Global Zein Protein Market

Global Zein Protein Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Type (Food Grade, Pharmaceutical Grade, and Industrial Grade), By Application (Food & Beverages, Pharmaceuticals, Cosmetics, and Packaging), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Zein Protein Market Summary, Size & Emerging Trends

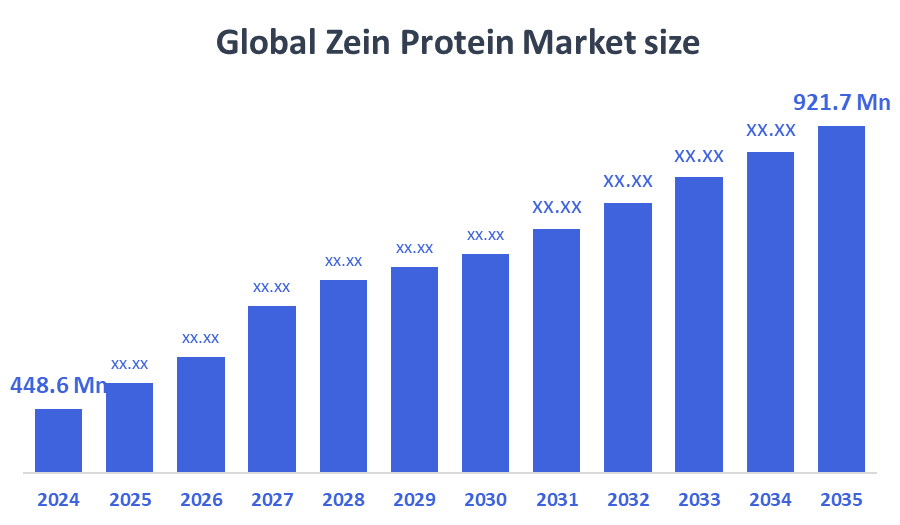

According to Decision Advisor, The Global Zein Protein Market Size is Expected to Grow from USD 448.6 Million in 2024 to USD 921.7 Million by 2035, at a CAGR of 6.77% during the forecast period 2025-2035. Increasing demand for plant-based and biodegradable proteins in food, pharmaceutical, and packaging industries is driving the zein protein market growth.

Key Market Insights

- North America holds the largest share in the zein protein market due to strong adoption in food and pharmaceutical applications.

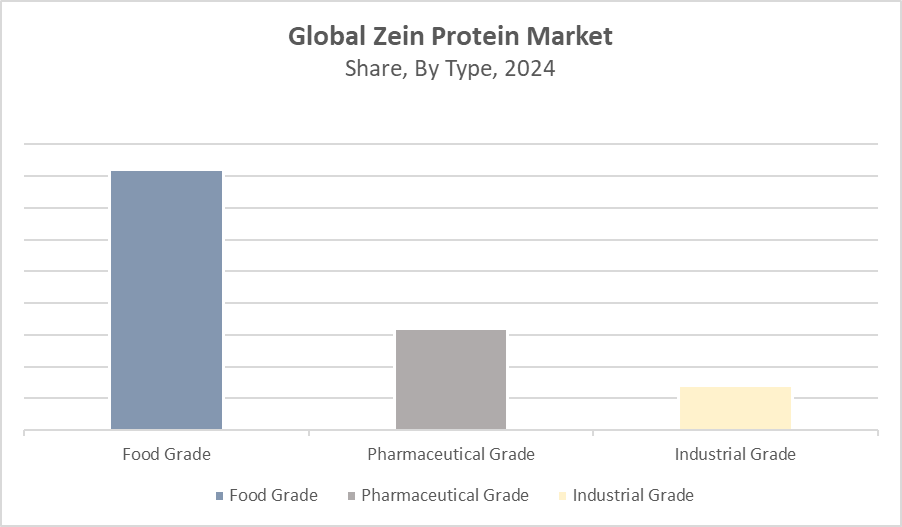

- Among types, the food grade zein dominates the market in revenue share.

- The food & beverages application segment leads the market, driven by demand for gluten-free and allergen-free ingredients.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 448.6 Million

- 2035 Projected Market Size: USD 921.7 Million

- CAGR (2025-2035): 6.77%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Zein Protein Market

Zein protein is a plant-based, alcohol-soluble prolamin extracted from corn, known for its excellent film-forming, water-resistance, and biodegradable properties. It is increasingly being used across industries including food & beverages, pharmaceuticals, cosmetics, and sustainable packaging. In food, it acts as a coating agent for candies, nuts, and pills, enhancing shelf life without compromising edibility. In pharmaceuticals, zein is valued for forming controlled-release capsules that are both non-toxic and digestible. Rising consumer demand for clean-label, allergen-free, and eco-friendly ingredients is a major driver for market growth. Governments and regulatory bodies are also promoting biodegradable materials to reduce plastic pollution, pushing manufacturers to adopt zein-based alternatives. Furthermore, technological innovations in extraction and processing are making zein more accessible and cost-effective, improving its market viability. As industries transition toward sustainability and green materials, the demand for zein protein is expected to grow steadily.

Zein Protein Market Trends

- Rising trend of plant-based proteins in food and nutraceuticals is expanding zein usage.

- Increased R&D in biodegradable packaging solutions using zein is gaining traction.

- Collaborations between biotech firms and manufacturers are driving innovation and market penetration.

Zein Protein Market Dynamics

Driving Factors: Rising Demand for Natural and Sustainable Ingredients

The rising demand for natural, allergen-free, and non-GMO ingredients in the food and pharmaceutical industries is a key growth driver for the zein protein market. As consumers shift toward plant-based and eco-friendly products, zein protein stands out for its biodegradability and functionality. Additionally, tightening environmental regulations are accelerating the transition to biodegradable packaging, boosting zein adoption. Technological advancements in zein extraction and refinement have improved quality while reducing costs, making commercial adoption more feasible.

Restrain Factors: High Costs and Limited Commercial Scalability

Despite its advantages, the zein protein market faces hurdles due to high production and processing costs. The lack of large-scale manufacturing infrastructure makes it less competitive compared to other plant proteins or synthetic alternatives. Additionally, zein’s sensitivity to moisture and temperature can reduce its shelf life and limit its use in certain applications. The presence of lower-cost substitutes like soy or whey protein further challenges its mainstream adoption in both food and non-food industries.

Opportunities: Expansion into New Applications and Emerging Markets

Zein protein shows strong potential in cosmetics and advanced drug delivery, thanks to its biocompatible and film-forming nature. As healthcare and beauty sectors seek plant-based and bioactive materials, zein offers a natural solution. Additionally, emerging economies in Asia Pacific and Latin America are witnessing growing demand due to industrial modernization and consumer health trends. Innovations involving zein-blended biopolymers also offer new frontiers for applications in eco-packaging, pharmaceuticals, and functional materials, supporting future market expansion.

Challenges: Supply Chain Disruptions and Regulatory Barriers

The market is challenged by volatile corn prices and global supply chain disruptions, which affect zein availability and cost-efficiency. Regulatory requirements for food and pharmaceutical applications involve extensive safety, efficacy, and labeling compliance, which can delay commercialization. Furthermore, the need for skilled labor and technical expertise to formulate and process zein-based products is lacking in many regions. These factors combined pose substantial operational and strategic hurdles for manufacturers and investors in the market.

Global Zein Protein Market Ecosystem Analysis

The ecosystem comprises corn suppliers, zein extraction and processing firms, manufacturers of end products (food, pharma, packaging), distributors, and retailers. Regulatory agencies enforce quality and safety standards, influencing production practices. Strategic partnerships between biotech innovators and packaging companies are essential for developing novel applications. After-sales service providers support maintenance of specialized machinery used in processing.

Global Zein Protein Market, By Type

Food grade zein accounted for approximately 55% of the global revenue share in 2024, making it the dominant segment. Its popularity stems from its film-forming and moisture-resistant properties, making it ideal for coatings on candies, nuts, and fruits, as well as edible packaging films. Its biodegradable and non-toxic nature appeals to food manufacturers seeking clean-label, sustainable solutions. Growing demand for natural food preservatives and eco-friendly packaging alternatives continues to fuel this segment’s strong market performance.

Pharmaceutical grade zein held around 25% of the market share in 2024. It is primarily used in controlled-release drug delivery systems, coating for capsules, and biodegradable films. Its biocompatibility, digestibility, and ability to form stable drug carriers make it highly suitable for encapsulating both hydrophilic and hydrophobic drugs. As the pharmaceutical industry pushes for plant-based and allergen-free excipients, the demand for pharmaceutical-grade zein is expected to grow, particularly in nutraceuticals and oral drug delivery platforms.

Global Zein Protein Market, By Application

The food & beverages segment held the largest market share at 40% in 2024, driven by growing consumer preference for natural, allergen-free, and gluten-free products. Zein is widely used as a coating agent for confectionery, nuts, and cereals, enhancing product shelf life without synthetic additives. It also functions as a fat replacer and emulsifier in low-fat formulations. The shift toward sustainable and edible packaging solutions further boosts its adoption across processed and packaged food categories.

The pharmaceuticals segment accounted for 30% of the global zein protein market in 2024. Zein’s biocompatibility, biodegradability, and non-toxic profile make it ideal for use in controlled-release capsules, oral drug carriers, and coating applications. As pharmaceutical companies seek plant-based excipients to meet regulatory and consumer demands, zein is increasingly being adopted in nutraceuticals, supplements, and prescription drugs. Ongoing research into targeted drug delivery systems is expected to further elevate its role in pharmaceutical formulations.

North America dominated the zein protein market in 2024 with a 38% revenue share,

driven by its strong demand from the food, pharmaceutical, and sustainable packaging sectors. The United States leads this regional growth due to a well-established R&D infrastructure, widespread use of plant-based ingredients, and a consumer shift toward clean-label, allergen-free products. In addition, supportive regulations promoting biodegradable materials further accelerate the adoption of zein across industries such as nutraceuticals, organic snacks, and pharma coatings.

Europe held around 27% of the global zein protein market in 2024.

Countries like Germany, France, and Italy are at the forefront, particularly in pharmaceutical innovation and sustainable packaging solutions. Stricter EU regulations on plastic usage and consumer emphasis on eco-friendly, bio-based ingredients are fostering the adoption of zein. The European food industry’s focus on gluten-free, vegan, and premium formulations also supports consistent demand. Moreover, government funding in green technologies contributes to innovation in zein-based applications.

Asia Pacific emerged as the fastest-growing region, accounting for 25% of the market share in 2024.

Rapid urbanization, increased packaged food consumption, and expanding pharmaceutical production in countries like China, India, Japan, and across Southeast Asia are fueling demand. Rising environmental consciousness, especially regarding plastic waste reduction, is creating strong market opportunities for zein as a biodegradable packaging material. Additionally, growing government incentives for local manufacturing and innovation in bio-based ingredients are accelerating regional adoption.

WORLDWIDE TOP KEY PLAYERS IN THE ZEIN PROTEIN MARKET INCLUDE

- Archer-Daniels Midland Company (ADM)

- Cargill, Incorporated

- Ingredion Incorporated

- Roquette Frères

- Flo Chemical Corporation

- Global Protein Products, Inc.

- Prairie Gold, Inc.

- Sigma-Aldrich Corporation

- Tate & Lyle PLC

- Zein Products

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the zein protein market based on the below-mentioned segments:

Global Zein Protein Market, By Type

- Food Grade

- Pharmaceutical Grade

- Industrial Grade

Global Zein Protein Market, By Application

- Food & Beverages

- Pharmaceuticals

- Cosmetics

- Packaging

Global Zein Protein Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q. What types of zein protein are available in the market?

The market includes food grade, pharmaceutical grade, and industrial grade zein, with food grade dominating the revenue share.

Q. What are the main challenges facing the zein protein market?

Challenges include high production and processing costs, limited large-scale manufacturing infrastructure, sensitivity to moisture and temperature, and competition from lower-cost protein substitutes.

Q. What opportunities exist for zein protein market growth?

Opportunities include expanding applications in cosmetics, drug delivery, biodegradable packaging, and growing demand in emerging markets like Asia Pacific and Latin America.

Q. Who are the key players in the global zein protein market?

Major players include Archer-Daniels Midland Company (ADM), Cargill, Incorporated, Ingredion Incorporated, Roquette Frères, Flo Chemical Corporation, and others.

Q. How is zein protein used in pharmaceuticals?

Pharmaceutical grade zein is used for controlled-release capsules, drug coatings, and biodegradable films due to its biocompatibility and digestibility.

Q. What trends are shaping the zein protein market?

Key trends include rising plant-based protein demand, increasing R&D in biodegradable packaging, and collaborations between biotech firms and manufacturers driving innovation.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 180 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |