Petrochemicals: India's next growth engine!

Published on: December 2025

Petrochemicals: India's next growth engine!

The Indian petrochemical industry has emerged as one of the country's most vibrant industrial sectors. Petrochemicals are the building components of many common items, ranging from packaging and medications to plastics and textiles. India has positioned itself as a global petrochemical powerhouse due to growing domestic demand, government programs like Make in India and Atmanirbhar Bharat, and significant investments. Further, India has focus on self-sufficiency goals will add to the petrochemical supply and expanding ambitious capacity expansion might exacerbate oversupply problems in the Asia-Pacific petrochemical sector in response to China's previous actions. India is predicted to contribute one-third of the capacity increases worldwide by 2030.

Key Market Valuation Details:

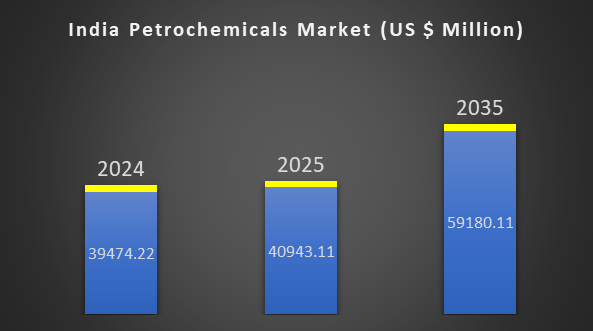

- India Petrochemicals Market Size is expected to Grow from USD 39474.22 Million in 2024 to USD 59180.11 Million by 2035, growing at a CAGR of 3.75% during the forecast period 2025-2035.

- India, the third-biggest maker of chemicals in Asia and the sixth-biggest manufacturer globally, sells chemicals to over 175 countries, representing up to 15% of its overall exports. By 2028, projections show a rise from 257 MMTPA to 310 MMTPA, improving cost competitiveness.

- Private sector commitments total Rs. 1,06,452 crore (USD12 billion) with more flexibility, the public sector undertakings plan Rs. 2,21,775 crore (USD25 billion) associated with refinery expansions.

- This is in line with larger programs such as Petroleum, Chemicals & Petrochemicals Investment Regions (PCPIRs), which aim to invest up to USD420 billion in the sector overall. By 2030, India's capacity is projected to increase from 29.62 million tonnes to 46 million tonnes.

Why India focused on petrochemical assets?

The Indian petrochemical sector is strategically establishing itself as a major player in the world market in addition to satisfying home demand. The industry is set for exponential growth with a focus on increased product ranges, capacity expansion, and ecologically sustainable practices. Businesses are making significant R&D investments to produce high-value goods, and India's advantageous location and trade policies continue to propel international collaborations. The key to realising the industry's full potential will be this synergy between investment, legislative support, and innovation.

India's import and export data of petrochemicals

Exports

- India is a leading supplier of petrochemicals and chemicals, and the sector is predicted to reach USD300 billion by 2025, driven by rising worldwide demand for speciality chemicals and polymers.

- Petroleum goods made up 15.52% of India's total merchandise exports in the first quarter of fiscal year 2025-26 (April-June 2025), worth USD 17.25 billion.

- Petroleum product exports in FY 2025 totalled over RS5.3 trillion (about USD 63 billion).

Imports

- Mineral fuels, oils, and distillation products (including petrochemical feedstocks) accounted for 15.85% of India's total merchandise imports in the first quarter of FY 2025–2026, which totalled USD 179.46 billion.

- Naphtha, ethane, and propane are key imported petrochemical feedstocks, acquired from nations such as the United States, Qatar, and Russia to support domestic production.

- In FY (April-July 2025), imports of castor oil, essential oils, cosmetics, and toiletries totalled USD 987.94 million.

What are the reasons behind it?

India is a major player in the petrochemicals industry globally. Also, India's shift to a lower-carbon future, the industry also promotes the growth of hydrogen, bio-refineries, and green fuels. Petrochemicals are essential to India's economic development because they are the foundation of several industries, including consumer products, automotive, construction, packaging, and textiles. Further, rising domestic demand, fast urbanisation, rising disposable incomes, and government initiatives like the Petroleum, Chemicals and Petrochemicals Investment Regions (PCPIRs) and 100% Foreign Direct Investment (FDI) in the sector, which are intended to increase self-sufficiency, lessen reliance on imports.

Key trends of Petrochemicals that uplift the Indian petrochemical industry

Sustainability Efforts: Indian companies are at the forefront of creating sustainable methods, like converting plastic waste into viable petrochemical items. These efforts are not only diminishing the environmental footprint but also generating new sources of income.

Digital Transformation: The integration of digital technologies such as AI, IoT, and blockchain is transforming the petrochemical sector in India. These advancements boost operational effectiveness, lower expenses, and increase supply chain transparency, establishing India as a frontrunner in the international market.

Capacity Expansion Initiatives: Key companies are significantly investing in increasing their production capabilities to satisfy both local and global demand. These development initiatives are promoting growth and generating employment opportunities nationwide.

Government Assistance: The Indian government is enthusiastically backing the petrochemical sector with advantageous policies, tax benefits, and infrastructure enhancements. This assistance is essential for the industry's ongoing development and international competitiveness.

Collaboration impact: Indian petrochemical firms are creating strategic partnerships with international leaders to collaboratively develop advanced technologies and broaden their global presence. These partnerships are promoting creativity and guaranteeing a continuous influx of funding.

Major Industry players in the Indian petrochemicals sector

- Reliance Industries Limited (RIL):

Reliance Industries had a market capitalisation of RS20.781 trillion. Reliance Industries is now the world's 67th most valuable firm by market capitalisation. Reliance Industries Limited (RIL) dominates India's chemicals sector, accounting for approximately 30-35% of the petrochemicals market through polymers, polyester, and intermediates.

- Godrej Industries Limited:

Godrej has a market capitalisation of RS1.158 trillion. This places Godrej as the world's 1599th most valuable company by market capitalisation. Godrej Industries Limited has a tiny share (1-2%) of India's petrochemicals sector, focusing on oleochemicals, surfactants, and specialised chemical intermediates rather than bulk petrochemicals such as polymers and aromatics.

- GAIL Petrochemicals:

GAIL had a market capitalisation of RS1.121 trillion. Also, GAIL is the 1643rd most valuable company in the world in terms of market capitalisation. The company has approximately 5-7% in India's petrochemicals sector, principally through its polymer production (HDPE, LLDPE).

- Tata Chemicals Limited:

Tata Chemicals has a market capitalisation of RS199.24 billion. Tata Chemicals is now the 4479th most valuable company globally in terms of market capitalisation. Tata Chemicals Limited focuses on basic chemicals (soda ash, sodium bicarbonate, salt), specialised chemicals, and consumer products rather than bulk petrochemicals, accounting for just around 2-3% of the Indian petrochemicals sector.

- BASF India Limited:

BASF India has a market capitalisation of RS175.89 billion. BASF India is now the 4698th most valuable company in the world based on market capitalisation. BASF India Limited generally focuses on speciality chemicals, performance materials, and coatings rather than bulk petrochemicals like polymers and aromatics, accounting for just about 2-3% of the Indian petrochemicals market.

Recent Handshakes

- In April 2025, Reliance Industries Limited (RIL) announced a massive investment of RS1.5 trillion (USD18 billion) split equally between new energy and petrochemical expansion. This includes RS75,000 crore (USD9B) each for clean energy projects and petrochemical growth.

- In November 2024, GAIL partnered with INEOS to revive its Purified Terephthalic Acid (PTA) plant in Mangalore, marking a major step in strengthening India’s petrochemical capacity. Broadens its petrochemical reach beyond polyethene and polypropylene to include aromatics and polyester raw materials.

Final Wrap Up:

India's petrochemical sector is expected to rise from USD 39474.22 million in 2024 to USD 59180.11 million by 2035, at a 3.75% CAGR, driven by domestic demand in packaging, automotive, and construction, as well as USD 37 billion in capex by 2030. In the context of sustainability trends, digital transformation, and capacity expansions to 46 million tonnes by 2030, government measures like PCPIRs and 100% FDI, along with exports exceeding USD 63 billion in FY25 and imports of essential feedstocks, highlight self-sufficiency ambitions. The industry is dominated by Reliance Industries (30-35% share), GAIL, Godrej, Tata Chemicals, and BASF. Recent developments include Reliance's RS1.5 trillion investment and GAIL-INEOS PTA cooperation, positioning India for one-third of global capacity expansions despite Asia-Pacific oversupply.