Global Voluntary Carbon Credit Market

Global Voluntary Carbon Credit Market Size, Share, and COVID-19 Impact Analysis, By Project (Renewable Energy, Energy Efficiency, Afforestation and Reforestation, Methane Capture and Destruction, Others), By Application (Industrial, Household Devices, Energy, Agriculture, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Voluntary Carbon Credit Market Summary

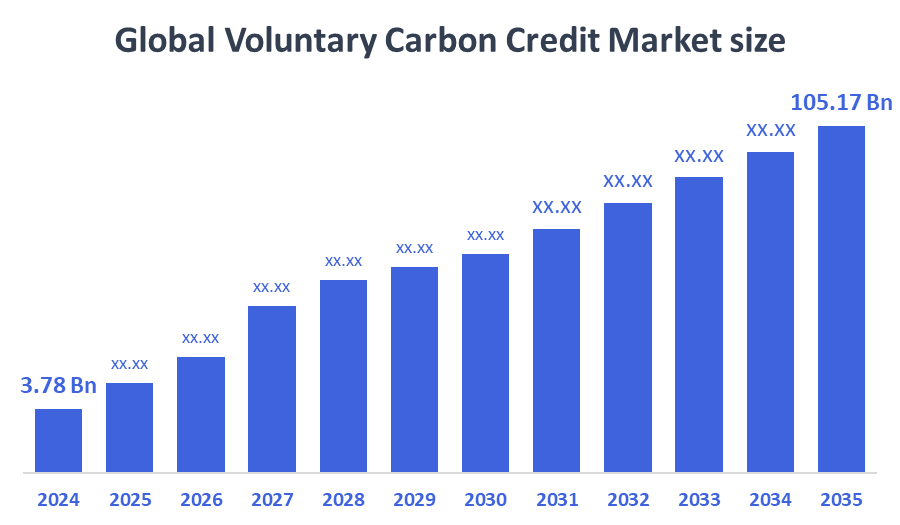

The Global Voluntary Carbon Credit Market Size Was Estimated at USD 3.78 Billion in 2024 and is Projected to Reach USD 105.17 Billion by 2035, Growing at a CAGR of 35.3% from 2025 to 2035. The market for voluntary carbon credits is expanding as a result of increased corporate sustainability objectives, greater awareness of climate change, pressure to make net-zero commitments, and support for carbon offset initiatives. Consumer preferences, investment expectations, and the governmental push for carbon accountability are further factors driving demand.

Key Regional and Segment-Wise Insights

- With a revenue share of more than 36.82% in 2024, the North American voluntary carbon credit market led the global market.

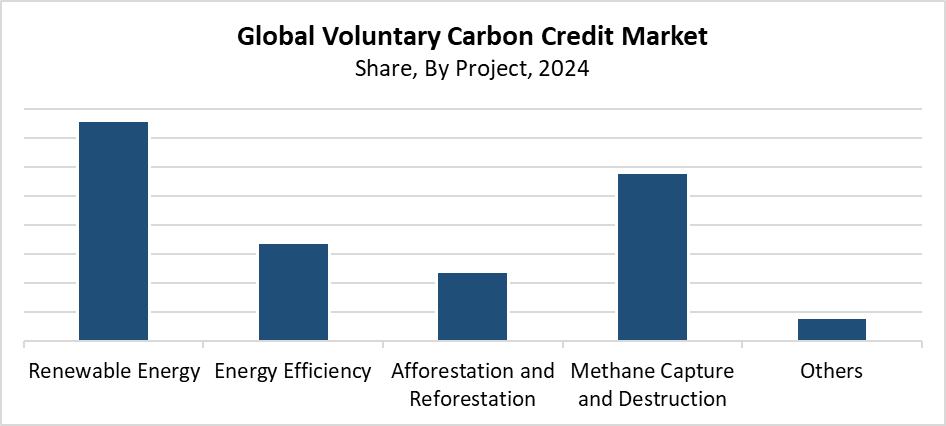

- In 2024, the renewable energy segment had the largest revenue share of 38.53%, dominating the market for voluntary carbon credits by project.

- In 2024, the industrial segment had the largest revenue share of 31.57% and led the market based on application.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 3.78 Billion

- 2035 Projected Market Size: USD 105.17 Billion

- CAGR (2025-2035): 35.3%

- North America: Largest market in 2024

The voluntary carbon credit market enables people and organizations, as well as businesses, to acquire carbon credits, which stem from certified projects that reduce or eliminate greenhouse gas emissions, thus helping to neutralize their carbon footprint. The voluntary market functions without legal requirements because it depends on environmental care alongside sustainability goals and social responsibility practices from businesses. This industry experiences rapid growth because corporations commit to net-zero targets, and investors and consumers demand sustainable practices, while people worldwide become more aware of climate change. The leading buyers of carbon credits include companies from the energy and aviation sectors as well as industrial and technological sectors, who offset their unavoidable emissions through methane capture, renewable energy, and reforestation projects.

The voluntary carbon credit market achieves better protection while remaining trustworthy through technological advancement. Blockchain technology and digital MRV systems enable real-time tracking of carbon credits, which decreases fraud and enhances market efficiency. The measurement of actual nature-based carbon sequestration can be performed through AI and satellite image analysis. Governments, together with international organizations, show rising support for voluntary carbon markets by providing incentives and creating standardization initiatives as well as regulatory frameworks. Programs aim to guard credit integrity while connecting voluntary markets to international climate agreements, which include the Paris Agreement.

Project Insights

The renewable energy segment dominates the voluntary carbon credit market in 2024 by holding the largest revenue share of 38.53% 2024. The leadership position stems from the worldwide clean energy transformation, together with expanding corporate requirements for carbon offsetting to reach net-zero and sustainability objectives. The segment generates projects through wind, solar, hydro, and biomass energy that substitute fossil fuel-based power plants while producing verifiable reductions in greenhouse gas emissions. The voluntary market favors renewable energy projects because they scale well, have broad acceptance, and straightforward verification processes. Their ability to provide energy access and decrease emissions in developing countries boosts their value in the carbon offset market.

The methane capture and destruction segment will experience substantial growth throughout the forecasted period because methane produces more than 80 times the warming effect of CO? during the next 20 years. The projects that capture methane from oil and gas facilities, landfills, and agricultural operations use this captured methane either as a renewable energy source or destroy it by flaring. Methane mitigation has emerged as a leading priority because international initiatives to reduce short-lived climate pollutants continue to expand. The voluntary carbon credit market sees increased demand for methane capture project credits because corporations seek impactful offset solutions and receive backing from initiatives, including the Global Methane Pledge.

Application Insights

The industrial segment led the voluntary carbon credit market with a 31.57% revenue share during 2024. The main industries leading this dominance include manufacturing, alongside mining, oil and gas, and chemical industries. These sectors generate substantial greenhouse gas emissions and now seek carbon offset solutions to fulfill their sustainability objectives. Industrial firms utilize voluntary carbon credits as part of their internal net-zero objectives while simultaneously supporting their emission reduction programs. Organizations can select from different carbon credit projects, which include methane collection and renewable energy systems, to optimize their emission offsetting processes. Industrial sectors face growing investor and regulatory demands to demonstrate environmental responsibility, which drives their need for voluntary carbon credits.

The household devices segment of the voluntary carbon credits market is expected to grow at a significant CAGR during the forecast period. Consumer awareness, together with increased adoption of low-emission and energy-efficient household goods and gadgets, drives this market growth. Manufacturers that produce household products are integrating carbon offset initiatives and sustainability measures into their product offerings due to increasing family demand to reduce environmental impacts. The expansion of smart home technologies, together with Internet of Things-enabled gadgets, leads to better energy management and reduced emissions, among other advantages. The manufacturing businesses of household appliances dedicate rising amounts of funding toward voluntary carbon credits to counterbalance their supply chain and production-related emissions. The voluntary carbon credit market experiences quick growth in household devices because government incentives back this segment while promoting energy-efficient appliance adoption.

Regional Insights

The North American voluntary carbon credit market dominated the global market by holding the largest revenue share of 36.82% in 2024. The region leads because businesses there dedicate themselves to environmental responsibility, while many companies choose to become net-zero and carbon-neutral. The market for carbon offsets exists because numerous major companies operate in the manufacturing and energy sectors and technology fields. The carbon credit market of North America benefits from its advanced trading platforms and well-defined verification standards, which build investor confidence through transparency. The voluntary carbon credit market grows because of increasing investor interest, combined with supportive government regulations and rising consumer climate change. The region continues to lead in voluntary carbon credits because it actively participates in technology-based and nature-based carbon offset projects.

Europe Voluntary Carbon Credit Market Trends

The European voluntary carbon credit market has experienced substantial growth because businesses face mounting regulatory demands to reduce their carbon emissions beyond legal requirements, while climate awareness continues to rise. European companies purchase carbon credits as part of their sustainability objectives, which align with the European Green Deal mission. The market achieves enhanced credibility and transparency through a trustworthy carbon credit trading and verification system. The market expands due to rising investments in nature-based solutions, including reforestation and renewable energy projects. The rising customer preference for environmentally sustainable products leads companies to purchase voluntary carbon credits for emission offsetting. The worldwide voluntary carbon credit market sees increased European participation because of government programs supporting clean energy and carbon neutrality, together with financial institutions' active participation.

Asia Pacific Voluntary Carbon Credit Market Trends

The Asia Pacific voluntary carbon credit market is growing significantly because people are becoming more environmentally aware, while economies develop and industrial activities grow in China, India, Japan, and Southeast Asia. A growing number of regional businesses are adopting voluntary carbon credits to reach new sustainability targets and demonstrate corporate social responsibility. The region's extensive natural resources allow various carbon offset projects to thrive through methane capture, along with renewable energy development and reforestation initiatives. Market expansion occurs because government initiatives supporting climate action and green energy transformation continue to grow. The increasing accessibility and transparency through digital platforms for carbon credit trading attract more market participants. The voluntary carbon credit market in the Asia Pacific will experience substantial future growth because the region manages economic development alongside environmental stewardship.

Key Voluntary Carbon Credit Companies:

The following are the leading companies in the voluntary carbon credit market. These companies collectively hold the largest market share and dictate industry trends.

- Ecosecurities

- Puro. earth

- 3Degrees

- BURN Manufacturing

- Climate Impact Partners

- Terrasos

- Biofílica Ambipar

- EcoAct

- Indus Delta Capital Limited

- BioCarbon Partners

- EKI Energy Services Ltd. (formerly EnKing International)

- AB Verra

- Others

Recent Developments

- In April 2024, RVCMC, supported by the Saudi PIF, teamed up with Xpansiv to introduce a new carbon credit trading platform. The goal of the action is to increase transparency and allocate climate funds to underprivileged areas.

- In June 2023, with more than 2.2 million tonnes sold, RVCMC held Nairobi's largest voluntary carbon credit auction. Eighteen regional programs that concentrated on removing and reducing emissions provided the credits. Among the major purchasers were Saudi Electricity Company, ENOWA, and Aramco.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the voluntary carbon credit market based on the below-mentioned segments:

Global Voluntary Carbon Credit Market, By Project

- Renewable Energy

- Energy Efficiency

- Afforestation and Reforestation

- Methane Capture and Destruction

- Others

Global Voluntary Carbon Credit Market, By Application

- Industrial

- Household Devices

- Energy

- Agriculture

- Others

Global Voluntary Carbon Credit Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 220 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |