India’s Ice Cream Story: Scooping Spoon for Dairy Market Growth

Published on: December 2025

India’s Ice Cream Story: Scooping Spoon for Dairy Market Growth

India’s ice cream sector has experienced a significant evolution in recent decades from a predominantly seasonal and unstructured market to a vibrant industry characterised by creativity, fierce competition, and increasing consumer interest. Historically linked to summer enjoyment, ice cream has gradually transformed into a year-round delight, driven by increasing incomes, urban growth, and a younger population that increasingly craves convenience and innovation in their food selections. In recent times, innovation has emerged as a foundation for industry expansion. Modern consumers are attracted to innovative flavour combinations, health-oriented recipes and experiential venues such as ice cream shops and dessert cafes. Digital platforms also significantly impact purchasing behaviour, facilitating e-commerce delivery and assisting brands in fostering stronger connections with consumers.

Key Market insights

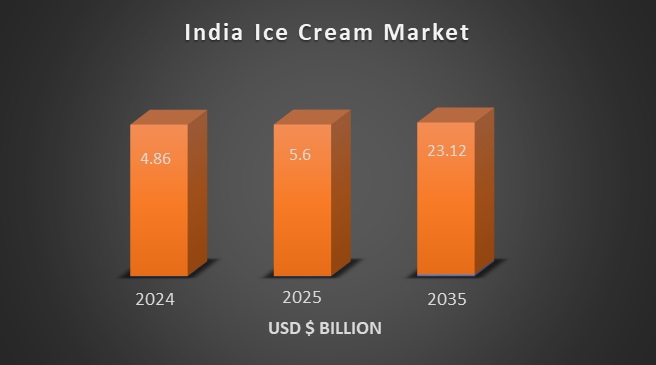

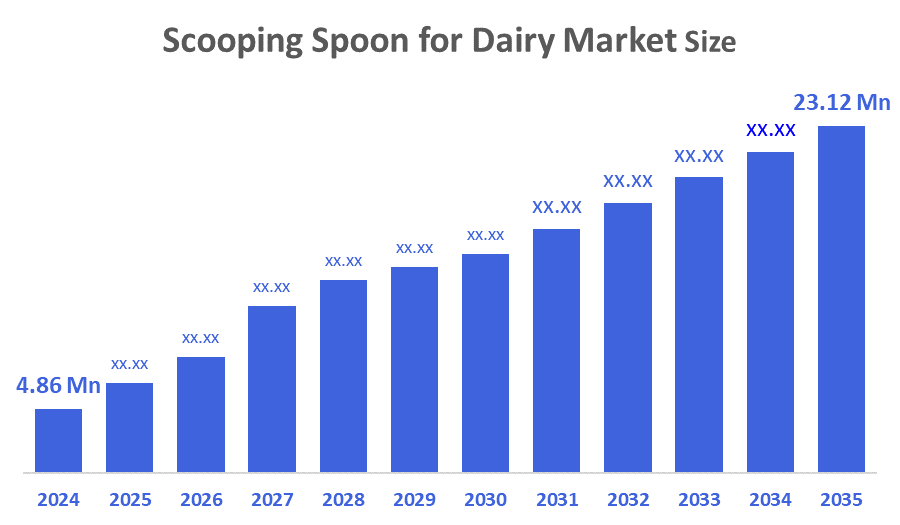

- India Ice Cream Market Size is Expected to Grow from USD 4.86 Billion in 2024 to USD 23.12 Billion in 2035, Growing at a CAGR of 15.23% during the forecast period 2025-2035.

- India's exports of the commodity group (Ice cream and other edible ice) amounted to 10.3 million.

- In 2023, India’s imports of the commodity group (Ice cream and other edible ice), regardless of cocoa content, amounted to 6.95 million.

- Bhutan, the United States, and Singapore are the leading countries importing ice cream from India, collectively representing approximately 78% of India's ice cream exports by shipment volume.

- In 2023, the United States was in first place with $3.68 million (1.08 million kg), followed by the United Arab Emirates at $1.02 million (291 thousand kg), and Nepal at approximately 1.84 million.

What are the reasons for the booming ice cream business as compared to other dairy products?

The ice cream industry in India is thriving in comparison to other dairy items due to a number of important reasons. Increasing disposable incomes, swift urban growth, and an expanding middle class have prompted consumers to invest more in luxurious and high-quality treats such as ice cream. City living and the growth of contemporary retail options supermarkets, hypermarkets, and online delivery, have rendered ice cream more available and easier to obtain, leading to an increase in demand. Further, changing consumer preferences is a key factor for this expansion. Indian consumers are showing a growing interest in unique flavours, health-focused choices (including plant-based, low-sugar, and high-protein ice creams), and experiential shopping formats. In contrast to conventional dairy items, ice cream provides more opportunities for flavour creativity and premium options, attracting younger, health-aware, and digitally savvy consumers. Moreover, government support for investments in food processing, consistent raw material pricing, and a strategic emphasis on exports are enhancing the appeal of the ice cream industry for local and global investors.

Trend That Uplifts These Desserts to New Heights

Focus on new components.

Consumers demonstrate a significant interest in new varieties, with 85% of Indian participants frequently or occasionally sampling different flavours, particularly among millennials. Young consumers boost the desire for innovative ingredients such as spicy sauces, salted caramel, cheddar, and rosemary, enhancing traditional flavours and fruity choices.

Concerns About Health

Health consciousness drives the need for low-fat ice creams, typically standardised at approximately 5% fat content, as producers aim for further reductions to lower expenses and satisfy consumer tastes. Sugar-free alternatives are available, yet knowledge remains low; consumers presently enjoy sugary snacks, although specialists anticipate increased examination shortly.

Clear and simple labelling

Leveraging health trends, consumers prefer straightforward, easy-to-say ingredient lists for enhanced transparency and confidence in products.

Adaptable Packaging

The demand increases for compact, portion-controlled formats ideal for take-home or single-serve use, improving convenience for daily snacking.

Some Top Flavours in the Indian Ice Cream Sector

India’s ice cream scene is experiencing a notable shift in flavours, influenced by evolving consumer tastes, fond memories, and a desire for uniqueness. Classic vanilla and chocolate are still favoured, yet there's a significant move towards creative, local, and hybrid flavours that appeal to changing tastes.

- Seasonal Fruit Flavours

- Mithai-Inspired Flavours

- Classics with Novel Twists

- Floral Flavours

- Contrasting Flavour Pairs

- Savoury Flavours

- Nostalgic Flavours

- International Dessert-Inspired Flavours

- Cocktail and Mocktail-Inspired Flavours

- Unique / Fusion Flavours

Seasonal Fruit Flavours

- Popular for their natural freshness and health appeal.

- Classic favourites: Strawberry, Mango, Orange.

- Rising demand for regional and exotic fruits: Tender Coconut, Sapota, Black Plum, Lychee, Passionfruit, Dragon Fruit, etc.

- Reflect evolving tastes and an appetite for novelty.

Mithai-Inspired Flavours

- Infusion of traditional Indian sweets into ice cream (e.g., Rabadi Malai, Kesar Rasmalai, Gulab Jamun, Jalebi).

- Appeals through cultural nostalgia and festive richness.

- Attracts both older generations and younger millennials/Gen Z seeking heritage connection.

Classics with Novel Twists

- Reinventions of well-known base flavours with new pairings (e.g., Vanilla with Salted Caramel, Chocolate Orange Zest).

- Balances familiarity with creativity for a fresh indulgence experience.

Floral Flavours

- Delicate and sophisticated, gaining popularity for their soothing aromas.

- Common: Rose, Jasmine, Lavender. Also, unique and luxurious notes like Marigold and Elderflower.

Contrasting Flavour Pairs

- Bold, exciting combinations with sweet, spicy, tangy blends (e.g., Guava Ginger, Orange Chilli).

- Appeals to adventurous consumers seeking dynamic tastes.

Big name in this business:

Forerunners (Before the 1950s)

Vadilal Industries (1907, Ahmedabad): The oldest brand in India, pioneered organised production, a wide range of flavours, and innovations, maintaining a market share of 15-16%.

Havmor Ice Cream (1944, Ahmedabad): Began locally, grew nationally with affordable-premium flavours; Lotte purchase (2017) enhanced distribution.

Dinshaw's Daiy (1932, Nagpur): Operated by a family, it established a strong presence in central/western India through high-quality dairy products.

Interrupters and Broadcasters (1950s-1990s)

Amul (Gujarat Cooperative, 1950s emergence): Late to the scene yet revolutionary with genuine milk, budget-friendly options in numerous flavours, leading as the top brand.

Mother Dairy (1974, Delhi): Improved widespread accessibility in urban and rural regions with reliable, affordable frozen treats.

Kwality (1940s, later Kwality Wall's by HUL 1995): Created various products; HUL's distribution enhanced the popularity of Cornetto and Magnum packs.

Contemporary and Regional Leaders

Arun Ice Creams (1970, Chennai): Predominant in South India, featuring local tastes such as blackcurrant, now expanded nationally.

Naturals Ice Cream (1984, Mumbai): High-quality artisanal, fruit-focused attraction for health-aware city dwellers.

Creambell (2003, Delhi): Concentrates on indulgent, value-driven products for young consumers in the North/East.

Recent Handshake

- In October 2025, Hocco Ice Cream and Haldiram’s have teamed up to launch the world’s first-ever Barfi Ice Cream, blending traditional mithai flavours with modern ice cream innovation this Diwali. Moreover, due to this, Hocco is positioned as a leader in fusion desserts, whereas Haldiram’s capitalises on its brand reliability in mithai.

- In September 2025, Indulge Creamery launched in India as a premium artisanal ice cream brand, blending globally inspired flavours with a café-style experience. The brand guarantees to provide premium ice creams made with high-quality ingredients and an emphasis on rich, balanced flavours through a slow-churning process.

- In July 2025, Hangyo Ice Creams has scaled up its production to 1.25 lakh litres per day, driven by surging demand across Karnataka, Kerala, and Goa, with its annual turnover now reaching ₹300 crores. This is due to increasing disposable incomes, urban growth, and shifts in lifestyle are driving ice cream consumption in South India.

Final Sum Up

The swift expansion of the sector relies on innovation encompassing distinctive flavours, health-focused selections, and immersive retail formats, while digital platforms enhance consumer communication and interaction. India’s ice cream industry has evolved from a seasonal, specialised market into a vibrant, year-round sector driven by increasing incomes, urban growth, and a youthful, convenience-oriented demographic. Major market highlights indicate an anticipated increase from USD 4.86 billion in 2024 to USD 23.12 billion by 2035 at a CAGR of 15.23%, along with vibrant export markets spearheaded by the US, UAE, and Nepal, reflecting rising global interest. The surge in traditional dairy products comes from increased flavour options, a focus on premium offerings, health-conscious selections like low-fat and sugar-free items, and improved convenience with contemporary retail and online delivery services