, digital payments.

Market Dynamics of the Vietnam Hospitality Market:

The Vietnam hospitality market is driven by the increasing disposable incomes, improved transportation infrastructure, increasing government policy support for tourism through visa-free entry and an increase in investment by international hotel brands, as well as the growing use of digital booking and smart hospitality technologies is also driving increased demand and expansion of the market.

The Vietnam hospitality market is restrained by the lack of infrastructure in emerging markets, lack of skilled labour, the complexity of regulatory & compliance requirements, fluctuations in seasonal demand affecting the stability of occupancy & revenue during off-peak periods, all create barriers to foreign direct investment & direct, functionally efficient expansion.

The future of Vietnam hospitality market is bright and promising, with versatile opportunities emerging from the secondary and new hospitality centres, sustainable, eco-tourism, and increasing growth in the Meetings, Incentives, Conferences, and Exhibitions sector also supports the demand for convention type hotel product and ancillary business services. Additionally, branded residential products are increasingly gaining popularity in the Vietnam hospitality market, which is further supported by an increased number of projects in this segment in the future.

Market Segmentation

The Vietnam Hospitality Market share is classified into type, accommodation class, and booking channel.

By Type:

The Vietnam hospitality market is divided by chain hotels and independent hotels. Among these, the chain hotels segment accounted for the largest revenue market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Strong brand recognition and trust, global reach and distribution increasing occupancy, leveraging technology for efficiency, attracting both International tourists and a growing middle-class seeking reliable, standardized experiences all contribute to the chain hotels segment's largest share and higher spending on hospitality when compared to other type.

By Accommodation Class:

The Vietnam hospitality market is divided by accommodation class into luxury, mid & upper-mid scale, and other. Among these, the luxury segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The luxury segment dominates because of increased international tourism, rising domestic incomes, government focus on high-end experiences, increase demand for unique, quality stays in Vietnam cities, with investors adding more upscale properties, creating a competitive space for brands offering prestige and personalized service.

By Booking Channel:

The Vietnam hospitality market is divided by booking channel into direct digital, OTAs, and other. Among these, the direct digital segment accounted for the highest share in 2024 and is predicted to grow at a significant CAGR during the forecast period. High digital adoption and mobile-first culture, convenience and variety offer unparalleled ease, price comparison, and instant booking, increase in disposable income, and smart technology integration all contribute to the direct digital segment's largest share and higher spending on hospitality when compared to other type.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Vietnam hospitality market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Vietnam Hospitality Market:

- Marriott International

- Accor S.A.

- InterContinental Hotels Group (IHG)

- Hilton Hotels & Resorts

- Hyatt Hotels Corporation

- Wyndham Hotels & Resorts

- Radisson Hotel Group

- Banyan Tree Hotels & Resorts

- Six Senses

- Melia Hotels International

- Best Western Hotels & Resorts

- Oakwood

- Vinpearl

- Muong Thanh Hospitality

- Saigontourist

- Others

Recent Developments in Vietnam Hospitality Market:

In June 2025, InterContinental Hotels Group (IHG), a leading global hospitality company, is expanding in Vietnam through a hotel management agreement with Nha Trang Bay JSC, part of the GreenSpark Group. Opening by late 2024, the voco Scenia Bay Nha Trang, by IHG will be centrally located in Nha Trang. The 250-room, 28-floor property will offer panoramic sea views, meeting the growing demand for premium accommodations in a city known for its beaches, clear waters, and seafood.

In August 2024, Wyndham secured agreements for 120 hotels and commenced operations at 74 properties across the Asia-Pacific region, including the Wyndham Garden Sonasea Van Don in Quang Ninh.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Vietnam, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Vietnam hospitality market based on the below-mentioned segments:

Vietnam Hospitality Market, By Type

- Chain Hotels

- Independent Hotels

Vietnam Hospitality Market, By Accommodation Class

- Luxury

- Mid & Upper-Mid Scale

- Other

Vietnam Hospitality Market, By Booking Channel

- Direct Digital

- OTAs

- Other

FAQ

Q: What is the Vietnam hospitality market size?

A: Vietnam Hospitality Market is expected to grow from USD 20.92 billion in 2024 to USD 46.97 billion by 2035, growing at a CAGR of 7.63% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the strong growth in domestic and international tourism, rising disposable incomes, improved transport infrastructure, and supportive government policies such as visa liberalization and tourism promotion, increased investment by international hotel brands and the rapid adoption of digital booking and smart hospitality technologies further boost demand and market expansion.

Q: What factors restrain the Vietnam Hospitality market?

A: Constraints include the infrastructure gaps in emerging destinations, lack of skilled workforce, regulatory and compliance complexity create barriers for foreign investment and streamlined expansion, and seasonal demand fluctuations affecting occupancy and revenue stability outside peak periods.

Q: How is the market segmented by type?

A: The market is segmented into chain hotels and independent hotels.

Q: Who are the key players in the Vietnam hospitality market?

A: Key companies include Marriott International, Accor S.A., InterContinental Hotels Group (IHG), Hilton Hotels & Resorts, Hyatt Hotels Corporation, Wyndham Hotels & Resorts, Radisson Hotel Group, Banyan Tree Hotels & Resorts, Six Senses, Melia Hotels International, Best Western Hotels & Resorts, Oakwood, Vinpearl, Muong Thanh Hospitality, Saigontourist, and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 165 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |