Global Wood Processing Machines Market

Global Wood Processing Machines Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Machine Type (Sawing Machines, CNC Machines, Grinding & Sanding Machines, and Drilling & Boring Machines), By Application (Furniture Manufacturing, Construction, and Flooring), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Wood Processing Machines Market Summary, Size & Emerging Trends

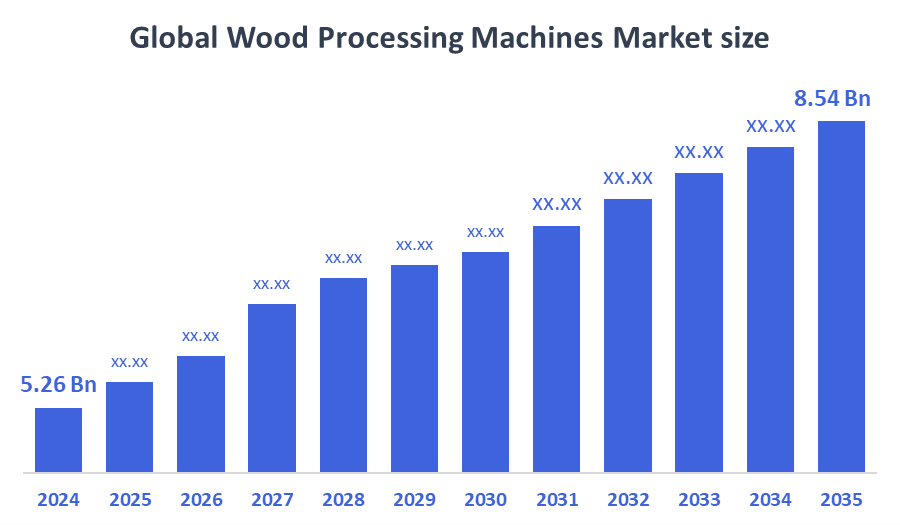

According to Decision Advisor, The Global Wood Processing Machines Market Size is Expected to Grow from USD 5.26 Billion in 2024 to USD 8.54 Billion by 2035, at a CAGR of 4.5% during the forecast period 2025-2035. Rising demand from furniture manufacturing and expanding construction activities globally are key drivers for the wood processing machines market.

Key Market Insights

- Asia Pacific is expected to account for the largest share in the wood processing machines market during the forecast period.

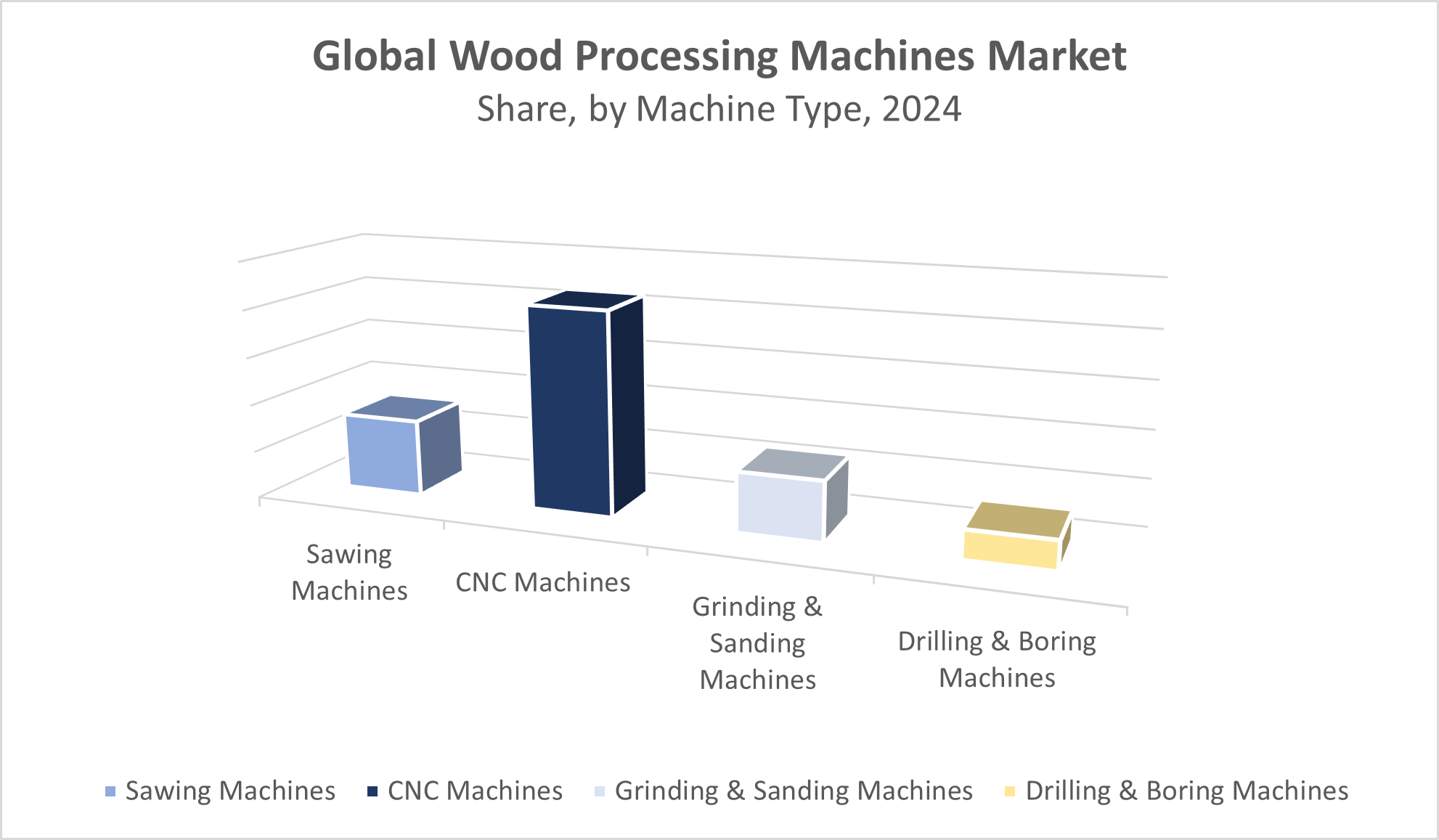

- In terms of machine type, the CNC machines segment dominated in terms of revenue during the forecast period.

- In terms of application, the furniture manufacturing segment accounted for the largest revenue share in the global wood processing machines market during the forecast period.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 5.26 Billion

- 2035 Projected Market Size: USD 8.54 Billion

- CAGR (2025-2035): 4.5%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Wood Processing Machines Market

The wood processing machines market focuses on the production and utilization of specialized machinery designed for sawing, shaping, grinding, sanding, drilling, and boring of wood materials. These machines are essential in enhancing efficiency, precision, and productivity across furniture manufacturing, construction, and flooring industries. Increasing urbanization, infrastructure development, and growing demand for high-quality wood products are boosting the adoption of advanced wood processing machinery globally. Governments are supporting this growth by promoting mechanization in the wood industry and encouraging sustainable forestry practices. Technological advancements such as automation, CNC integration, and energy-efficient equipment are transforming traditional woodworking processes, offering better performance and cost savings. This market is driven by the continuous need for durable and aesthetically pleasing wooden products across residential and commercial sectors.

Wood Processing Machines Market Trends

- Growing preference for automated and CNC-enabled wood processing machines to improve precision and reduce labor costs.

- Increasing incorporation of eco-friendly and energy-saving technologies in wood processing equipment.

- Strategic collaborations and product innovations aimed at expanding the product portfolio and geographical presence.

Wood Processing Machines Market Dynamics

Driving Factors: Increasing construction and furniture manufacturing activities

The rising demand for modern furniture and the booming construction sector worldwide are driving the need for advanced wood processing machines. Urbanization and population growth are fueling infrastructure development, requiring efficient wood processing solutions. Furthermore, the expansion of the flooring industry with a focus on hardwood and engineered wood products is supporting market growth. The trend toward customized and high-quality wood products in furniture manufacturing is promoting investments in CNC and automated machines.

Restrain Factors: High capital investment and maintenance costs

The wood processing machines market faces challenges from the high initial investment and operational costs associated with advanced machinery. Small and medium-sized enterprises (SMEs) may find it difficult to afford these machines, limiting market penetration in developing economies. Additionally, the requirement for skilled operators and ongoing maintenance can increase overall expenses, acting as a barrier to widespread adoption. Variability in wood quality and raw material availability can also affect production consistency and machine efficiency.

Opportunity: Adoption of Industry 4.0 and smart manufacturing

Technological advancements such as Industry 4.0 integration, IoT-enabled machinery, and smart factory solutions offer substantial growth opportunities. These technologies facilitate real-time monitoring, predictive maintenance, and enhanced process control, improving productivity and reducing downtime. Emerging markets in Asia Pacific and Latin America are increasingly adopting these innovations, driven by government initiatives and growing industrialization. The rising trend of customization and demand for premium wooden products also encourages investments in precision machinery, opening new avenues for market expansion.

Challenges: Supply chain disruptions and raw material shortages

The wood processing machines market is susceptible to supply chain issues, including delays in component delivery and logistics disruptions, which can affect production schedules. Furthermore, shortages in high-quality timber and fluctuating raw material prices can hamper manufacturing efficiency and product output. Regulatory constraints related to sustainable forestry and environmental protection add complexity to raw material sourcing, posing additional challenges for manufacturers and end-users.

Global Wood Processing Machines Market Ecosystem Analysis

The wood processing machines market ecosystem comprises key manufacturers, component suppliers, distributors, and end-users in furniture, construction, and flooring industries. Leading machine manufacturers focus on innovation, quality, and after-sales services to maintain competitive advantage. Suppliers of raw materials and machine parts, especially in Asia Pacific, play a critical role in cost and availability. Collaborative initiatives between technology providers and industry stakeholders are essential for driving adoption of smart machinery and sustainable practices. Regulatory bodies enforce safety and environmental standards that guide product development and market operations.

Global Wood Processing Machines Market, By Machine Type

What key advantages helped the CNC machines segment dominate the wood processing machines market revenue-wise during the forecast period?

The CNC machines segment dominated the wood processing machines market in revenue during the forecast period due to the increasing demand for high-precision, automated machining solutions in the woodworking industry. CNC machines offer superior accuracy, efficiency, and versatility compared to traditional wood processing equipment, enabling manufacturers to produce complex designs with consistent quality. The rising adoption of automation and Industry 4.0 technologies in manufacturing facilities has further boosted the demand for CNC machines. Additionally, the ability of CNC machines to reduce labor costs, minimize material wastage, and improve production speed has made them highly attractive to wood processing businesses.

How has the sawing machines segment sustained its significant presence in the wood processing machines market?

The sawing machines segment holds a significant share in the wood processing machines market due to its essential role in the initial and precise cutting of raw wood materials. Sawing machines are widely used across various applications including furniture manufacturing, construction, and timber processing, which drives steady demand. Their versatility, ease of use, and relatively lower cost compared to highly automated solutions make them accessible to a broad range of manufacturers, from small workshops to large-scale industrial operations. Additionally, continuous improvements in sawing technology, such as enhanced blade designs and automation integration, have further increased their efficiency and appeal.

Global Wood Processing Machines Market, By Application

How did the furniture manufacturing segment secure the largest revenue share throughout the forecast period?

The furniture manufacturing segment accounted for the largest revenue share during the forecast period due to the growing global demand for both residential and commercial furniture. Increasing urbanization, rising disposable incomes, and changing lifestyles have driven the need for innovative and high-quality furniture products, boosting the demand for advanced manufacturing solutions. This segment benefits from the adoption of modern wood processing technologies, including CNC and sawing machines, which improve production efficiency and product customization. Additionally, the expansion of the real estate sector and renovation activities worldwide has further stimulated furniture production and sales.

Why is the construction segment considered an important segment following closely in the market?

The construction segment follows closely in market revenue during the forecast period due to the robust demand for wood and related materials in building and infrastructure projects. Rapid urbanization, population growth, and increased investment in residential, commercial, and industrial construction have significantly driven the need for wood processing machines and related technologies. This segment benefits from advancements in construction methods that emphasize sustainability and the use of eco-friendly materials, including engineered wood products. The increasing focus on green buildings and energy-efficient structures has further boosted demand within this segment.

Asia Pacific is poised to hold the largest share of the global wood processing machines market throughout the forecast period,

largely driven by rapid industrialization and urbanization in key countries such as China, India, and Japan. These nations are witnessing significant growth in furniture manufacturing hubs and construction activities, which increases the demand for efficient and advanced wood processing equipment. Additionally, the region benefits from competitive labor costs, making manufacturing more cost-effective, along with strong government incentives aimed at modernizing the manufacturing sector. India, in particular, is experiencing a fast-paced expansion as investments in woodworking machinery and infrastructure development surge, fueling market growth.

China stands out as a major driver of growth in the wood processing machines market within the Asia Pacific region.

The country’s booming furniture manufacturing sector, fueled by both domestic demand and exports, necessitates advanced wood processing machinery to enhance productivity and precision. Additionally, China’s ongoing urbanization and large-scale construction projects significantly increase the need for efficient woodworking equipment. Government initiatives promoting manufacturing modernization and smart factory adoption further accelerate demand for CNC machines, sawing machines, and other automated solutions. With competitive labor costs and a strong industrial base, China remains a key market contributing substantially to the region’s overall growth.

North America is expected to exhibit the fastest CAGR.

This growth is propelled by the early and widespread adoption of automated and CNC wood processing machines, driven by the region’s robust research and development capabilities and well-established advanced manufacturing infrastructure. The combination of technological innovation and strong industrial base allows North America to rapidly integrate new machinery and improve production efficiency, contributing to its accelerated market growth.

The United States leads market expansion in wood processing machines.

The country’s well-developed manufacturing sector, combined with a strong emphasis on automation and Industry 4.0 technologies, drives the widespread adoption of CNC and other automated wood processing equipment. High investment in R&D allows U.S. manufacturers to innovate and integrate advanced machinery that improves efficiency and product quality.

WORLDWIDE TOP KEY PLAYERS IN THE WOOD PROCESSING MACHINES MARKET INCLUDE

-

- SCM Group

- Homag Group

- Biesse Group

- Weinig AG

- Sawtek Industries

- Holz-Her GmbH

- Anderson Group

- Leadermac Machinery

- DMC Technology

- Others

Product Launches in Wood Processing Machines Market

- In January 2024, Homag Group launched a new CNC machining center equipped with enhanced automation and AI-powered quality control. This innovation is designed to boost production efficiency and minimize waste in furniture manufacturing, supporting smarter and more sustainable operations.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the wood processing machines market based on the below-mentioned segments:

Global Wood Processing Machines Market, By Machine Type

-

- Sawing Machines

- CNC Machines

- Grinding & Sanding Machines

- Drilling & Boring Machines

Global Wood Processing Machines Market, By Application

-

- Furniture Manufacturing

- Construction

- Flooring

Global Wood Processing Machines Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q. What is the projected growth rate of the global wood processing machines market?

The market is expected to grow at a CAGR of 4.5% between 2025 and 2035.

Q. Which region holds the largest market share for wood processing machines?

Asia Pacific holds the largest share of the market in 2024, driven by rapid industrialization and urbanization in countries like China, India, and Japan.

Q. Which machine type dominates the market revenue-wise?

CNC machines dominate the market due to their precision, automation capabilities, and efficiency in wood processing.

Q. Why is the furniture manufacturing segment significant in the wood processing machines market?

The furniture manufacturing segment accounts for the largest revenue share, fueled by increasing global demand for innovative, high-quality furniture products.

Q. What factors are driving the growth of the wood processing machines market?

Key drivers include rising construction and furniture manufacturing activities, urbanization, infrastructure development, and technological advancements like Industry 4.0 and automation.

Q. What are the major challenges faced by the wood processing machines market?

High initial investment, maintenance costs, supply chain disruptions, raw material shortages, and regulatory constraints related to sustainability pose challenges.

Q. Which region is expected to grow the fastest?

North America is expected to register the fastest CAGR due to advanced manufacturing infrastructure and adoption of automation technologies.

Q. How are technological advancements influencing the wood processing machines market?

Technologies such as CNC integration, automation, IoT, and AI-powered quality control enhance efficiency, precision, and sustainability in wood processing.

Q. What are the main applications of wood processing machines?

The primary applications include furniture manufacturing, construction, and flooring.

Q. Who are the key players in the wood processing machines market?

Leading companies include SCM Group, Homag Group, Biesse Group, Weinig AG, Sawtek Industries, and Holz-Her GmbH, among others.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 213 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |