Global Virtual Commissioning Market

Global Virtual Commissioning Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Component (Software and Services), By End-Use Industry (Automotive, Aerospace & Defense, Industrial Equipment, Electronics & Semiconductors, and Energy & Utilities), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Virtual Commissioning Market Summary, Size & Emerging Trends

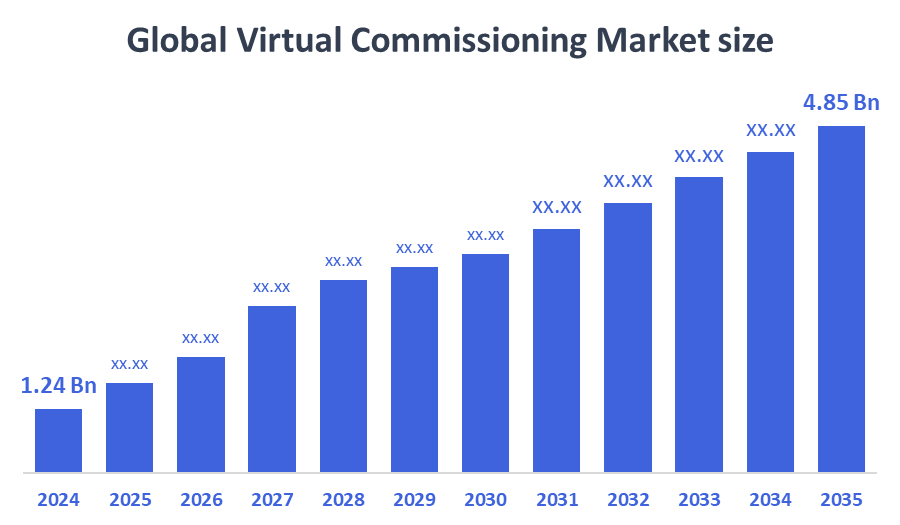

According to Decision Advisor, The Global Virtual Commissioning Market Size is Expected to Grow from USD 1.24 Billion in 2024 to USD 4.85 Billion by 2035, at a CAGR of 13.2% during the forecast period 2025-2035. The market is rapidly expanding due to increasing demand for digital twins, simulation-based engineering, and cost-efficient production validation across industries.

Key Market Insights

- North America accounted for the largest market share in 2024.

- Asia Pacific is projected to witness the highest CAGR during the forecast period.

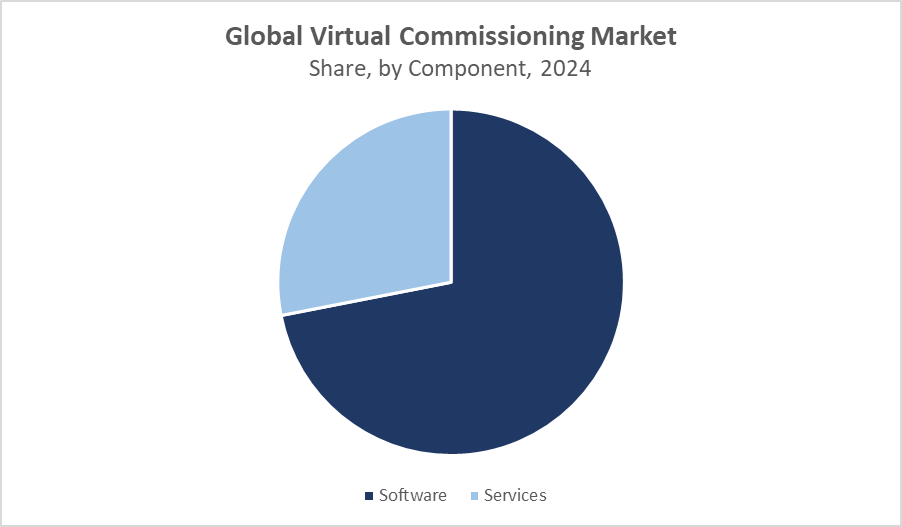

- By component, the software segment dominated in terms of revenue.

- By end-use industry, the automotive sector held the largest market share in 2024.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 1.24 Billion

- 2035 Projected Market Size: USD 4.85 Billion

- CAGR (2025-2035): 13.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Virtual Commissioning Market

Virtual commissioning refers to the digital testing and simulation of manufacturing systems, control logic, and automation setups before physical implementation. It enables engineers to validate and optimise production systems in a virtual environment, significantly reducing risk, time, and cost associated with physical commissioning. This technology integrates with digital twins, PLC programming, and industrial IoT platforms, facilitating smart factory development. It finds major applications in automotive, aerospace, industrial machinery, and electronics manufacturing industries where real-time simulation and reduced downtime are critical. The growing focus on Industry 4.0, digital transformation, and agile manufacturing practices is driving global adoption. Organizations are leveraging virtual commissioning to improve product quality, reduce development cycles, and ensure seamless integration between physical systems and software.

Virtual Commissioning Market Trends

- Rising adoption of digital twins and smart factory technologies across manufacturing environments.

- Increased integration of AI and ML in simulation software for predictive maintenance and performance optimization.

- Cloud-based platforms and remote collaboration tools enabling flexible engineering and faster global deployment.

Virtual Commissioning Market Dynamics

Driving Factors: Demand for cost and time efficiency in industrial automation

The growing complexity of industrial automation systems is pushing manufacturers to adopt smarter, more efficient methods to validate and deploy production processes. Traditional commissioning methods are time-consuming and costly, often requiring physical setup, manual adjustments, and system downtime. Virtual commissioning solves these issues by enabling simulation and testing in a digital environment before any physical installation occurs. This approach allows manufacturers to detect and resolve errors early, optimize control logic, and ensure smooth integration of machinery. Sectors like automotive and aerospace, which involve high-value production lines and frequent model changes, particularly benefit from this technology. Virtual commissioning accelerates time-to-market, lowers operational risk, and improves the overall efficiency of industrial setups, making it a key enabler of digital transformation in manufacturing.

Restraint Factors: High Initial Investment and Software Complexity

Despite its long-term advantages, the initial adoption of virtual commissioning solutions can be challenging, especially for small and medium-sized enterprises (SMEs). High upfront costs associated with purchasing advanced simulation software, integrating hardware components, and training staff can act as a barrier. Furthermore, the software used for virtual commissioning often involves digital twins, real-time logic simulation, and 3D modelling, is technically complex and may require specialised knowledge in automation and control systems. Many companies also face difficulty integrating virtual models with existing programmable logic controllers (PLCs), robotics, and SCADA systems, which adds to implementation complexity. These factors can slow down adoption, particularly in regions or industries with limited digital infrastructure.

Opportunity: Expansion into electronics and semiconductor industries

As the electronics and semiconductor industries continue to adopt high levels of automation and miniaturized production environments, virtual commissioning is emerging as a crucial tool. These sectors involve intricate assembly lines, strict process controls, and the need for precise timing and coordination of equipment. Virtual commissioning enables companies to simulate the entire process flow, identify potential bottlenecks, and optimize production layouts before any physical changes are made. This reduces waste, shortens development cycles, and ensures smoother scaling of operations. Additionally, the rapid pace of innovation in electronics manufacturing is creating consistent demand for agile and reconfigurable systems an area where virtual commissioning offers immense value. As these industries grow in emerging markets, the opportunity for vendors to expand their offerings is substantial.

Challenges: Interoperability and standardisation issues

One of the major hurdles in scaling virtual commissioning solutions lies in the lack of interoperability and standardized protocols across platforms. Manufacturing systems often involve a wide range of hardware and software such as PLCs from different vendors, robotic arms, human-machine interfaces (HMIs), and proprietary simulation tools. Ensuring that these disparate systems communicate effectively is a technical challenge and often requires custom integration work. The absence of widely accepted industry standards increases implementation complexity, limits scalability, and raises maintenance costs. For companies operating multiple production sites or dealing with global suppliers, this becomes even more critical. To overcome these issues, there is a growing need for open architecture solutions and collaborative standard-setting across the industrial automation ecosystem.

Global Virtual Commissioning Market Ecosystem Analysis

The virtual commissioning ecosystem includes software developers, automation solution providers, industrial equipment manufacturers, and end users across manufacturing sectors. Leading players focus on providing open platforms compatible with various automation hardware. The ecosystem thrives on continuous innovation, collaboration between OEMs and system integrators, and regulatory support for digitalization initiatives across global manufacturing hubs.

Global Virtual Commissioning Market, By Component

The software segment dominated the global virtual commissioning market in 2024, accounting for approximately 68% of total revenue. This segment benefits from the widespread adoption of digital twin platforms, PLC simulation tools, and real-time visualization software, which allow manufacturers to simulate and validate automation systems before physical deployment. These advanced tools are critical for reducing commissioning time, enhancing production accuracy, and minimizing operational risks. The rising demand for integrated virtual environments in industries such as automotive, aerospace, and electronics is further driving software adoption. Continuous upgrades in features such as real-time monitoring, 3D modeling, and AI-driven simulation contribute to the segment’s dominant position.

The services segment, while smaller in revenue share, is experiencing faster growth and accounted for around 32% of the market in 2024. With virtual commissioning becoming more accessible to small and mid-sized enterprises (SMEs), there is growing reliance on technical consulting, system integration, training, and support services to successfully implement these solutions. Many companies lack in-house expertise to handle complex simulation environments, driving demand for third-party vendors who can offer managed services and customisation. As digital transformation accelerates across emerging economies, the services segment is expected to expand rapidly, playing a critical role in supporting widespread adoption of virtual commissioning platforms.

Global Virtual Commissioning Market, By End-Use Industry

The automotive segment held the largest revenue share in the global virtual commissioning market in 2024, accounting for approximately 34% of total revenue. This dominance is driven by automakers’ growing need for flexible, efficient, and highly automated production lines. Virtual commissioning allows manufacturers to simulate complete assembly processes, optimize robot movements, and minimize downtime when introducing new vehicle models or updating existing lines. The ability to pre-validate production systems virtually helps automotive companies reduce costly delays and maintain competitive time-to-market advantages.

The electronics & semiconductors segment is projected to record the fastest CAGR over the forecast period. The rapid growth stems from the sector’s increasing dependence on automation technologies and the necessity to simulate highly complex control systems used in chip manufacturing and electronic assembly. Virtual commissioning offers these industries the tools to efficiently design, test, and optimize their manufacturing workflows, ensuring higher precision and reducing the risk of costly errors during physical commissioning.

North America dominated the global virtual commissioning market in 2024, holding the largest revenue share,

primarily due to its technologically advanced industrial base and early adoption of Industry 4.0 practices. The United States leads the region with significant implementation of digital twin technologies, cloud-integrated automation systems, and smart factory solutions. These innovations are widely used across key industries such as automotive, aerospace, and electronics, where operational efficiency and reduced time-to-market are critical. Additionally, the strong presence of global automation leaders, such as Rockwell Automation, Siemens USA, and Emerson Electric, contributes to the region’s dominance by driving continuous innovation and large-scale deployments.

Asia Pacific is forecasted to grow at the highest CAGR during the period,

becoming a major growth engine for the virtual commissioning market. This growth is propelled by increasing investments in smart manufacturing, government-led digitalization initiatives, and expanding industrial bases in key economies such as China, India, and South Korea. The region is also witnessing rapid development in automated production lines, especially in electronics and automotive manufacturing. As multinational corporations establish more production hubs in Asia Pacific to benefit from cost efficiencies and skilled labor, the demand for virtual commissioning tools is rising sharply. The region’s emphasis on digital innovation and factory automation is positioning it as a global hotspot for next-gen industrial technologies.

WORLDWIDE TOP KEY PLAYERS IN THE VIRTUAL COMMISSIONING MARKET INCLUDE

- Siemens AG

- Rockwell Automation, Inc.

- ABB Ltd.

- Dassault Systèmes

- Siemens Digital Industries Software

- Bosch Rexroth AG

- Mitsubishi Electric Corporation

- MapleSim (Maplesoft)

- Altair Engineering Inc.

- FANUC Corporation

- Others

Product Launches in Virtual Commissioning Market

- In May 2024, Siemens Digital Industries Software launched an upgraded version of its NX Virtual Commissioning platform with improved real-time PLC simulation and enhanced integration with industrial robotics. The update is aimed at streamlining commissioning processes for large-scale automotive and electronics manufacturers.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the virtual commissioning market based on the below-mentioned segments:

Global Virtual Commissioning Market, By Component

- Software

- Services

Global Virtual Commissioning Market, By End-Use Industry

- Automotive

- Aerospace & Defense

- Industrial Equipment

- Electronics & Semiconductors

- Energy & Utilities

Global Virtual Commissioning Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q: Which regulations or standards are influencing this market?

A: While not heavily regulated, the market is shaped by industrial automation standards and the push for open architecture systems that ensure interoperability across hardware and software platforms.

Q: Which component segment dominated the Virtual Commissioning Market in 2024?

A: The software segment dominated with approximately 68% of total revenue, fueled by rising use of digital twins and simulation tools.

Q: Which component segment is expected to grow the fastest over the next 10 years?

A: The services segment is expected to grow faster, driven by rising demand for consulting, training, integration, and support services, especially among SMEs.

Q: Which end-use industry held the largest share in the Virtual Commissioning Market?

A: The automotive industry led the market with around 34% of total revenue in 2024 due to its reliance on automated and flexible production lines.

Q: Which end-use segment is projected to grow the fastest?

A: The electronics & semiconductors segment is forecasted to grow at the fastest pace, owing to the complexity and automation of chip and component manufacturing.

Q: How do North America and Asia–Pacific compare in terms of market maturity and growth potential?

A: North America is the most mature market with strong industrial automation infrastructure, while Asia-Pacific is the fastest-growing region due to rapid industrial expansion and government-led digitalization.

Q: What are the latest trends in the Virtual Commissioning Market?

A: Trends include the integration of AI/ML in simulation, cloud-based collaboration tools, digital twins, and adoption of smart factory frameworks.

Q: What are the top investment opportunities in the Global Virtual Commissioning Market?

A: High-potential areas include cloud-native simulation platforms, AI-integrated virtual testing tools, and tailored services for electronics and semiconductor industries.

Q: What is the long-term outlook (2025–2035) for the Virtual Commissioning Market?

A: The market is expected to maintain strong growth momentum driven by digital transformation, advanced automation, and the global shift towards agile and smart manufacturing practices.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 165 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |