Global Wound Debridement Devices Market

Global Wound Debridement Devices Market Size, Share, and COVID-19 Impact Analysis, By Product (Hydrosurgical, Low-Frequency Ultrasound, Mechanical, Larval Therapy, and Others), By Method (Autolytic, Surgical, Enzymatic, Mechanical, and Maggot), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

Global Wound Debridement Devices Market Size Insights Forecasts to 2035

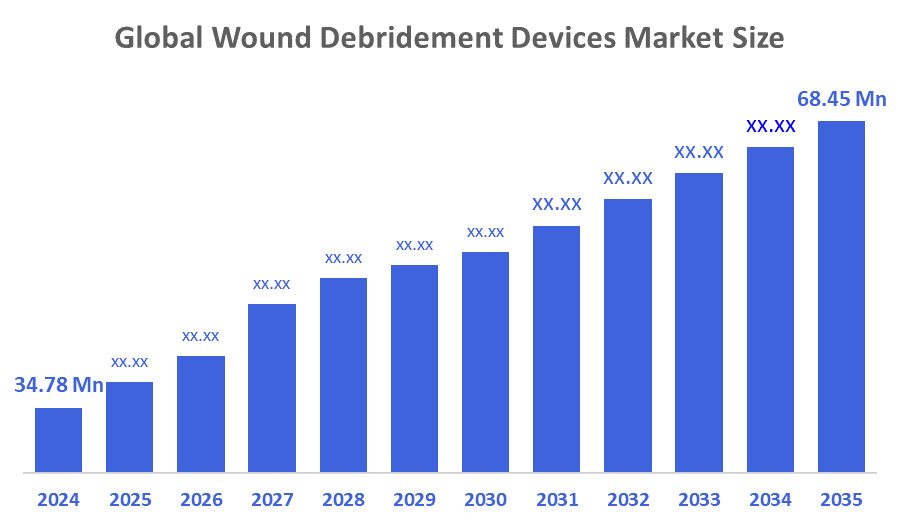

- The Global Wound Debridement Devices Market Size Was Estimated at USD 34.78 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.35 % from 2025 to 2035

- The Worldwide Wound Debridement Devices Market Size is Expected to Reach USD 68.45 Million by 2035

- North America is expected to grow the fastest during the forecast period.

According to a research report published by Decisions Advisors and Consulting, The Global Wound Debridement Devices Market Size Was Worth Around USD 34.78 Million In 2024 And Is Predicted To Grow To Around USD 68.45 Million By 2035 With A Compound Annual Growth Rate (CAGR) Of 6.35 % From 2025 To 2035. A significant number of patients continuously suffer from different chronic diseases, for example, pressure ulcers, diabetic foot ulcers, and other target wounds that have contributed significantly to the market growth. Besides that, the availability of reimbursement in developed economies, as well as changing lifestyles, are expected to be the factors that will continue to cause the market to grow. Also, various types of accidents, e.g., road accidents, burns, and trauma, are increasing all over the world. This is expected to lead to more demand for the market. Moreover, more and more governments and private companies are participating in awareness programs about wound care treatment, which also helps the market to grow.

Market Overview

Wound debridement devices that provide mechanical, enzymatic, or autolytic removal of dead tissue are becoming increasingly indispensable parts of daily hospital and home wound care. This is because they significantly enhance healing, reduce the risk of infections, and effortlessly fit into the overall wound care regimen. The increasing use of wound debridement equipment can be attributed mainly to the extensive implementation of next-generation wound care products, the mounting number of consumers with chronic wounds, and the growing trend towards highly effective and time-saving debridement techniques. Moreover, the rising numbers of chronic wounds, e.g. diabetic foot ulcers, pressure ulcers, and venous leg ulcers, in combination with an ageing population and an increase in diabetes incidence, are paving the way for advanced wound debridement solutions to be the new normal in patient care. These complementary factors contribute to the rapid adoption of wound debridement device solutions, thereby significantly boosting the industry's growth. Besides, the World Health Organisation (2023) states that about 20 to 50 million additional people got non-fatal injuries, many of them resulting in disability. Such injuries, moreover, damage tissue, get contaminated, or necrotise, and hence need regular debridement to prevent infection and ensure proper healing.

Galway-based health-tech start-up FeelTect secured €1.5 million in funding to launch its pioneering wound care device, Tight Alright, the world’s first connected health technology for real-time monitoring of compression therapy. The device is being commercially introduced at Thun Hospital in Switzerland.

Mölnlycke Health Care invested US $15 million in MediWound Ltd., a Nasdaq-listed company specialising in next-generation enzymatic therapeutics for non-surgical wound debridement. The deal was announced on July 15, 2024, through a private investment in public equity (PIPE).

Report Coverage

This research report categorises the wound debridement devices market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the wound debridement devices market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the wound debridement devices market.

Driving Factors

The Global Wound Debridement Devices Market Size is driven by the increasing number of chronic wounds in hospitals, care facilities, and home healthcare. With patients and providers becoming more aware and advanced healthcare ecosystems being adopted, demand for innovative solutions is on the rise. The major players in the industry, like Smith+Nephew, are launching new enzymatic debridement products that are more efficacious and go along with their advanced portfolio, thus the trend continues to evolve. Moreover, the intro of modern wound debridement devices offers targeted removal of dead tissues, faster healing, and improved infection control, which makes them stand apart from traditional methodologies. Further, they are easily incorporated into advanced wound care protocols, can be remotely monitored, and are designed to be user-friendly, which increases the likelihood of their adoption in various healthcare settings, which boosts the market growth.

The UK article “demystifying debridement: introducing a new approach to mechanical debridement” highlights a novel, simplified method for wound debridement that aims to improve accessibility, consistency, and patient outcomes. It emphasises mechanical debridement as a safe, effective, and practical option for clinicians across care settings.

Restraining Factors

Risks of infection during tissue removal and the high price of advanced wound care are issues that hamper the debridement devices usage. Essentially, safety and affordability concerns continue to be the main obstacles for patients and providers to the wider market penetration of these devices.

Market Segmentation

The wound debridement devices market share is classified into product and method.

- The mechanical segment dominated the market in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the product, the wound debridement devices market is differentiated into hydrosurgical, low-frequency ultrasound, mechanical, larval therapy, and others. Among these, the mechanical segment dominated the market in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segment expansion is driven by its ease to apply. Further, health care professionals usually give preference to mechanical debridement methods because these methods effectively and directly remove non, living tissues. There is also a considerable demand in the market for mechanical means because these means are accessible and can be applied in different healthcare settings.

- The enzymatic segment accounted for the highest market share in 2024 and is anticipated to grow at a notable CAGR over the forecast period.

Based on the method, the wound debridement devices market is segmented into autolytic, surgical, enzymatic, mechanical, and maggot. Among these, the enzymatic segment accounted for the highest market share in 2024 and is anticipated to grow at a notable CAGR over the forecast period. The segment expansion is driven by its main advantage, which has really driven its adoption: the ability of enzymes to be highly selective when targeting and breaking down dead tissue. Moreover, it can be easily used in different wound care settings, thus allowing for great versatility.

Regional Segment Analysis of the Wound Debridement Devices Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the wound debridement devices market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the wound debridement devices market over the predicted timeframe. APAC is experiencing a healthcare transformation, and this is mainly due to the increasing awareness of health, higher disposable income, and technological innovations in countries like China, Japan, and India. This region trend of seeking more sophisticated medical treatments, which is also backed by governments' healthcare access improvement initiatives, is fuelling the use of advanced debridement technologies. Besides that, as the region is gaining a reputation as the production centre of medical devices and parts, the lower prices and availability of wound debridement devices are extending to a larger pool of patients and healthcare providers.

North America is expected to grow at a rapid CAGR in the wound debridement devices market during the forecast period. The regional market expansion is fueled by the rapid adoption of advanced wound care technologies, as well as a strong trend of home healthcare. Players in the wound debridement devices industry continue to thrive. Healthcare professionals are patients outcomes improvement become one of the main agendas through facilitating effective and efficient debridement solutions. The increasingly wound debridement devices industry gets a boost from growing patient preference for advanced wound management protocols, as well as robust demand for minimally invasive procedures and home care options. In addition, the implementation of digital health technologies and data analytics in wound care is becoming a major driver for market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the wound debridement devices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Abbott

- Arobella Medical

- B. Braun SE

- Bioventus LLC.

- Coloplast Group

- Essity Aktiebolag

- Hollister Incorporated

- Integra LifeSciences Corporation

- Lohmann & Rauscher GmbH & Co. KG

- Medtronic

- Mölnlycke Health Care AB

- Organogenesis Inc.

- Smith+Nephew

- Zimmer Biomet

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2026, the FDA officially qualified MolecuLightDX wound measurement as a medical device development tool (MDDT), making it the first imaging-based wound measurement technology recognised for use in evaluating new wound care products. This milestone announcement allows developers to generate FDA-accepted data in clinical investigations.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the wound debridement devices market based on the below-mentioned segments:

Global Wound Debridement Devices Market, By Product

- Hydrosurgical

- Low-Frequency Ultrasound

- Mechanical, Larval Therapy, and Others

Global Wound Debridement Devices Market, By Method

- Autolytic

- Surgical

- Enzymatic

- Mechanical

- Maggot

Global Wound Debridement Devices Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

- What is the current market size in 2024?

The market size is estimated at USD 34.78 million.

- What is the projected market size by 2035?

It is expected to reach USD 68.45 million.

- What is the CAGR during 2025-2035?

The compound annual growth rate is 6.35%.

- Which product segment dominated in 2024?

The mechanical segment led the market and is expected to grow significantly.

- Which method segment had the highest share in 2024?

The enzymatic segment held the top share and anticipates notable growth.

- Which region will hold the largest market share?

Asia-Pacific is anticipated to have the largest share over the forecast period.

- Which region is expected to grow the fastest?

North America is projected to grow at the fastest CAGR.

- Who are some key companies in this market?

Major players include Smith+Nephew, Mölnlycke Health Care, Medtronic, and Integra LifeSciences.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Feb 2026 |

| Access | Download from this page |