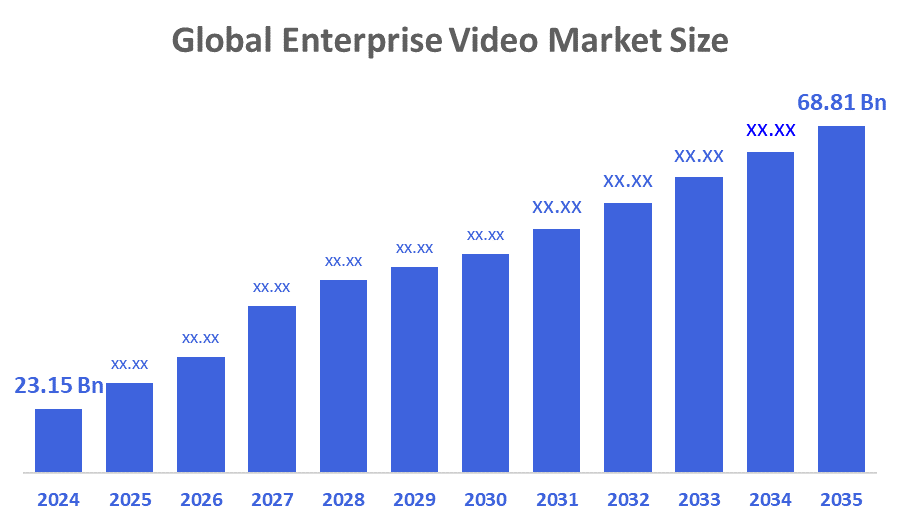

Global Enterprise Video Market Size to Exceed USD 68.81 Billion by 2035 | CAGR of 10.41%

Global Enterprise Video Market Size to Exceed USD 68.81 Billion by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Global Enterprise Video Market Size is expected to Grow from USD 23.15 Billion in 2024 to USD 68.81 Billion by 2035, at a CAGR of 10.41% during the forecast period 2025-2035.

Browse 210 Market Data Tables And 45 Figures Spread Through 190 Pages and In-Depth TOC On the Global Enterprise Video Market Size, Share, and COVID-19 Impact Analysis, By Deployment Mode (On-Premises, and Cloud), By Delivery Mode (Video Conferencing, and Web Conferencing), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 – 2035. Get Detailed Report Description Here: https://www.decisionsadvisors.com/reports/enterprise-video-market

The enterprise video sector pertains to the industry niche that offers video-driven solutions and services tailored for companies and organisations to improve communication, collaboration, training, marketing, and customer interaction. Enterprise video refers to the adoption of video technology in companies and organisations for numerous purposes, including marketing, training, collaboration, and communication. Corporate video solutions are often utilised by organisations to improve internal communication and collaboration among teams, employees, and departments. Along with producing on-demand video materials for training, knowledge exchange, and employee involvement, this could also include live streaming departmental updates, town hall gatherings, executive messages, and corporate occasions. The rise of workplace video solutions stems from companies' demand for comprehensive tools that combine voice calling, video conferencing, messaging, and collaboration features into one platform. The demand for integrated communication and collaboration tools in industries such as IT, healthcare, and BFSI is fueling the expansion of business video. The firms are focusing on adopting enterprise video solutions to enhance customer interaction, corporate communication, and training and development. The growth of the enterprise video market is obstructed by high infrastructure expenses, challenges in integrating with legacy systems, and persistent concerns regarding data security.

The cloud segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the deployment mode, the enterprise video market is differentiated into on-premises and cloud. Among these, the cloud segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Cloud deployment offers several advantages, including cheaper initial investment costs, lower maintenance overheads, and scalability, which are well-suited to the needs and budgetary constraints of SMEs.

The video conferencing segment dominated the market in 2024 and is projected to grow at a significant CAGR during the forecast period.

Based on the delivery mode, the enterprise video market is segmented into video conferencing and web conferencing. Among these, the video conferencing segment dominated the market in 2024 and is projected to grow at a significant CAGR during the forecast period. Video conferencing is the most often used distribution method in the workplace video market due to its many features that allow for high-quality audio and visual interactions.

Asia Pacific is expected to hold the majority share of the global enterprise video market during the forecast period.

Asia Pacific is expected to hold the majority share of the global enterprise video market during the forecast period. China, India, and Japan are the top three countries among the many domestic and international businesses competing for market supremacy. Businesses like Brightcove and Kaltura are expanding in the region, and there is fierce rivalry. The increasing focus on remote work and digital transformation initiatives across several industries further encourages the use of workplace video solutions.

Europe is anticipated to grow at the fastest pace in the global enterprise video market during the forecast period. Leading countries in this field are France, Germany, and the UK, where companies are gradually integrating video technology into their operations. Moreover, the strong regulatory bodies ensure a stable environment for innovation and growth in the enterprise video sector.

Major vendors in the global enterprise video market are Adobe, AWS, Cisco, Google, Haivision, IBM, INXPO, Kollective Technology, LogMeIn, MediaPlatform, Microsoft, Poly, RingCentral, Zoom Video Communications, and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2023, Mcarbon introduced Spark, a new enterprise-level video call technology that enables companies to interact with clients via smooth, adaptable video communication. Mcarbon's Spark, a significant advancement in CPaaS-driven enterprise video, seeks to revolutionise how businesses interact with customers through scalable, personalised video communication.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the enterprise video market based on the below-mentioned segments:

Global Enterprise Video Market, By Deployment Mode

- On-Premises

- Cloud

Global Enterprise Video Market, By Delivery Mode

- Video Conferencing

- Web Conferencing

Global Enterprise Video Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Company Profile

| Decisions Advisors | |

|---|---|

| Industry | Information & Technology |

| Website | https://www.decisionsadvisors.com/ |

| Date | January 2026 |

Connect with us

- USA - +1 303 800 4326

- APAC - +91 9561448932

- sales@sphericalinsights.com